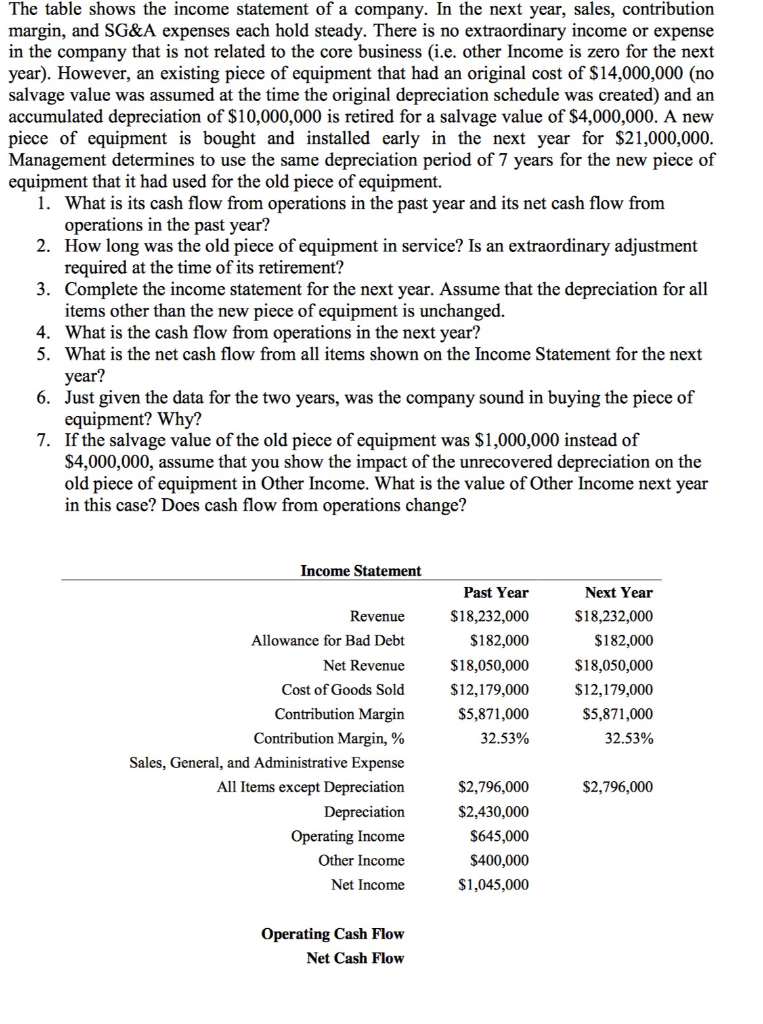

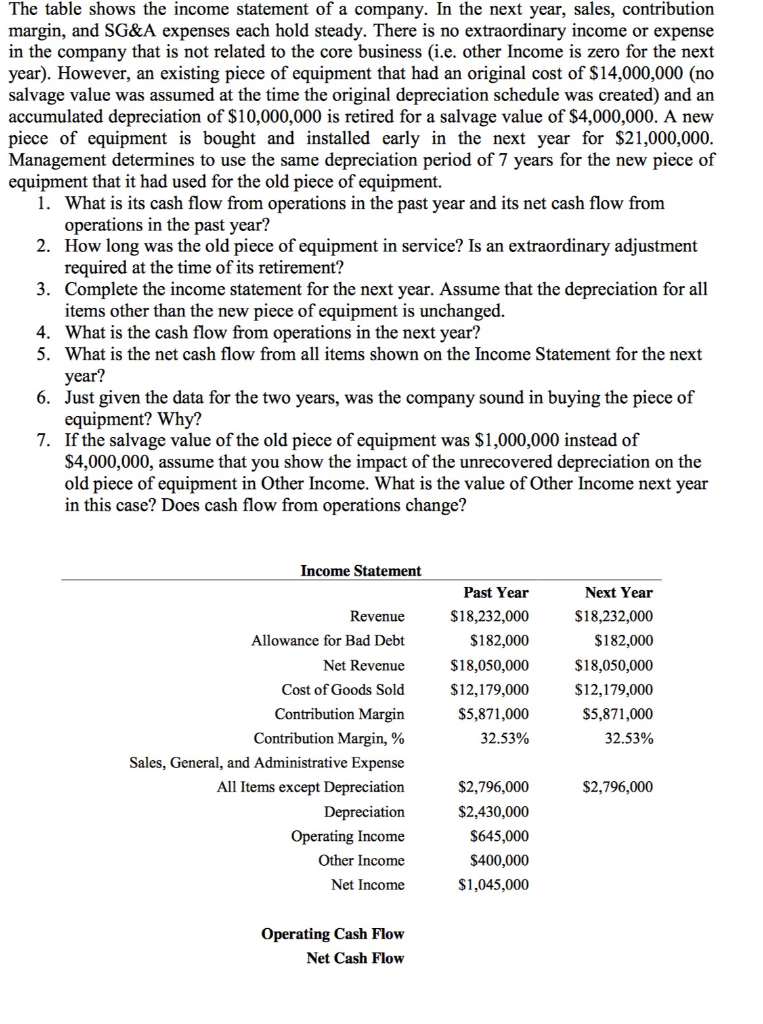

The table shows the income statement of a company. In the next year, sales, contribution margin, and SG&A expenses each hold steady. There is no extraordinary income or expense in the company that is not related to the core business (i.e. other Income is zero for the next year). However, an existing piece of equipment that had an original cost of $14,000,000 (no salvage value was assumed at the time the original depreciation schedule was created) and an accumulated depreciation of $10,000,000 is retired for a salvage value of $4,000,000. A new piece of equipment is bought and installed early in the next year for $21,000,000 Management determines to use the same depreciation period of 7 years for the new piece of equipment that it had used for the old piece of equipment. 1. What is its cash flow from operations in the past year and its net cash flow frorm 2. How long was the old piece of equipment in service? Is an extraordinary adjustment 3. Complete the income statement for the next year. Assume that the depreciation for all 4. What is the cash flow from operations in the next year? operations in the past year? required at the time of its retirement? items other than the new piece of equipment is unchanged. 5. 6. 7. What is the net cash flow from all items shown on the Income Statement for the next year? Just given the data for the two years, was the company sound in buying the piece of equipment? Why? If the salvage value of the old piece of equipment was $1,000,000 instead of $4,000,000, assume that you show the impact of the unrecovered depreciation on the old piece of equipment in Other Income. What is the value of Other Income next year in this case? Does cash flow from operations change? Income Statement Past Year S18,232,000 $182,000 $18,050,000 $12,179,000 S5,871,000 32.53% Next Year S18,232,000 $182,000 $18,050,000 $12,179,000 $5,871,000 32.53% Revenue Allowance for Bad Debt Net Revenue Cost of Goods Sold Contribution Margin Contribution Margin, % Sales, General, and Administrative Expense All Items except Depreciation Depreciation Operating Income Other Income Net Income $2,796,000 $2,430,000 $645,000 $400,000 S1,045,000 $2,796,000 Operating Cash Flow Net Cash Flow