Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Talbot Company uses electrical assemblies to produce an array of small appliances. One of its high cost /high volume assemblies, the XO-01, has

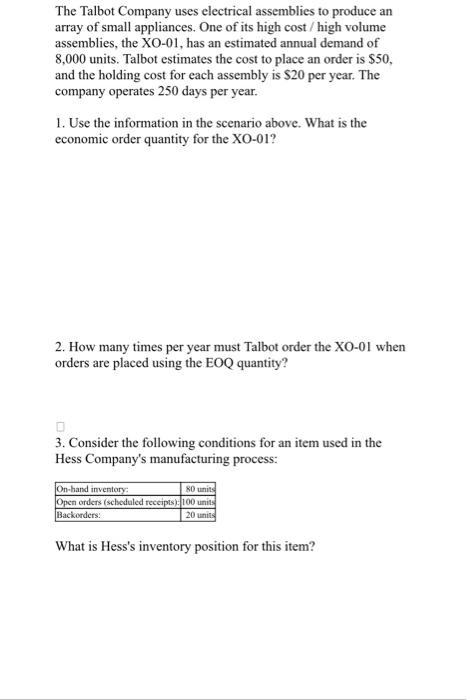

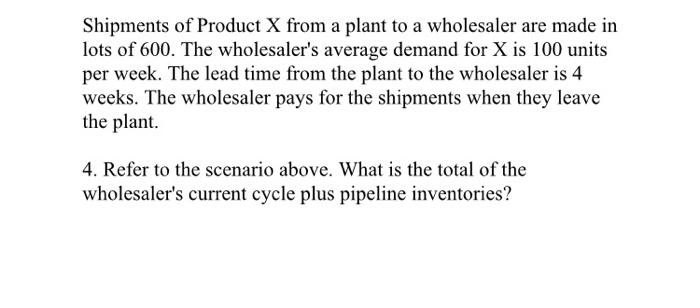

The Talbot Company uses electrical assemblies to produce an array of small appliances. One of its high cost /high volume assemblies, the XO-01, has an estimated annual demand of 8,000 units. Talbot estimates the cost to place an order is $50, and the holding cost for each assembly is $20 per year. The company operates 250 days per year. 1. Use the information in the scenario above. What is the economic order quantity for the XO-01? 2. How many times per year must Talbot order the XO-01 when orders are placed using the EOQ quantity? 3. Consider the following conditions for an item used in the Hess Company's manufacturing process: On-hand inventory: 80 units Open orders (scheduled receipts): 100 units Backorders: 20 units What is Hess's inventory position for this item? Shipments of Product X from a plant to a wholesaler are made in lots of 600. The wholesaler's average demand for X is 100 units per week. The lead time from the plant to the wholesaler is 4 weeks. The wholesaler pays for the shipments when they leave the plant. 4. Refer to the scenario above. What is the total of the wholesaler's current cycle plus pipeline inventories?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Annual demand D 8000 Order Cost S 50 Holding cost H 20 Econo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started