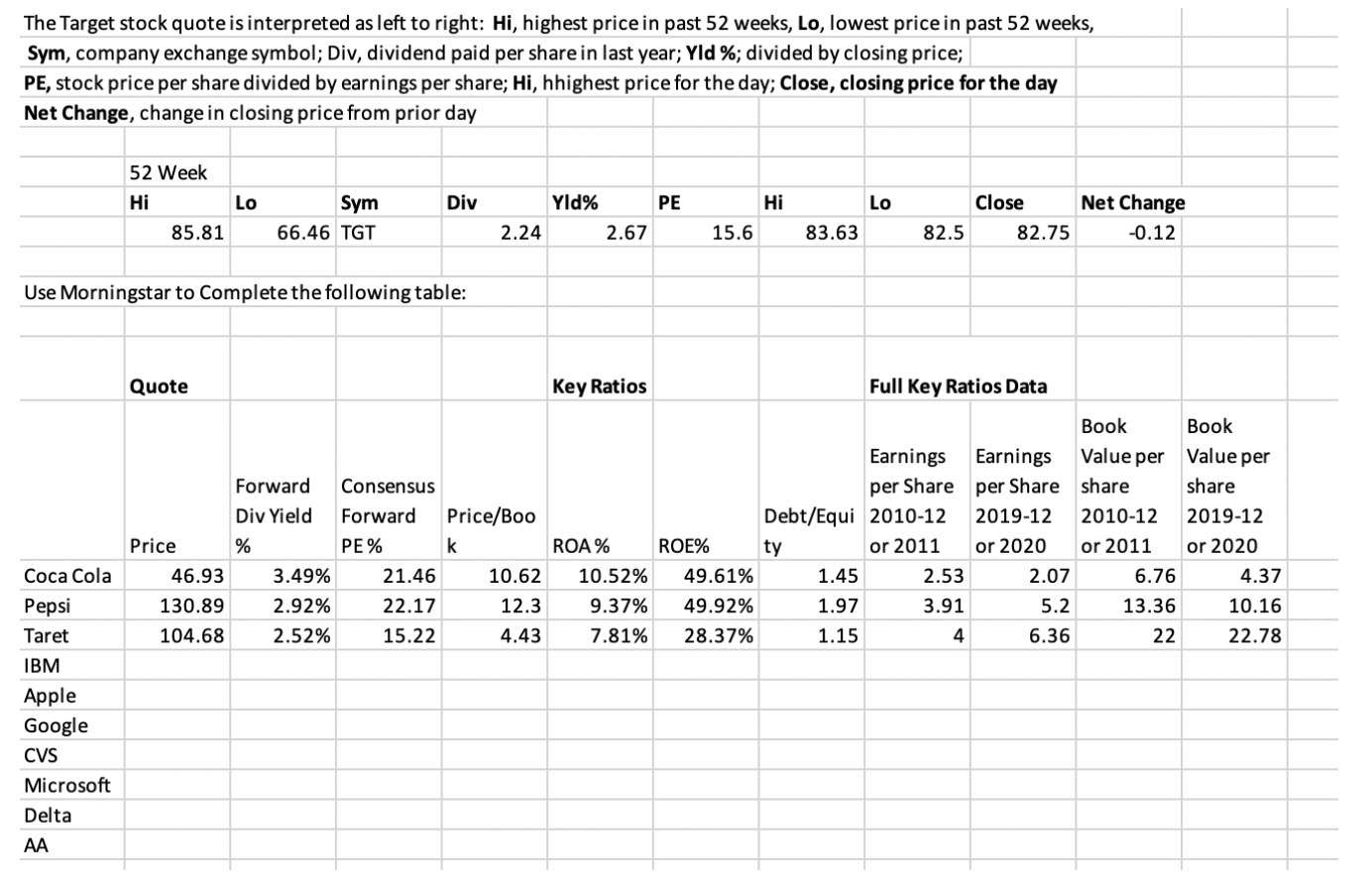

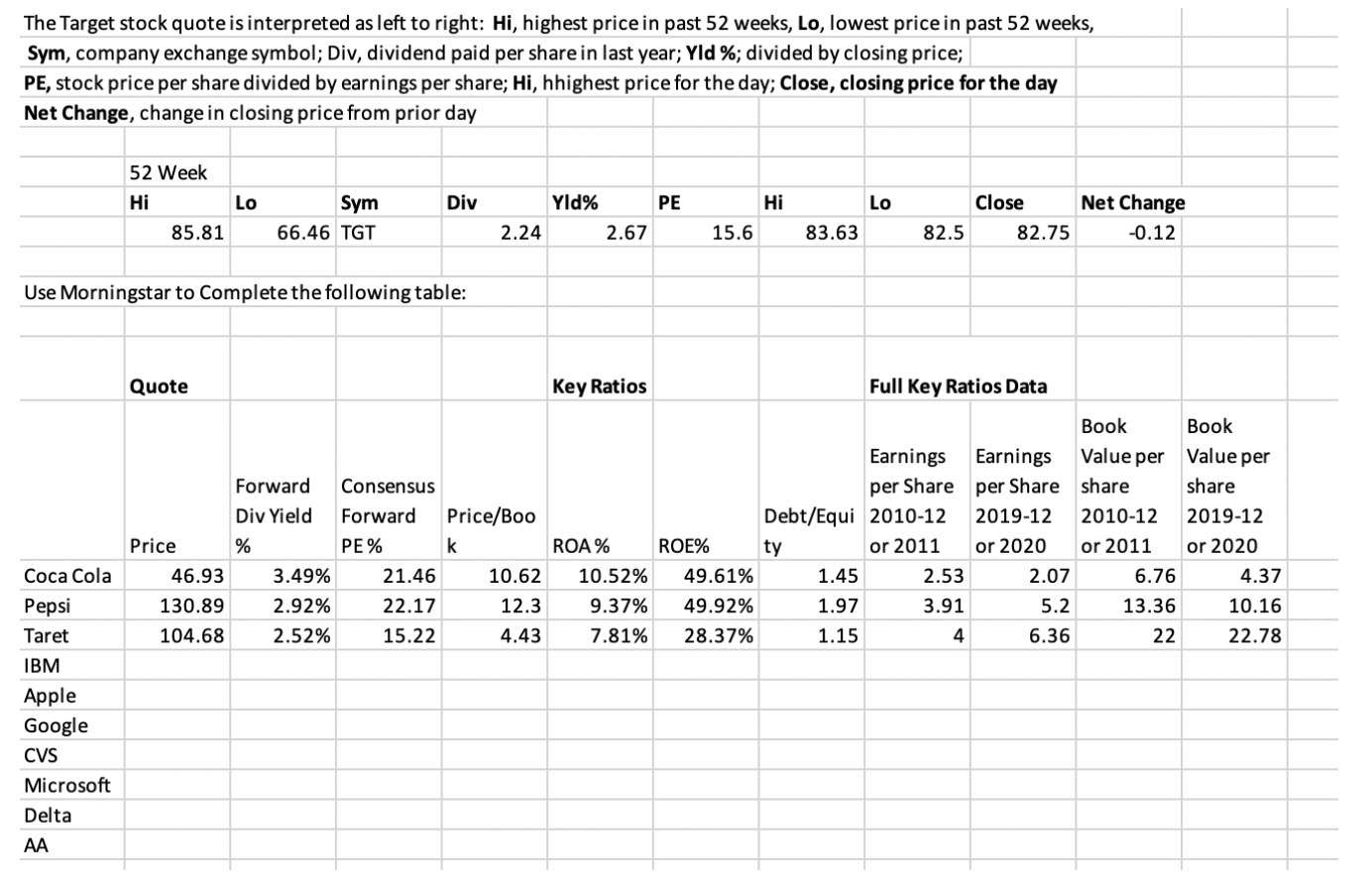

The Target stock quote is interpreted as left to right: Hi, highest price in past 52 weeks, Lo, lowest price in past 52 weeks, Sym, company exchange symbol; Div, dividend paid per share in last year; Yld %; divided by closing price; PE, stock price per share divided by earnings per share; Hi, hhighest price for the day; Close, closing price for the day Net Change, change in closing price from prior day 52 Week 85.81 Lo D iv Hi Sym 66.46 TGT 2.24 Yid% 2 PE .67 15.6 Lo 83.63 82.5 Close Net Change 82.75 -0.12 Use Morningstar to Complete the following table: Quote Key Ratios Full Key Ratios Data Forward Div Yield Price 46.93 3.49% 130.89 2.92% 104.68 2.52% Consensus Forward Price/Boo PE% 21.46 10.62 22.17 12.3 15.22 4.43 Book Book Earnings Earnings Value per Value per per Share per Share share share Debt/Equi 2010-12 2019-12 2010-12 2019-12 ty or 2011 or 2020 or 2011 or 2020 1.45 2.53 2.07 6.76 4.37 1.97 3.91 5.2 13.36 10.16 1.15 4 6 .36 22 22.78 ROA% 10.52% 9.37% 7.81% ROE% 49.61% 49.92% 28.37% Coca Cola Pepsi Taret IBM Apple Google CVS Microsoft Delta The Target stock quote is interpreted as left to right: Hi, highest price in past 52 weeks, Lo, lowest price in past 52 weeks, Sym, company exchange symbol; Div, dividend paid per share in last year; Yld %; divided by closing price; PE, stock price per share divided by earnings per share; Hi, hhighest price for the day; Close, closing price for the day Net Change, change in closing price from prior day 52 Week 85.81 Lo D iv Hi Sym 66.46 TGT 2.24 Yid% 2 PE .67 15.6 Lo 83.63 82.5 Close Net Change 82.75 -0.12 Use Morningstar to Complete the following table: Quote Key Ratios Full Key Ratios Data Forward Div Yield Price 46.93 3.49% 130.89 2.92% 104.68 2.52% Consensus Forward Price/Boo PE% 21.46 10.62 22.17 12.3 15.22 4.43 Book Book Earnings Earnings Value per Value per per Share per Share share share Debt/Equi 2010-12 2019-12 2010-12 2019-12 ty or 2011 or 2020 or 2011 or 2020 1.45 2.53 2.07 6.76 4.37 1.97 3.91 5.2 13.36 10.16 1.15 4 6 .36 22 22.78 ROA% 10.52% 9.37% 7.81% ROE% 49.61% 49.92% 28.37% Coca Cola Pepsi Taret IBM Apple Google CVS Microsoft Delta