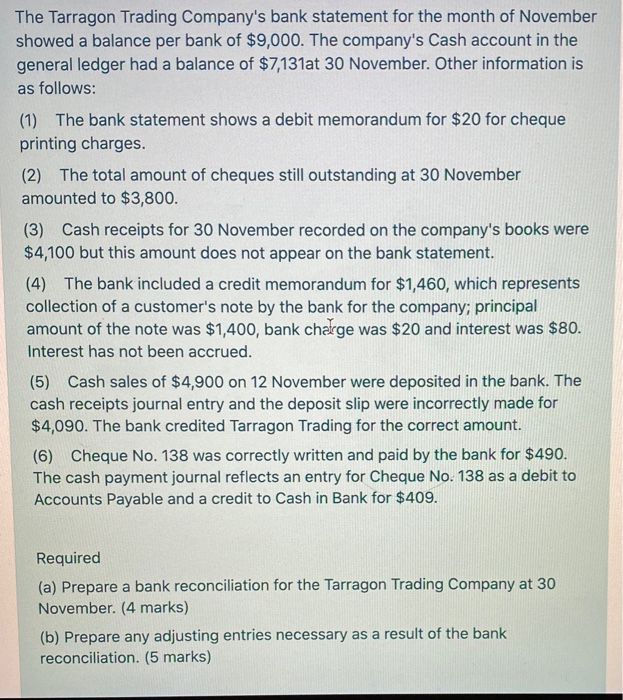

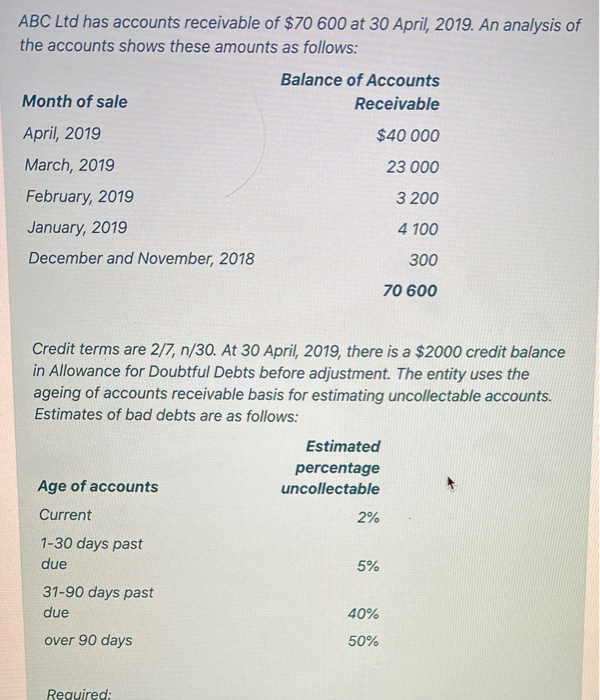

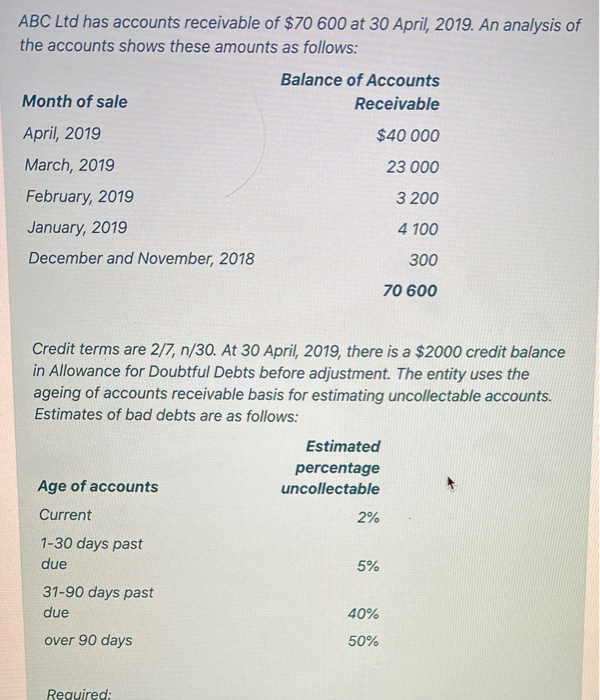

The Tarragon Trading Company's bank statement for the month of November showed a balance per bank of $9,000. The company's Cash account in the general ledger had a balance of $7,131at 30 November. Other information is as follows: (1) The bank statement shows a debit memorandum for $20 for cheque printing charges. (2) The total amount of cheques still outstanding at 30 November amounted to $3,800. (3) Cash receipts for 30 November recorded on the company's books were $4,100 but this amount does not appear on the bank statement. (4) The bank included a credit memorandum for $1,460, which represents collection of a customer's note by the bank for the company; principal amount of the note was $1,400, bank checge was $20 and interest was $80. Interest has not been accrued. (5) Cash sales of $4,900 on 12 November were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $4,090. The bank credited Tarragon Trading for the correct amount. (6) Cheque No. 138 was correctly written and paid by the bank for $490. The cash payment journal reflects an entry for Cheque No. 138 as a debit to Accounts Payable and a credit to Cash in Bank for $409. Required (a) Prepare a bank reconciliation for the Tarragon Trading Company at 30 November. (4 marks) (b) Prepare any adjusting entries necessary as a result of the bank reconciliation. (5 marks) ABC Ltd has accounts receivable of $70 600 at 30 April, 2019. An analysis of the accounts shows these amounts as follows: Balance of Accounts Month of sale Receivable $40 000 23 000 April, 2019 March, 2019 February, 2019 January, 2019 December and November, 2018 3 200 4 100 300 70 600 Credit terms are 2/7, n/30. At 30 April 2019, there is a $2000 credit balance in Allowance for Doubtful Debts before adjustment. The entity uses the ageing of accounts receivable basis for estimating uncollectable accounts. Estimates of bad debts are as follows: Estimated percentage Age of accounts uncollectable Current 2% 5% 1-30 days past due 31-90 days past due 40% over 90 days 50% Required: The Tarragon Trading Company's bank statement for the month of November showed a balance per bank of $9,000. The company's Cash account in the general ledger had a balance of $7,131at 30 November. Other information is as follows: (1) The bank statement shows a debit memorandum for $20 for cheque printing charges. (2) The total amount of cheques still outstanding at 30 November amounted to $3,800. (3) Cash receipts for 30 November recorded on the company's books were $4,100 but this amount does not appear on the bank statement. (4) The bank included a credit memorandum for $1,460, which represents collection of a customer's note by the bank for the company; principal amount of the note was $1,400, bank checge was $20 and interest was $80. Interest has not been accrued. (5) Cash sales of $4,900 on 12 November were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $4,090. The bank credited Tarragon Trading for the correct amount. (6) Cheque No. 138 was correctly written and paid by the bank for $490. The cash payment journal reflects an entry for Cheque No. 138 as a debit to Accounts Payable and a credit to Cash in Bank for $409. Required (a) Prepare a bank reconciliation for the Tarragon Trading Company at 30 November. (4 marks) (b) Prepare any adjusting entries necessary as a result of the bank reconciliation. (5 marks) ABC Ltd has accounts receivable of $70 600 at 30 April, 2019. An analysis of the accounts shows these amounts as follows: Balance of Accounts Month of sale Receivable $40 000 23 000 April, 2019 March, 2019 February, 2019 January, 2019 December and November, 2018 3 200 4 100 300 70 600 Credit terms are 2/7, n/30. At 30 April 2019, there is a $2000 credit balance in Allowance for Doubtful Debts before adjustment. The entity uses the ageing of accounts receivable basis for estimating uncollectable accounts. Estimates of bad debts are as follows: Estimated percentage Age of accounts uncollectable Current 2% 5% 1-30 days past due 31-90 days past due 40% over 90 days 50% Required