Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Tax Authority of a country is trying to deal with companies not paying their taxes and encourage them to do so. A typical

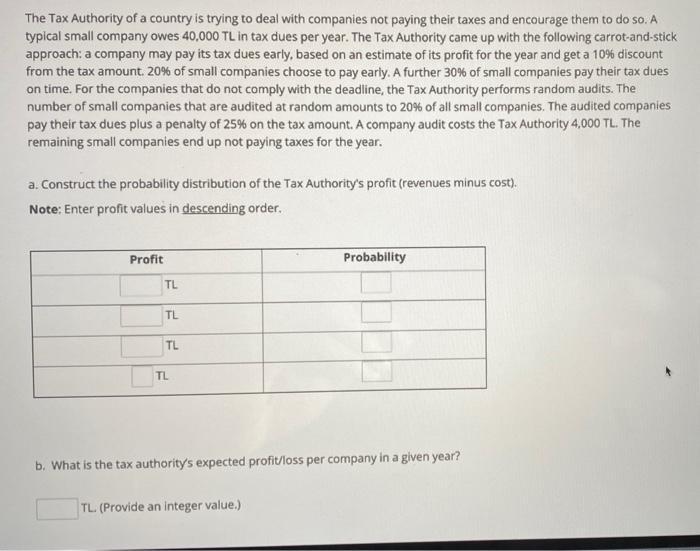

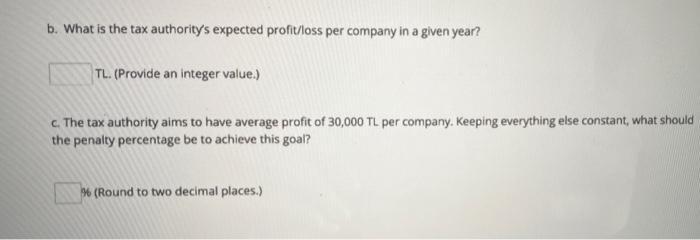

The Tax Authority of a country is trying to deal with companies not paying their taxes and encourage them to do so. A typical small company owes 40,000 TL in tax dues per year. The Tax Authority came up with the following carrot-and-stick approach: a company may pay its tax dues early, based on an estimate of its profit for the year and get a 10% discount from the tax amount. 20% of small companies choose to pay early. A further 30% of small companies pay their tax dues on time. For the companies that do not comply with the deadline, the Tax Authority performs random audits. The number of small companies that are audited at random amounts to 20% of all small companies. The audited companies pay their tax dues plus a penalty of 25% on the tax amount. A company audit costs the Tax Authority 4,000 TL. The remaining small companies end up not paying taxes for the year. a. Construct the probability distribution of the Tax Authority's profit (revenues minus cost). Note: Enter profit values in descending order. Profit Probability TL b. What is the tax authority's expected profit/loss per company in a given year? TL. (Provide an integer value.) TL TL TL b. What is the tax authority's expected profit/loss per company in a given year? TL. (Provide an integer value.) c. The tax authority aims to have average profit of 30,000 TL per company. Keeping everything else constant, what should the penalty percentage be to achieve this goal? % (Round to two decimal places.)

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

the profit be n deductin after Tan who pay earlyg ton ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started