Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Tax Formula for Individuals, Filing Status and Tax Computation, Qualifying Dependents, The Standard Deduction (LO 1.3, 1.5, 1.6, 1.8) Jackson, age 35, and

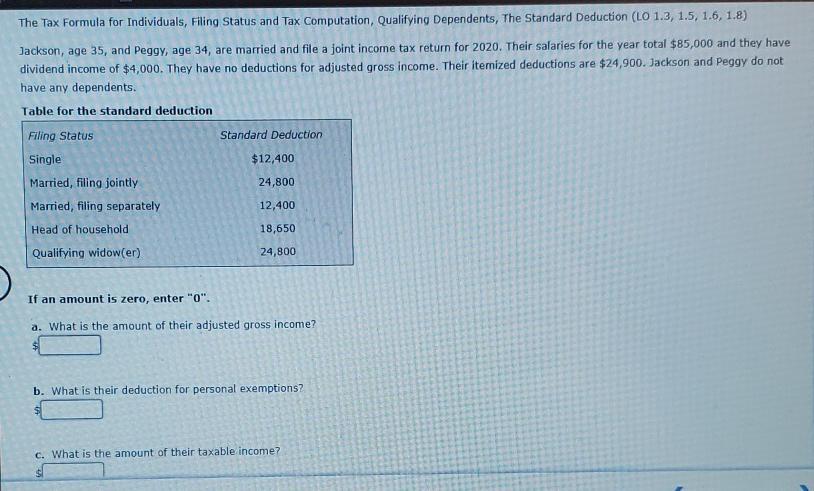

The Tax Formula for Individuals, Filing Status and Tax Computation, Qualifying Dependents, The Standard Deduction (LO 1.3, 1.5, 1.6, 1.8) Jackson, age 35, and PeggY, age 34, are married and file a joint income tax return for 2020. Their salaries for the year total $85,000 and they have dividend income of $4,000. They have no deductions for adjusted gross income. Their itemized deductions are $24,900. Jackson and Peggy do not have any dependents. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 If an amount is zero, enter "0". a. What is the amount of their adjusted gross income? b. What is their deduction for personal exemptions? c. What is the amount of their taxable income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Adusted gooss income Total income incomes that am which is Summabion of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started