Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 11 The taxpayer came to Canada in 1977. He stayed in Canada until 1987. Prior to 1987 the taxpayer studied engineering and obtained

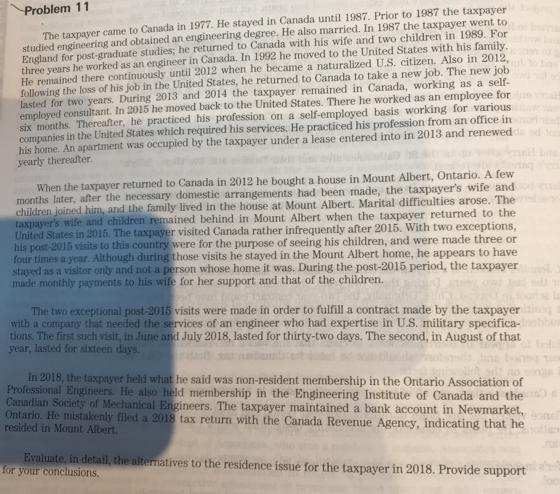

Problem 11 The taxpayer came to Canada in 1977. He stayed in Canada until 1987. Prior to 1987 the taxpayer studied engineering and obtained an engineering degree. He also married. In 1987 the taxpayer went to England for post-graduate studies; he returned to Canada with his wife and two children in 1989. For three years he worked as an engineer in Canada. In 1992 he moved to the United States with his family. He remained there continuously until 2012 when he became a naturalized U.S. citizen. Also in 2012, following the loss of his job in the United States, he returned to Canada to take a new job. The new job lasted for two years. During 2013 and 2014 the taxpayer remained in Canada, working as a self- employed consultant. In 2015 he moved back to the United States. There he worked as an employee for six months. Thereafter, he practiced his profession on a self-employed basis working for various companies in the United States which required his services. He practiced his profession from an office in his home. An apartment was occupied by the taxpayer under a lease entered into in 2013 and renewed yearly thereafter. When the taxpayer returned to Canada in 2012 he bought a house in Mount Albert, Ontario. A few months later, after the necessary domestic arrangements had been made, the taxpayer's wife and children joined him, and the family lived in the house at Mount Albert. Marital difficulties arose. The taxpayer's wife and children remained behind in Mount Albert when the taxpayer returned to the United States in 2015. The taxpayer visited Canada rather infrequently after 2015. With two exceptions, his post-2015 visits to this country were for the purpose of seeing his children, and were made three or four times a year. Although during those visits he stayed in the Mount Albert home, he appears to have stayed as a visitor only and not a person whose home it was. During the post-2015 period, the taxpayer made monthly payments to his wife for her support and that of the children. The two exceptional post-2015 visits were made in order to fulfill a contract made by the taxpayer with a company that needed the services of an engineer who had expertise in U.S. military specifica- tions. The first such visit, in June and July 2018, lasted for thirty-two days. The second, in August of that year, lasted for sixteen days. In 2018, the taxpayer held what he said was non-resident membership in the Ontario Association of Professional Engineers. He also held membership in the Engineering Institute of Canada and the Canadian Society of Mechanical Engineers. The taxpayer maintained a bank account in Newmarket, Ontario. He mistakenly filed a 2018 tax return with the Canada Revenue Agency, indicating that he resided in Mount Albert. Evaluate, in detail, the alternatives to the residence issue for the taxpayer in 2018. Provide support for your conclusions.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The taxpayers residency status for 2018 is unclear There are a number of factors that could be used ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3bde54789_182715.pdf

180 KBs PDF File

635e3bde54789_182715.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started