Answered step by step

Verified Expert Solution

Question

1 Approved Answer

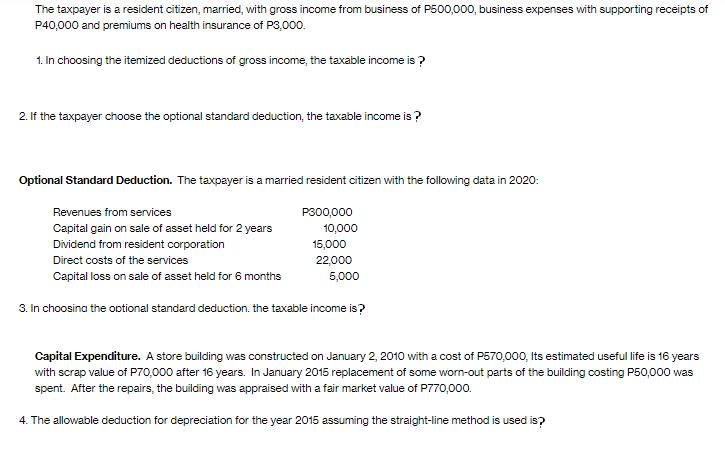

The taxpayer is a resident citizen, married, with gross income from business of P500,000, business expenses with supporting receipts of P40,000 and premiums on

The taxpayer is a resident citizen, married, with gross income from business of P500,000, business expenses with supporting receipts of P40,000 and premiums on health insurance of P3,000. 1. In choosing the itemized deductions of gross income, the taxable income is ? 2. If the taxpayer choose the optional standard deduction, the taxable income is? Optional Standard Deduction. The taxpayer is a married resident citizen with the following data in 2020: Revenues from services Capital gain on sale of asset held for 2 years Dividend from resident corporation P300,000 10,000 15,000 22,000 5,000 Direct costs of the services Capital loss on sale of asset held for 6 months 3. In choosing the optional standard deduction. the taxable income is? Capital Expenditure. A store building was constructed on January 2, 2010 with a cost of P570,000, Its estimated useful life is 16 years with scrap value of P70,000 after 16 years. In January 2015 replacement of some worn-out parts of the building costing P50,000 was spent. After the repairs, the building was appraised with a fair market value of P770,000. 4. The allowable deduction for depreciation for the year 2015 assuming the straight-line method is used is?

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each question step by step 1 In choosing the itemized deductions of gross income the taxable income is To calculate the taxable income us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started