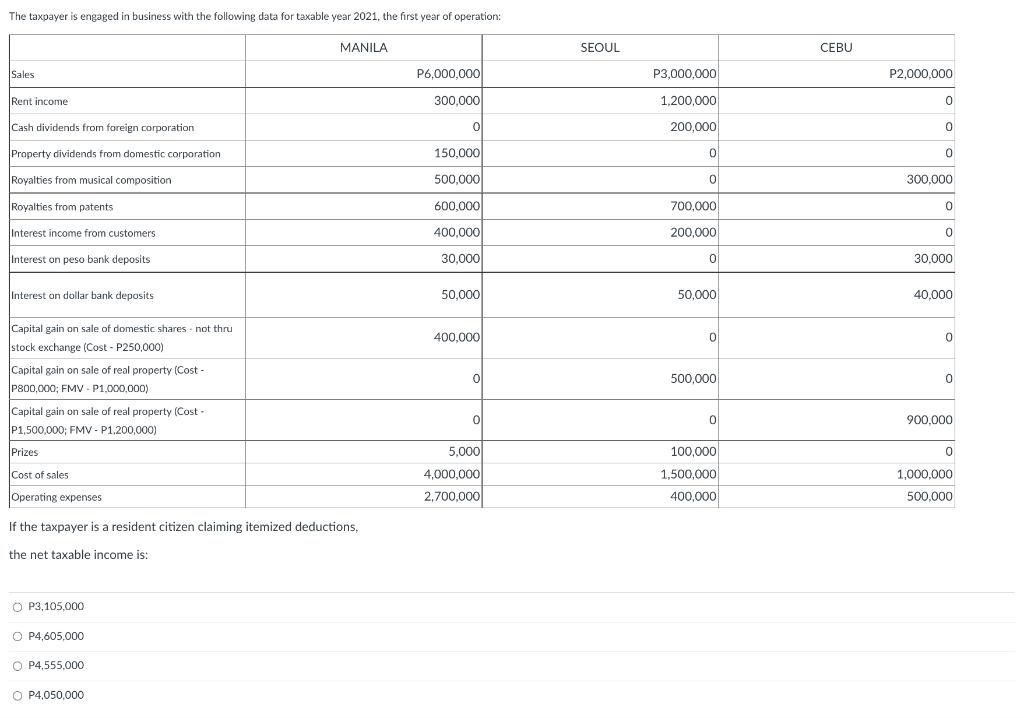

The taxpayer is engaged in business with the following data for taxable year 2021, the first year of operation: MANILA Sales Rent income Cash

The taxpayer is engaged in business with the following data for taxable year 2021, the first year of operation: MANILA Sales Rent income Cash dividends from foreign corporation Property dividends from domestic corporation. Royalties from musical composition Royalties from patents Interest income from customers. Interest on peso bank deposits Interest on dollar bank deposits Capital gain on sale of domestic shares - not thru stock exchange (Cost - P250,000) Capital gain on sale of real property (Cost- P800,000; FMV - P1,000,000) Capital gain on sale of real property (Cost- P1,500,000; FMV - P1,200,000) Prizes Cost of sales Operating expenses If the taxpayer is a resident citizen claiming itemized deductions, the net taxable income is: O P3,105,000 O P4,605,000 OP4,555,000 OP4,050,000 P6,000,000 300,000 0 150,000 500,000 600,000 400,000 30,000 50.000 400,000 0 ol 5,000 4,000,000 2,700,000 SEOUL P3,000,000 1,200,000 200,000 0 0 700,000 200,000 0 50,000 0 500,000 0 100,000 1.500,000 400,000 CEBU P2,000,000 0 0 0 300,000 0 0 30.000 40,000 0 0 900,000 0 1,000,000 500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below P4555000 cl...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started