Question

The taxpayers, Spouses Nelson and Judith Limpe are resident citizens. Engr. Nelson Limpe works as the Department Head of Timeworks Corporation, while Mrs Judith Limpe,

The taxpayers, Spouses Nelson and Judith Limpe are resident citizens. Engr. Nelson Limpe works as the Department Head of Timeworks Corporation, while Mrs Judith Limpe, is a payroll clerk of Timeworks Corp. They a had the following transactions for the year:

Additional information Three years ago last March 15, the taxpayer rented a Manila lot from Leaderland Resources for 15 years. Six months later, he built a building valued at P 30M with life expectancy of 20 years. He uses the spread out method in reporting income. During the year, the taxpayer recovered P 150,000 from a bad debt from his father-in-law, written off two years ago, which writing off decreased the net income to the same extent. During the year, the taxpayer recovered P 50,000 from a bad debt written off the previous year, which writing off increased the losses to P 250,000. The taxpayer received a stock dividend of 20,000 shares at P100/share. The taxpayer sold his wrist watch for a gain of P 50,000.00 but sold his car at a loss of P 60,000.00. When creditable withholding taxes are required, the same were withheld. He has the following:

REQUIRED:

1. Determine the income tax still due and payable by the Spouses Engr and Mrs Limpe, assuming that they are using the itemized deduction, the estate of the father is being settled judicially, and that the partnership is a general business partnership.

2. Determine the income tax still due and payable by the Spouses Limpe, assuming that they are using the optional standard deduction, the estate of the father is being settled extra judicially, and that the partnership is a general professional partnership engaged in the practice of the same profession.

3. Determine the income tax still due and payable if the estate is using the itemized deduction, and it is being settled judicially,

4. Determine the income tax still due and payable if the partnership is using the itemized deduction, and it is general business partnership.

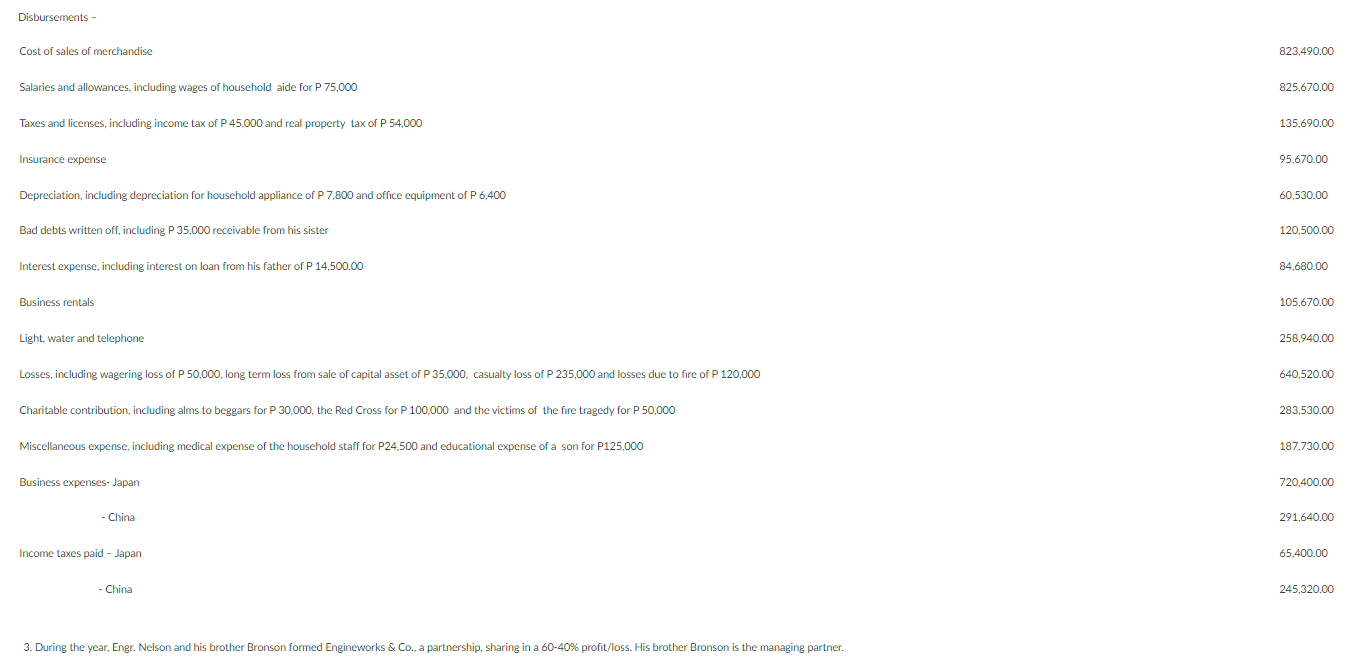

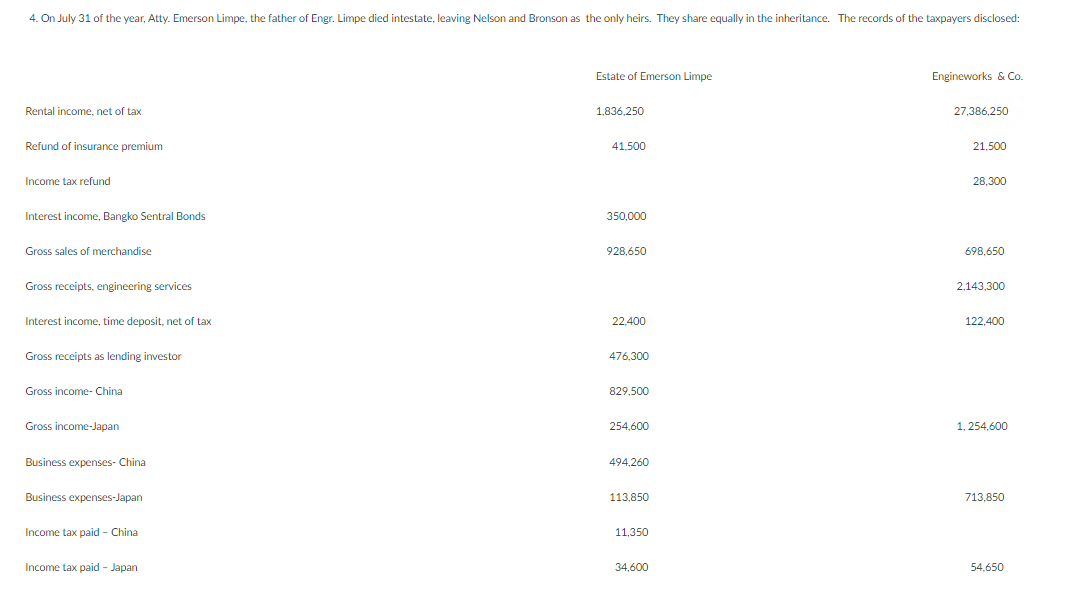

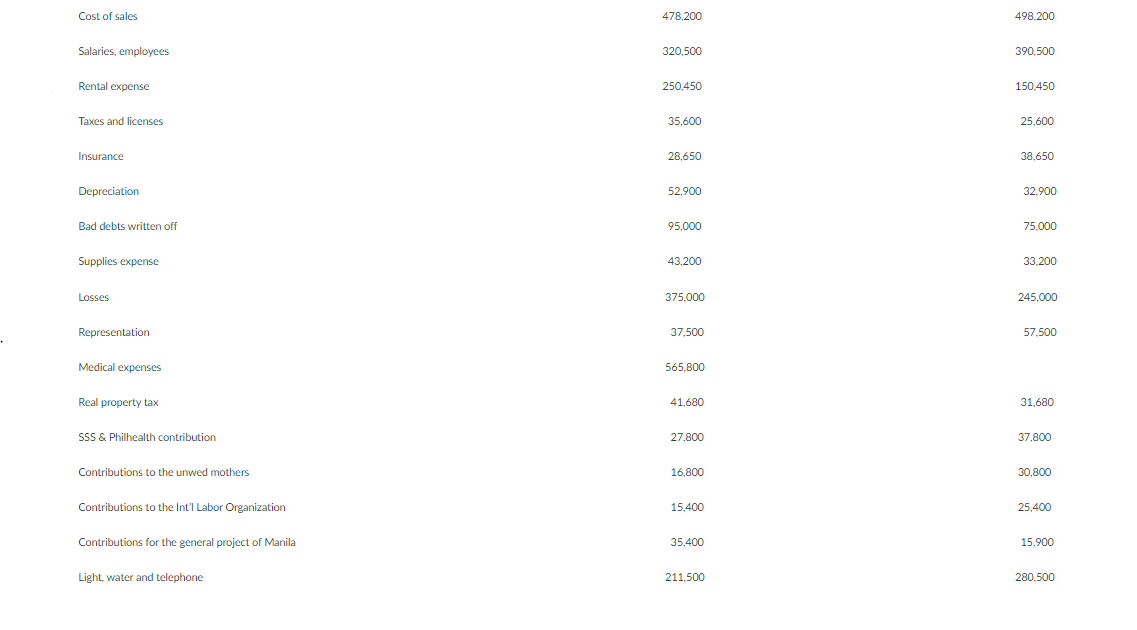

Income on sale of car acquired 8 months ago Commission from the employer Rental income on lease of land, net of tax Musical director's fees, net of tax Hazard pay Interest, Banco de Oro, net of tax Cash dividend, net of tax Winnings, US game show SSS sickness benefits Royalties, net of tax Mirs. Limper = Net salaries Witholding tax Union dues Papment. 555 lown 555/ Philhealth contribution 185000.00 income onsale of fenctrics accuincd 2 years ago 555 didability bonchits. 90.50000 Boras 4890000 Acfund of hospital capcroes 57.50000 Allowances 3200000 Medical experise 1600000 Overtime pay 14.32200 Fringe bernefiss 40.91000 Cash eward for tonesty 150000.00 Condonation of indebtedness by the croditor 75.00000 Gain on garage sak of various used clethos 35.25000 2. Engr. Limpe, an enterprising business person, had the followir Gross receipts in his rent-a-plant business Refund on excess payment of insurance premium Honorarium as speaker in an Engineering Forum Refund of excess payment of donor's tax Rental income, net of tax Receipts as operator of janitorial services, net of tax Gross sales of merchandise Interest income, Development Bank of the Philippines bonds Interest income, Banco de Oro, net of tax Gross receipts as operator of beauty and wellness center Winnings in a local TV game show, net of tax Gross receipts, shoes repair and key duplication business Refund of fire insurance premium Estate tax refund Property dividend, net of tax Birthday gift from the spouse Gross business income - Japan Disbursements - Cost of sales of merchandise Salaries and allowances, including wages of household aide for P75,000 Taxes and licenses, including income tax of P 45,000 and real property tax of P 54,000 Insurance expense Depreciation, including depreciation for household appliance of P7,800 and office equipment of P6,400 Bad debts written off, including P35,000 receivable from his sister Interest expense, including interest on loan from his father of P 14,500.00 Business rentals Light, water and telephone Losses, including wagering loss of P50,000, long term loss from sale of capital asset of P35,000, casualty loss of P235,000 and losses due to fire of P120,000 Charitable contribution, including alms to beggars for P30,000, the Red Cross for P100,000 and the victims of the fire tragedy for P50,000 Miscellaneous expense, including medical expense of the household staff for P24,500 and educational expense of a son for P125,000 Business expenses- Japan - China Income taxes paid - Japan - China Income on sale of car acquired 8 months ago Commission from the employer Rental income on lease of land, net of tax Musical director's fees, net of tax Hazard pay Interest, Banco de Oro, net of tax Cash dividend, net of tax Winnings, US game show SSS sickness benefits Royalties, net of tax Mirs. Limper = Net salaries Witholding tax Union dues Papment. 555 lown 555/ Philhealth contribution 185000.00 income onsale of fenctrics accuincd 2 years ago 555 didability bonchits. 90.50000 Boras 4890000 Acfund of hospital capcroes 57.50000 Allowances 3200000 Medical experise 1600000 Overtime pay 14.32200 Fringe bernefiss 40.91000 Cash eward for tonesty 150000.00 Condonation of indebtedness by the croditor 75.00000 Gain on garage sak of various used clethos 35.25000 2. Engr. Limpe, an enterprising business person, had the followir Gross receipts in his rent-a-plant business Refund on excess payment of insurance premium Honorarium as speaker in an Engineering Forum Refund of excess payment of donor's tax Rental income, net of tax Receipts as operator of janitorial services, net of tax Gross sales of merchandise Interest income, Development Bank of the Philippines bonds Interest income, Banco de Oro, net of tax Gross receipts as operator of beauty and wellness center Winnings in a local TV game show, net of tax Gross receipts, shoes repair and key duplication business Refund of fire insurance premium Estate tax refund Property dividend, net of tax Birthday gift from the spouse Gross business income - Japan Disbursements - Cost of sales of merchandise Salaries and allowances, including wages of household aide for P75,000 Taxes and licenses, including income tax of P 45,000 and real property tax of P 54,000 Insurance expense Depreciation, including depreciation for household appliance of P7,800 and office equipment of P6,400 Bad debts written off, including P35,000 receivable from his sister Interest expense, including interest on loan from his father of P 14,500.00 Business rentals Light, water and telephone Losses, including wagering loss of P50,000, long term loss from sale of capital asset of P35,000, casualty loss of P235,000 and losses due to fire of P120,000 Charitable contribution, including alms to beggars for P30,000, the Red Cross for P100,000 and the victims of the fire tragedy for P50,000 Miscellaneous expense, including medical expense of the household staff for P24,500 and educational expense of a son for P125,000 Business expenses- Japan - China Income taxes paid - Japan - ChinaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started