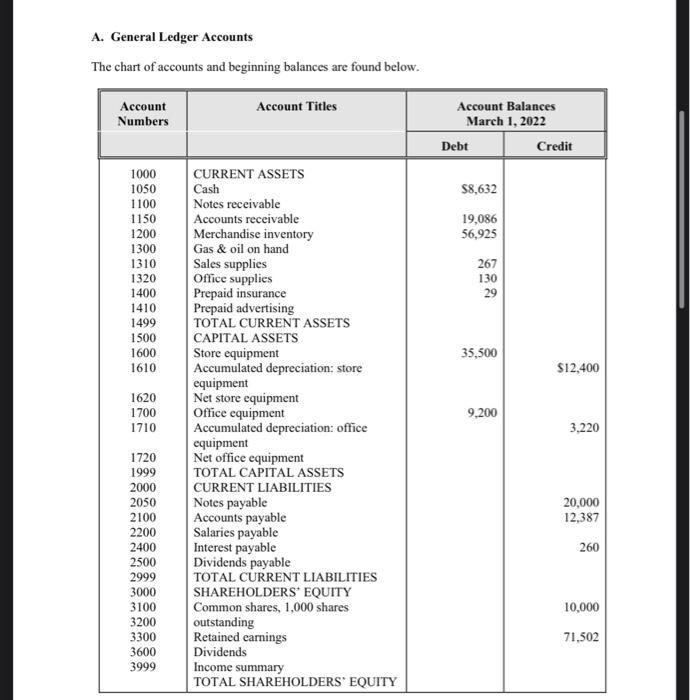

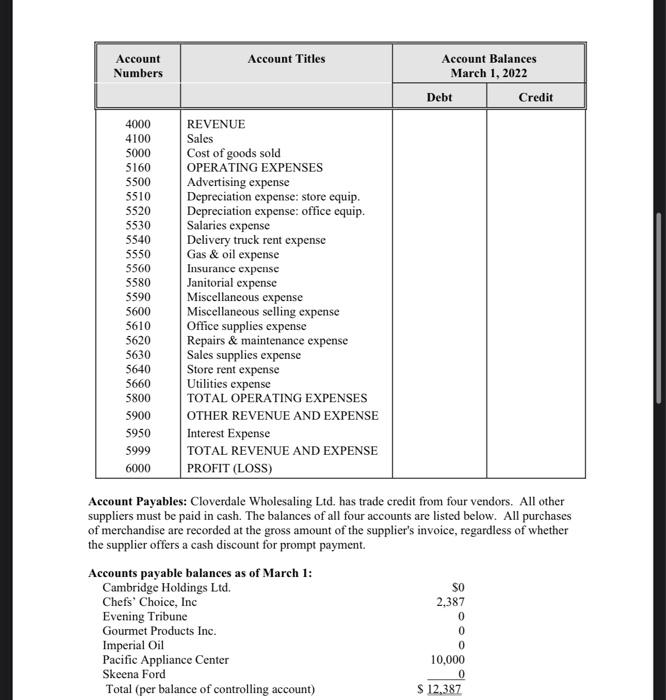

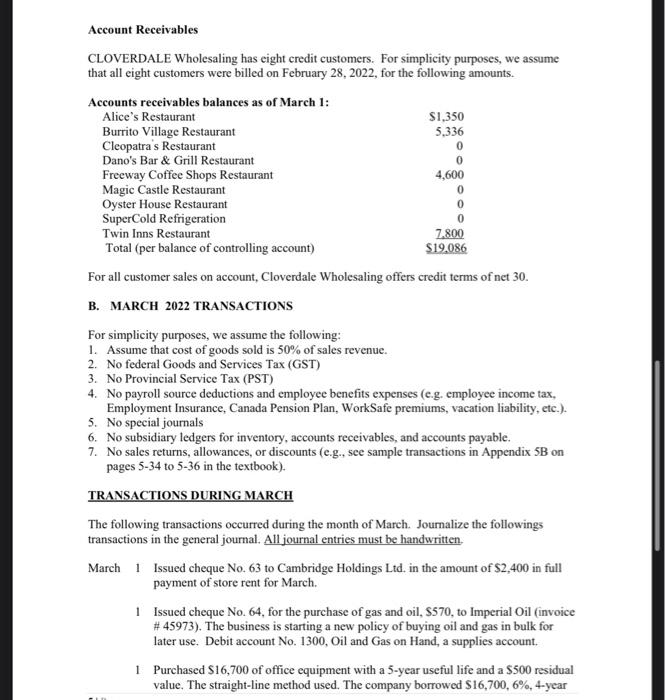

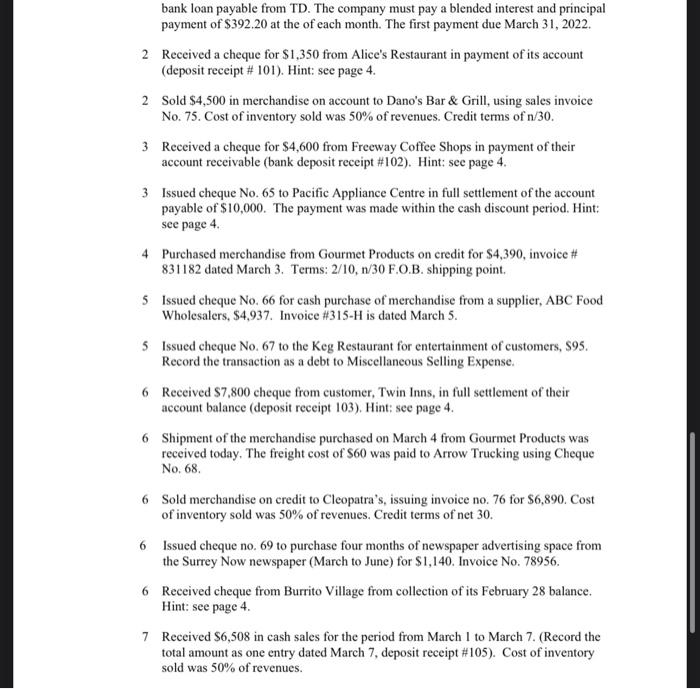

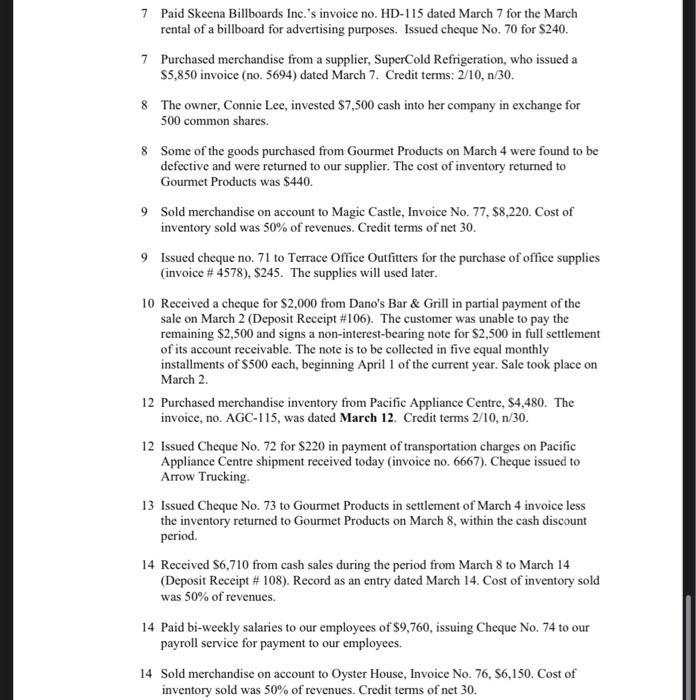

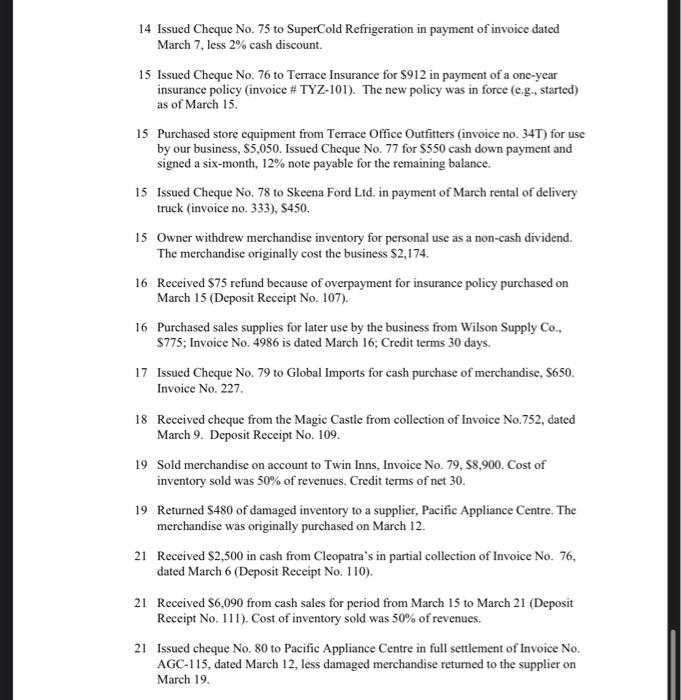

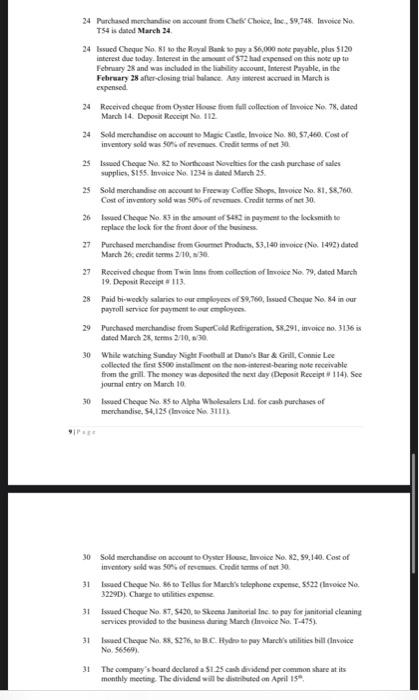

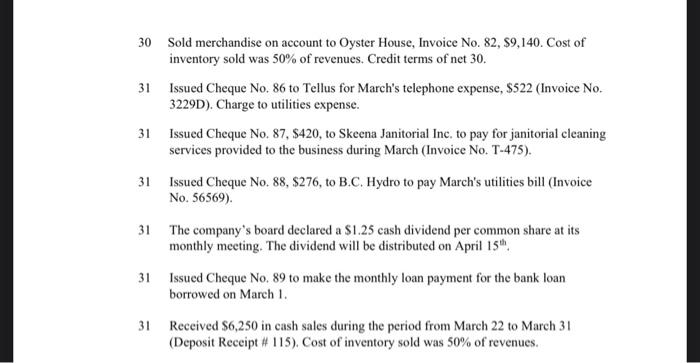

The term project is a manual accounting assignment is the one-month accounting cycle for a privately owned merchandising business, Cloverdale Wholesaling Ltd. The business is starting its new fiscal year, as of March 1, 2022. The fiscal year-end for Cloverdale Wholesaling Ltd. was February 28, 2022, so all the company`s temporary accounts (e.g., sales, expenses, dividends) are empty. The account balances, as of that date, for all general ledger accounts are provided on pages 2 and 3 . Your assignment is to set up and maintain the books of the business for the month of March 2022 , following the standard steps of the accounting cycle. 1. Record journal entries in the general journal. 2. Post these transactions to T-accounts (general ledger accounts). 3. Prepare an unadjusted trial balance. 4. Record the necessary adjusting entries. 5. Prepare the month-end financial statements for company (e.g., Income Statement, statement of retained earnings, and Balance Sheet). As Cloverdale Wholesaling Ltd. will be only one month into its new fiscal year, there is no need to prepare closing entries at the end of March. Cloverdale Wholesaling Ltd. uses a perpetual inventory system. GROUP PROJECT REQUIREMENTS Your submission must include: 1. Title page with your name, student number, course name and section number. 2. A declaration signed and dated by yourself, that reads as follows. Assignments will not be accepted without all names and signatures: "I hereby declare that all of the work in this assignment has been performed by members of our group without any outside assistance or resources except the textbook, the course website and WileyPlus. Should this declaration be shown not to be true, we understand that all group members will receive a mark of 0% (ZERO) for this component of the course". 3. All work must be handwritten. 4. The following working papers will be included as part of your submission - Journal entries for the month - General ledger T-accounts - Unadjusted trial balance (as of March 31, 2022) - Adjusting entries - All general ledger accounts (e.g., T-accounts) with beginning balances, posting of all March journal entries, month-end adjusting entries and ending balances, March 31. - Adjusted trial balance (as of March 31,2022 ). - Income statement (for month ended March 31, 2022) - Statement of Retained Earnings (for month ended March 31, 2022) - Balance sheet (as of March 31, 2022) A. General Ledger Accounts Acceunt Payables: Cloverdale Wholesaling Ltd. has trade credit from four vendors. All other suppliers must be paid in cash. The balances of all four accounts are listed below. All purchases of merchandise are recorded at the gross amount of the supplier's invoice, regardless of whether the supplier offers a cash discount for prompt payment. Account Receivables CLOVERDALE Wholesaling has eight credit customers. For simplicity purposes, we assume that all eight customers were billed on February 28, 2022, for the following amounts. For all customer sales on account, Cloverdale Wholesaling offers credit terms of net 30 . B. MARCH 2022 TRANSACTIONS For simplicity purposes, we assume the following: 1. Assume that cost of goods sold is 50% of sales revenue. 2. No federal Goods and Services Tax (GST) 3. No Provincial Service Tax (PST) 4. No payroll source deductions and employee benefits expenses (e.g. employee income tax, Employment Insurance, Canada Pension Plan, WorkSafe premiums, vacation liability, etc.). 5. No special journals 6. No subsidiary ledgers for inventory, accounts receivables, and accounts payable. 7. No sales returns, allowances, or discounts (e.g., see sample transactions in Appendix 5B on pages 5-34 to 5-36 in the textbook). TRANSACTIONS DURING MARCH The following transactions occurred during the month of March. Journalize the followings transactions in the general journal. All journal entries must be handwritten. March 1 Issued cheque No. 63 to Cambridge Holdings Ltd. in the amount of $2,400 in full payment of store rent for March. 1 Issued cheque No. 64, for the purchase of gas and oil, $570, to Imperial Oil (invoice \# 45973). The business is starting a new policy of buying oil and gas in bulk for later use. Debit account No. 1300, Oil and Gas on Hand, a supplies account. 1 Purchased $16,700 of office equipment with a 5-year useful life and a $500 residual value. The straight-line method used. The company borrowed $16,700,6%,4-year bank loan payable from TD. The company must pay a blended interest and principal payment of $392.20 at the of each month. The first payment due March 31, 2022. 2 Received a cheque for $1,350 from Alice's Restaurant in payment of its account (deposit receipt \# 101). Hint: see page 4. 2 Sold $4,500 in merchandise on account to Dano's Bar \& Grill, using sales invoice No. 75. Cost of inventory sold was 50% of revenues. Credit terms of n/30. 3 Received a cheque for $4,600 from Freeway Coffee Shops in payment of their account receivable (bank deposit receipt \#102). Hint: see page 4 . 3 Issued cheque No. 65 to Pacific Appliance Centre in full settlement of the account payable of $10,000. The payment was made within the cash discount period. Hint: see page 4. 4 Purchased merchandise from Gourmet Products on credit for $4,390, invoice \# 831182 dated March 3. Terms: 2/10,n/30F.O.B. shipping point. 5 Issued cheque No. 66 for cash purchase of merchandise from a supplier, ABC Food Wholesalers, \$4,937. Invoice \#315-H is dated March 5. 5 Issued cheque No. 67 to the Keg Restaurant for entertainment of customers, S95. Record the transaction as a debt to Miscellaneous Selling Expense. 6 Received $7,800 cheque from customer, Twin Inns, in full settlement of their account balance (deposit receipt 103). Hint: see page 4. 6 Shipment of the merchandise purchased on March 4 from Gourmet Products was received today. The freight cost of $60 was paid to Arrow Trucking using Cheque No, 68 . 6 Sold merchandise on credit to Cleopatra's, issuing invoice no. 76 for $6,890. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 6 Issued cheque no. 69 to purchase four months of newspaper advertising space from the Surrey Now newspaper (March to June) for $1,140. Invoice No. 78956. 6 Received cheque from Burrito Village from collection of its February 28 balance. Hint: see page 4. 7 Received \$6,508 in cash sales for the period from March I to March 7. (Record the total amount as one entry dated March 7 , deposit receipt \#105). Cost of inventory sold was 50% of revenues. 7 Paid Skeena Billboards Inc.'s invoice no. HD-115 dated March 7 for the March rental of a billboard for advertising purposes. Issued cheque No. 70 for $240. 7 Purchased merchandise from a supplier, SuperCold Refrigeration, who issued a $5,850 invoice (no. 5694) dated March 7. Credit terms: 2/10,n/30. 8 The owner, Connie Lee, invested $7,500 cash into her company in exchange for 500 common shares. 8 Some of the goods purchased from Gourmet Products on March 4 were found to be defective and were returned to our supplier. The cost of inventory returned to Gourmet Products was $440. 9 Sold merchandise on account to Magic Castle, Invoice No. 77, \$8,220. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 9. Issued cheque no. 71 to Terrace Office Outfitters for the purchase of office supplies (invoice \# 4578), \$245. The supplies will used later. 10 Received a cheque for $2,000 from Dano's Bar \& Grill in partial payment of the sale on March 2 (Deposit Receipt \#106). The customer was unable to pay the remaining $2,500 and signs a non-interest-bearing note for $2,500 in full settlement of its account receivable. The note is to be collected in five equal monthly installments of $500 each, beginning April 1 of the current year. Sale took place on March 2. 12 Purchased merchandise inventory from Pacific Appliance Centre, $4,480. The invoice, no. AGC-115, was dated March 12. Credit terms 2/10,n/30. 12 Issued Cheque No. 72 for $220 in payment of transportation charges on Pacific Appliance Centre shipment received today (invoice no. 6667). Cheque issued to Arrow Trucking. 13 Issued Cheque No. 73 to Gourmet Products in settlement of March 4 invoice less the inventory returned to Gourmet Products on March 8 , within the cash discount period. 14 Received S6,710 from cash sales during the period from March 8 to March 14 (Deposit Receipt \# 108). Record as an entry dated March 14. Cost of inventory sold was 50% of revenues. 14 Paid bi-weekly salaries to our employees of $9,760, issuing Cheque No. 74 to our payroll service for payment to our employees. 14 Sold merchandise on account to Oyster House, Invoice No. 76, \$6,150. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 14 Issued Cheque No. 75 to SuperCold Refrigeration in payment of invoice dated March 7 , less 2% cash discount. 15 Issued Cheque No. 76 to Terrace Insurance for $912 in payment of a one-year insurance policy (invoice \# TYZ-101). The new policy was in force (e.g., started) as of March 15. 15 Purchased store equipment from Terrace Office Outfitters (invoice no. 34T) for use by our business, $5,050. Issued Cheque No. 77 for $550 cash down payment and signed a six-month, 12% note payable for the remaining balance. 15 Issued Cheque No. 78 to Skeena Ford Ltd. in payment of March rental of delivery truck (invoice no. 333), $450. 15 Owner withdrew merchandise inventory for personal use as a non-cash dividend. The merchandise originally cost the business $2,174. 16 Received $75 refund because of overpayment for insurance policy purchased on March 15 (Deposit Receipt No. 107). 16 Purchased sales supplies for later use by the business from Wilson Supply Co., \$775; Invoice No. 4986 is dated March 16; Credit terms 30 days. 17 Issued Cheque No. 79 to Global Imports for cash purchase of merchandise, S650. Invoice No. 227. 18 Received cheque from the Magic Castle from collection of Invoice No.752, dated March 9. Deposit Receipt No. 109. 19 Sold merchandise on account to Twin Inns, Invoice No. 79, \$8,900. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 19 Returned $480 of damaged inventory to a supplier, Pacific Appliance Centre. The merchandise was originally purchased on March 12. 21 Received $2,500 in cash from Cleopatra's in partial collection of Invoice No. 76, dated March 6 (Deposit Receipt No. 110). 21 Received $6,090 from cash sales for period from March 15 to March 21 (Deposit Receipt No. 111). Cost of inventory sold was 50% of revenues. 21 Issued cheque No. 80 to Pacific Appliance Centre in full settlement of Invoice No. AGC-115, dated March 12, less damaged merchandise returned to the supplier on March 19. TS4 is dalel March 24. 24 Issucd Choque No, 81 so the Royal Bhek to pay a 96,000 note pryable, plus 5120 interest due boday. Itriefent in the amoun of \$72 had expensed on thes note up to February 28 and was included is the liahelify awoount, Interest Payable, in the Felorwary 28 afer-dosing trial bulases. Ady intrest aswruck in March is expensed. 24 Reserved cheque from Oynec Hocse froe full eollection laveice No. 7X, dated Marsh 14. Deposit Reccign Na. 112. 24. Sold merchandise on accounn to Mhpic Crutle, Invose No. s0, 57,460. Cost of inventory sold was 50 is of resenves. Credit terms of net 30 25. Issaed Cheque Ne. 82 to Northeoon Novahies for the cah purchase of sales supplies, 5155. Invwice Na.1234 is dated Murch 25. 25 Sold nserchandise on accuset wo Frecs ay Colfec Shops, lavoice No. 81, 88,760 Cost of inventory sold was 500 of novenaes. Crodit terms of net 30. 26. Issued Cheque Na. 83 in the amoum of 5621 in guyment so the locksmith bo replace the lock for the front doer of the bexisess. 77. Purchased merthacshus frem Cournet Prodacth. 53.140 invoiee (Nio. 1492) dated March 26c credit temins 210, a 30. 27 Rescivsd choque from Twin lass fhoe colloutice of Imroice No. 79, datcd Manh 19. Deposit Receipt a 113. 28. Paid bi-wockly salarics to our amployecs of 59,760, lsued Cheque No. 84 in our paytoll serviece for payment ie our employ thi. 29. Purchased menchandise from 5-perCold Refrigeration, 58.291, invoise no. 3136 is dated March 2k, 1erms 270, n30. 30 While watching Sundiry Night foothull at Duno's Bar & Grill, Consie Lee collected the firs 5500 installment oe the moe-inderest-bearing nole retervable from the grilt. The moncy was doporited the scat day iDeporit Receipt il 114). See journal entry on March 10 30- Isoued Cheque Na. s5 to Nyha Whilenlers Lad. fee eab purchases of merchandise, 54,125 (lavoice Nas, 3t11). 30. Sold micrchasdise on accoent to Oyster Hlouse, livoice No. 22,59,140. Cost of invichory sild was sofs of ecomms. Crodit hams of not 30 . 31 Iroued Cheque Na. Sti no Telles fier Mtuedr's talephone expenac. 5822 rlaroice No. 3229D). Change to artilitios evpense 31. Foued Cheque Na. 57, 54.00, to She ena Jariaceial Inc- wo pay for janiterial eleaning services peovided to the businesa durieg March (lavoice No. T-475). 31 Iroued Cheyoe Nan, sk, sighe, ao BCC. Hydra ta pay Marchrs anlities bill (invwice No. 565697 . 31 The company's hoard declarod a 91.25 cash dividend per coenmon share at its monthly meetiog. The dividend will be theribeted on Apeil 15th. 30 Sold merchandise on account to Oyster House, Invoice No. 82, \$9,140. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 31 Issued Cheque No. 86 to Tellus for March's telephone expense, \$522 (Invoice No. 3229D). Charge to utilities expense. 31 Issued Cheque No. 87, \$420, to Skeena Janitorial Inc, to pay for janitorial cleaning services provided to the business during March (Invoice No. T-475). 31 Issued Cheque No. 88, \$276, to B.C. Hydro to pay March's utilities bill (Invoice No. 56569 ). 31 The company's board declared a \$1.25 cash dividend per common share at its monthly meeting. The dividend will be distributed on April 15th. 31 Issued Cheque No. 89 to make the monthly loan payment for the bank loan borrowed on March 1. 31 Received $6,250 in cash sales during the period from March 22 to March 31 (Deposit Receipt #115 ). Cost of inventory sold was 50% of revenues. The term project is a manual accounting assignment is the one-month accounting cycle for a privately owned merchandising business, Cloverdale Wholesaling Ltd. The business is starting its new fiscal year, as of March 1, 2022. The fiscal year-end for Cloverdale Wholesaling Ltd. was February 28, 2022, so all the company`s temporary accounts (e.g., sales, expenses, dividends) are empty. The account balances, as of that date, for all general ledger accounts are provided on pages 2 and 3 . Your assignment is to set up and maintain the books of the business for the month of March 2022 , following the standard steps of the accounting cycle. 1. Record journal entries in the general journal. 2. Post these transactions to T-accounts (general ledger accounts). 3. Prepare an unadjusted trial balance. 4. Record the necessary adjusting entries. 5. Prepare the month-end financial statements for company (e.g., Income Statement, statement of retained earnings, and Balance Sheet). As Cloverdale Wholesaling Ltd. will be only one month into its new fiscal year, there is no need to prepare closing entries at the end of March. Cloverdale Wholesaling Ltd. uses a perpetual inventory system. GROUP PROJECT REQUIREMENTS Your submission must include: 1. Title page with your name, student number, course name and section number. 2. A declaration signed and dated by yourself, that reads as follows. Assignments will not be accepted without all names and signatures: "I hereby declare that all of the work in this assignment has been performed by members of our group without any outside assistance or resources except the textbook, the course website and WileyPlus. Should this declaration be shown not to be true, we understand that all group members will receive a mark of 0% (ZERO) for this component of the course". 3. All work must be handwritten. 4. The following working papers will be included as part of your submission - Journal entries for the month - General ledger T-accounts - Unadjusted trial balance (as of March 31, 2022) - Adjusting entries - All general ledger accounts (e.g., T-accounts) with beginning balances, posting of all March journal entries, month-end adjusting entries and ending balances, March 31. - Adjusted trial balance (as of March 31,2022 ). - Income statement (for month ended March 31, 2022) - Statement of Retained Earnings (for month ended March 31, 2022) - Balance sheet (as of March 31, 2022) A. General Ledger Accounts Acceunt Payables: Cloverdale Wholesaling Ltd. has trade credit from four vendors. All other suppliers must be paid in cash. The balances of all four accounts are listed below. All purchases of merchandise are recorded at the gross amount of the supplier's invoice, regardless of whether the supplier offers a cash discount for prompt payment. Account Receivables CLOVERDALE Wholesaling has eight credit customers. For simplicity purposes, we assume that all eight customers were billed on February 28, 2022, for the following amounts. For all customer sales on account, Cloverdale Wholesaling offers credit terms of net 30 . B. MARCH 2022 TRANSACTIONS For simplicity purposes, we assume the following: 1. Assume that cost of goods sold is 50% of sales revenue. 2. No federal Goods and Services Tax (GST) 3. No Provincial Service Tax (PST) 4. No payroll source deductions and employee benefits expenses (e.g. employee income tax, Employment Insurance, Canada Pension Plan, WorkSafe premiums, vacation liability, etc.). 5. No special journals 6. No subsidiary ledgers for inventory, accounts receivables, and accounts payable. 7. No sales returns, allowances, or discounts (e.g., see sample transactions in Appendix 5B on pages 5-34 to 5-36 in the textbook). TRANSACTIONS DURING MARCH The following transactions occurred during the month of March. Journalize the followings transactions in the general journal. All journal entries must be handwritten. March 1 Issued cheque No. 63 to Cambridge Holdings Ltd. in the amount of $2,400 in full payment of store rent for March. 1 Issued cheque No. 64, for the purchase of gas and oil, $570, to Imperial Oil (invoice \# 45973). The business is starting a new policy of buying oil and gas in bulk for later use. Debit account No. 1300, Oil and Gas on Hand, a supplies account. 1 Purchased $16,700 of office equipment with a 5-year useful life and a $500 residual value. The straight-line method used. The company borrowed $16,700,6%,4-year bank loan payable from TD. The company must pay a blended interest and principal payment of $392.20 at the of each month. The first payment due March 31, 2022. 2 Received a cheque for $1,350 from Alice's Restaurant in payment of its account (deposit receipt \# 101). Hint: see page 4. 2 Sold $4,500 in merchandise on account to Dano's Bar \& Grill, using sales invoice No. 75. Cost of inventory sold was 50% of revenues. Credit terms of n/30. 3 Received a cheque for $4,600 from Freeway Coffee Shops in payment of their account receivable (bank deposit receipt \#102). Hint: see page 4 . 3 Issued cheque No. 65 to Pacific Appliance Centre in full settlement of the account payable of $10,000. The payment was made within the cash discount period. Hint: see page 4. 4 Purchased merchandise from Gourmet Products on credit for $4,390, invoice \# 831182 dated March 3. Terms: 2/10,n/30F.O.B. shipping point. 5 Issued cheque No. 66 for cash purchase of merchandise from a supplier, ABC Food Wholesalers, \$4,937. Invoice \#315-H is dated March 5. 5 Issued cheque No. 67 to the Keg Restaurant for entertainment of customers, S95. Record the transaction as a debt to Miscellaneous Selling Expense. 6 Received $7,800 cheque from customer, Twin Inns, in full settlement of their account balance (deposit receipt 103). Hint: see page 4. 6 Shipment of the merchandise purchased on March 4 from Gourmet Products was received today. The freight cost of $60 was paid to Arrow Trucking using Cheque No, 68 . 6 Sold merchandise on credit to Cleopatra's, issuing invoice no. 76 for $6,890. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 6 Issued cheque no. 69 to purchase four months of newspaper advertising space from the Surrey Now newspaper (March to June) for $1,140. Invoice No. 78956. 6 Received cheque from Burrito Village from collection of its February 28 balance. Hint: see page 4. 7 Received \$6,508 in cash sales for the period from March I to March 7. (Record the total amount as one entry dated March 7 , deposit receipt \#105). Cost of inventory sold was 50% of revenues. 7 Paid Skeena Billboards Inc.'s invoice no. HD-115 dated March 7 for the March rental of a billboard for advertising purposes. Issued cheque No. 70 for $240. 7 Purchased merchandise from a supplier, SuperCold Refrigeration, who issued a $5,850 invoice (no. 5694) dated March 7. Credit terms: 2/10,n/30. 8 The owner, Connie Lee, invested $7,500 cash into her company in exchange for 500 common shares. 8 Some of the goods purchased from Gourmet Products on March 4 were found to be defective and were returned to our supplier. The cost of inventory returned to Gourmet Products was $440. 9 Sold merchandise on account to Magic Castle, Invoice No. 77, \$8,220. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 9. Issued cheque no. 71 to Terrace Office Outfitters for the purchase of office supplies (invoice \# 4578), \$245. The supplies will used later. 10 Received a cheque for $2,000 from Dano's Bar \& Grill in partial payment of the sale on March 2 (Deposit Receipt \#106). The customer was unable to pay the remaining $2,500 and signs a non-interest-bearing note for $2,500 in full settlement of its account receivable. The note is to be collected in five equal monthly installments of $500 each, beginning April 1 of the current year. Sale took place on March 2. 12 Purchased merchandise inventory from Pacific Appliance Centre, $4,480. The invoice, no. AGC-115, was dated March 12. Credit terms 2/10,n/30. 12 Issued Cheque No. 72 for $220 in payment of transportation charges on Pacific Appliance Centre shipment received today (invoice no. 6667). Cheque issued to Arrow Trucking. 13 Issued Cheque No. 73 to Gourmet Products in settlement of March 4 invoice less the inventory returned to Gourmet Products on March 8 , within the cash discount period. 14 Received S6,710 from cash sales during the period from March 8 to March 14 (Deposit Receipt \# 108). Record as an entry dated March 14. Cost of inventory sold was 50% of revenues. 14 Paid bi-weekly salaries to our employees of $9,760, issuing Cheque No. 74 to our payroll service for payment to our employees. 14 Sold merchandise on account to Oyster House, Invoice No. 76, \$6,150. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 14 Issued Cheque No. 75 to SuperCold Refrigeration in payment of invoice dated March 7 , less 2% cash discount. 15 Issued Cheque No. 76 to Terrace Insurance for $912 in payment of a one-year insurance policy (invoice \# TYZ-101). The new policy was in force (e.g., started) as of March 15. 15 Purchased store equipment from Terrace Office Outfitters (invoice no. 34T) for use by our business, $5,050. Issued Cheque No. 77 for $550 cash down payment and signed a six-month, 12% note payable for the remaining balance. 15 Issued Cheque No. 78 to Skeena Ford Ltd. in payment of March rental of delivery truck (invoice no. 333), $450. 15 Owner withdrew merchandise inventory for personal use as a non-cash dividend. The merchandise originally cost the business $2,174. 16 Received $75 refund because of overpayment for insurance policy purchased on March 15 (Deposit Receipt No. 107). 16 Purchased sales supplies for later use by the business from Wilson Supply Co., \$775; Invoice No. 4986 is dated March 16; Credit terms 30 days. 17 Issued Cheque No. 79 to Global Imports for cash purchase of merchandise, S650. Invoice No. 227. 18 Received cheque from the Magic Castle from collection of Invoice No.752, dated March 9. Deposit Receipt No. 109. 19 Sold merchandise on account to Twin Inns, Invoice No. 79, \$8,900. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 19 Returned $480 of damaged inventory to a supplier, Pacific Appliance Centre. The merchandise was originally purchased on March 12. 21 Received $2,500 in cash from Cleopatra's in partial collection of Invoice No. 76, dated March 6 (Deposit Receipt No. 110). 21 Received $6,090 from cash sales for period from March 15 to March 21 (Deposit Receipt No. 111). Cost of inventory sold was 50% of revenues. 21 Issued cheque No. 80 to Pacific Appliance Centre in full settlement of Invoice No. AGC-115, dated March 12, less damaged merchandise returned to the supplier on March 19. TS4 is dalel March 24. 24 Issucd Choque No, 81 so the Royal Bhek to pay a 96,000 note pryable, plus 5120 interest due boday. Itriefent in the amoun of \$72 had expensed on thes note up to February 28 and was included is the liahelify awoount, Interest Payable, in the Felorwary 28 afer-dosing trial bulases. Ady intrest aswruck in March is expensed. 24 Reserved cheque from Oynec Hocse froe full eollection laveice No. 7X, dated Marsh 14. Deposit Reccign Na. 112. 24. Sold merchandise on accounn to Mhpic Crutle, Invose No. s0, 57,460. Cost of inventory sold was 50 is of resenves. Credit terms of net 30 25. Issaed Cheque Ne. 82 to Northeoon Novahies for the cah purchase of sales supplies, 5155. Invwice Na.1234 is dated Murch 25. 25 Sold nserchandise on accuset wo Frecs ay Colfec Shops, lavoice No. 81, 88,760 Cost of inventory sold was 500 of novenaes. Crodit terms of net 30. 26. Issued Cheque Na. 83 in the amoum of 5621 in guyment so the locksmith bo replace the lock for the front doer of the bexisess. 77. Purchased merthacshus frem Cournet Prodacth. 53.140 invoiee (Nio. 1492) dated March 26c credit temins 210, a 30. 27 Rescivsd choque from Twin lass fhoe colloutice of Imroice No. 79, datcd Manh 19. Deposit Receipt a 113. 28. Paid bi-wockly salarics to our amployecs of 59,760, lsued Cheque No. 84 in our paytoll serviece for payment ie our employ thi. 29. Purchased menchandise from 5-perCold Refrigeration, 58.291, invoise no. 3136 is dated March 2k, 1erms 270, n30. 30 While watching Sundiry Night foothull at Duno's Bar & Grill, Consie Lee collected the firs 5500 installment oe the moe-inderest-bearing nole retervable from the grilt. The moncy was doporited the scat day iDeporit Receipt il 114). See journal entry on March 10 30- Isoued Cheque Na. s5 to Nyha Whilenlers Lad. fee eab purchases of merchandise, 54,125 (lavoice Nas, 3t11). 30. Sold micrchasdise on accoent to Oyster Hlouse, livoice No. 22,59,140. Cost of invichory sild was sofs of ecomms. Crodit hams of not 30 . 31 Iroued Cheque Na. Sti no Telles fier Mtuedr's talephone expenac. 5822 rlaroice No. 3229D). Change to artilitios evpense 31. Foued Cheque Na. 57, 54.00, to She ena Jariaceial Inc- wo pay for janiterial eleaning services peovided to the businesa durieg March (lavoice No. T-475). 31 Iroued Cheyoe Nan, sk, sighe, ao BCC. Hydra ta pay Marchrs anlities bill (invwice No. 565697 . 31 The company's hoard declarod a 91.25 cash dividend per coenmon share at its monthly meetiog. The dividend will be theribeted on Apeil 15th. 30 Sold merchandise on account to Oyster House, Invoice No. 82, \$9,140. Cost of inventory sold was 50% of revenues. Credit terms of net 30 . 31 Issued Cheque No. 86 to Tellus for March's telephone expense, \$522 (Invoice No. 3229D). Charge to utilities expense. 31 Issued Cheque No. 87, \$420, to Skeena Janitorial Inc, to pay for janitorial cleaning services provided to the business during March (Invoice No. T-475). 31 Issued Cheque No. 88, \$276, to B.C. Hydro to pay March's utilities bill (Invoice No. 56569 ). 31 The company's board declared a \$1.25 cash dividend per common share at its monthly meeting. The dividend will be distributed on April 15th. 31 Issued Cheque No. 89 to make the monthly loan payment for the bank loan borrowed on March 1. 31 Received $6,250 in cash sales during the period from March 22 to March 31 (Deposit Receipt #115 ). Cost of inventory sold was 50% of revenues