Answered step by step

Verified Expert Solution

Question

1 Approved Answer

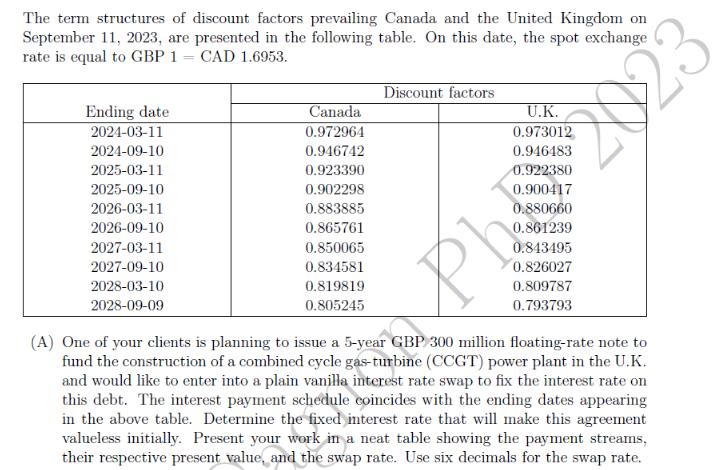

The term structures of discount factors prevailing Canada and the United Kingdom on September 11, 2023, are presented in the following table. On this

The term structures of discount factors prevailing Canada and the United Kingdom on September 11, 2023, are presented in the following table. On this date, the spot exchange rate is equal to GBP 1 CAD 1.6953. Ending date 2024-03-11 2024-09-10 2025-03-11 2025-09-10 2026-03-11 2026-09-10 2027-03-11 2027-09-10 2028-03-10 2028-09-09 Canada 0.972964 0.946742 0.923390 0.902298 0.883885 0.865761 0.850065 0.834581 0.819819 0.805245 Discount factors U.K. 0.973012 0.946483 0.922380 0.900417 0.880660 0.861239 0.843495 0.826027 0.809787 0.793793 Ph 23 (A) One of your clients is planning to issue a 5-year GBP 300 million floating-rate note to fund the construction of a combined cycle gas-turbine (CCGT) power plant in the U.K. and would like to enter into a plain vanilla interest rate swap to fix the interest rate on this debt. The interest payment schedule coincides with the ending dates appearing in the above table. Determine the fixed interest rate that will make this agreement valueless initially. Present your work in a neat table showing the payment streams, their respective present value, and the swap rate. Use six decimals for the swap rate. (B) Your client is also contemplating the possibility of issuing the debt in the Canadian market, instead of issuing it in the U.K. In this scenario, she would hedge her foreign exchange risk exposure with a fixed-floating cross-currency swap. Based on the infor- mation provided in the above table, construct this swap and spell out the terms of this agreement. Present your work in a neat table showing the payment streams, their respective present value, and the fixed rate. Use six decimals for the fixed rate. (C) Based on the above data, in which jurisdiction should your client issue the debt? Consider the following two scenarios: i) she can borrow in Canada at a fixed rate of 420 basis points per year, ii) she can borrow in Canada at a fixed rate of 460 basis points per year. Please, provide a brief explanation.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started