the

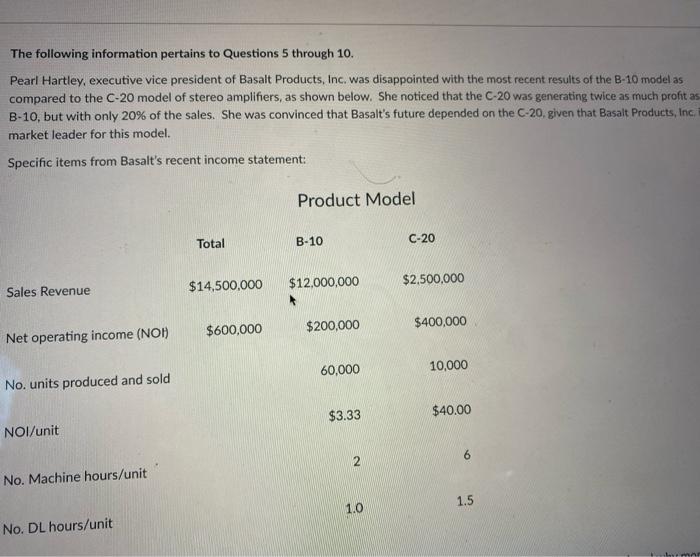

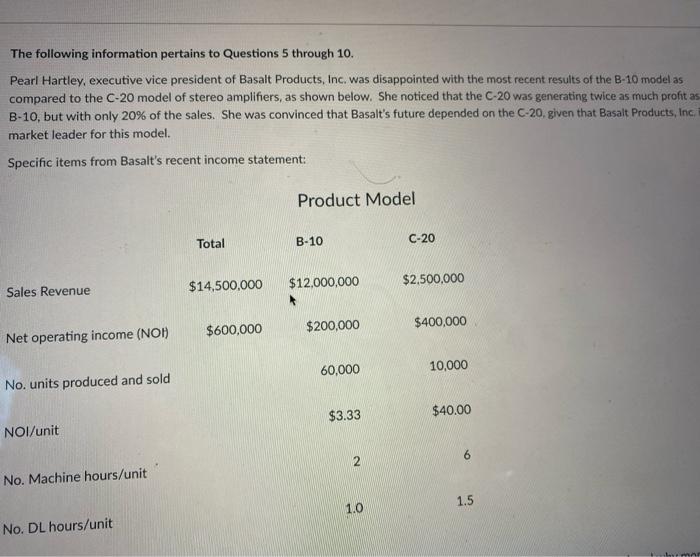

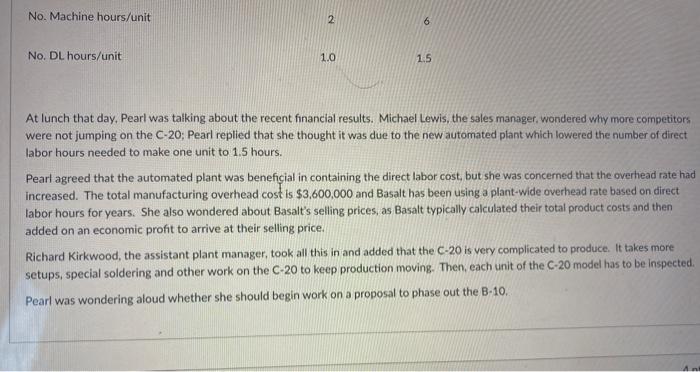

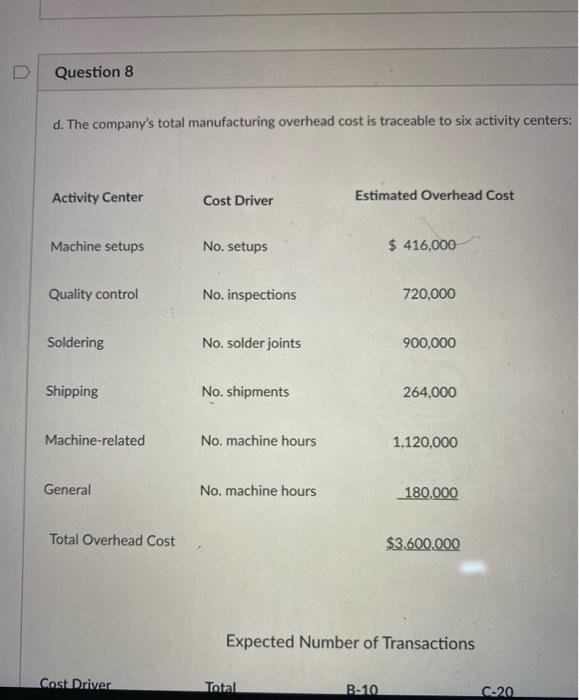

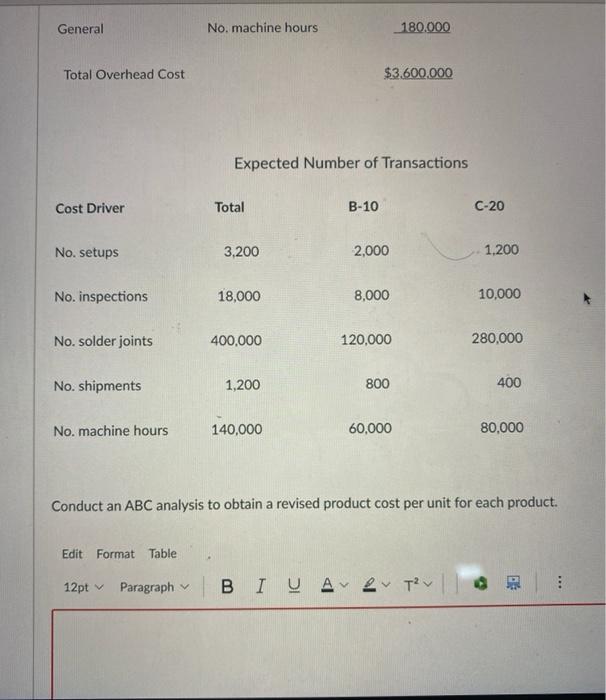

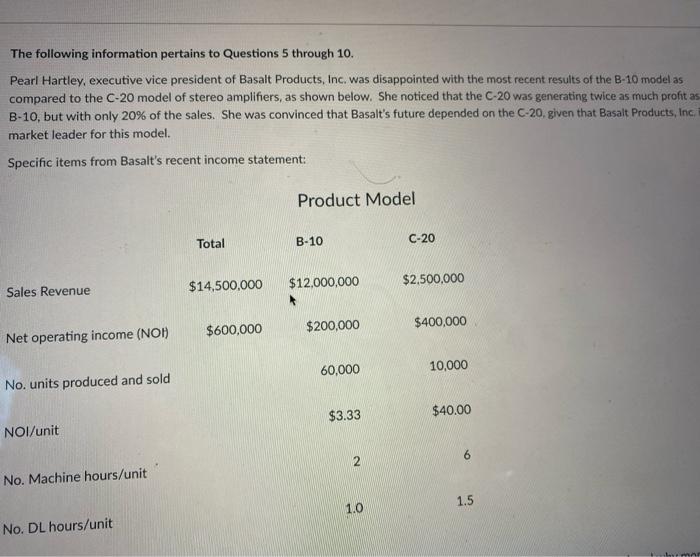

The following information pertains to Questions 5 through 10. Pearl Hartley, executive vice president of Basalt Products, Inc. was disappointed with the most recent results of the B-10 model as compared to the C-20 model of stereo amplifiers, as shown below. She noticed that the C-20 was generating twice as much profit as B-10, but with only 20% of the sales. She was convinced that Basalt's future depended on the C-20. given that Basalt Products, inc. market leader for this model. Specific items from Basalt's recent income statement: Product Model Total B-10 C-20 $14,500,000 $12,000,000 $2,500,000 Sales Revenue $600,000 $200,000 $400,000 Net operating income (NOI) 60,000 10,000 No. units produced and sold $3.33 $40.00 NOI/unit 6 2 No. Machine hours/unit 1.0 1.5 No. DL hours/unit No. Machine hours/unit 2 6 No. DL hours/unit 1.0 15 At lunch that day, Pearl was talking about the recent financial results. Michael Lewis, the sales manager, wondered why more competitors were not jumping on the C-20; Pearl replied that she thought it was due to the new automated plant which lowered the number of direct labor hours needed to make one unit to 1.5 hours. Pearl agreed that the automated plant was beneficial in containing the direct labor cost, but she was concerned that the overhead rate had Increased. The total manufacturing overhead cost is $3,600,000 and Basalt has been using a plant-wide overhead rate based on direct labor hours for years. She also wondered about Basalt's selling prices, as Basalt typically calculated their total product costs and then added on an economic profit to arrive at their selling price. Richard Kirkwood, the assistant plant manager, took all this in and added that the C-20 is very complicated to produce. It takes more setups, special soldering and other work on the C-20 to keep production moving. Then, each unit of the C-20 model has to be inspected. Pearl was wondering aloud whether she should begin work on a proposal to phase out the B-10. D Question 8 d. The company's total manufacturing overhead cost is traceable to six activity centers: Activity Center Cost Driver Estimated Overhead Cost Machine setups No. setups $ 416,000 Quality control No. inspections 720,000 Soldering No. solder joints 900,000 Shipping No. shipments 264.000 Machine-related No. machine hours 1,120,000 General No. machine hours 180,000 Total Overhead Cost $3.600,000 Expected Number of Transactions Cost Driver Total B-10 C020 General No, machine hours 180.000 Total Overhead Cost $3.600.000 Expected Number of Transactions Cost Driver Total B-10 C-20 No. setups 3,200 2,000 1,200 No. inspections 18,000 8,000 10,000 No. solder joints 400.000 120,000 280,000 No. shipments 1,200 800 400 No. machine hours 140,000 60,000 80.000 Conduct an ABC analysis to obtain a revised product cost per unit for each product. Edit Format Table 12pt Paragraph BI U ART