Answered step by step

Verified Expert Solution

Question

1 Approved Answer

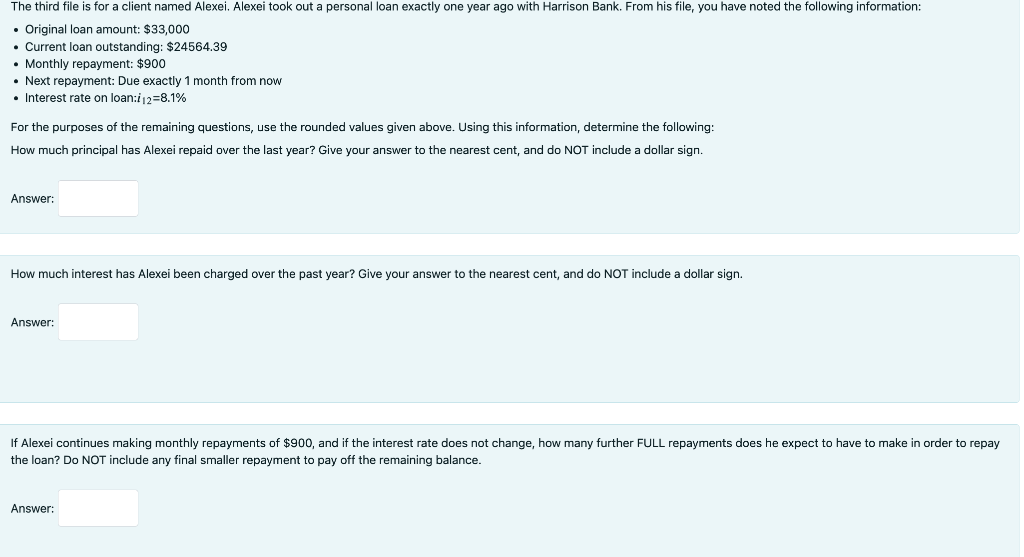

The third file is for a client named Alexei. Alexei took out a personal loan exactly one year ago with Harrison Bank. From his

The third file is for a client named Alexei. Alexei took out a personal loan exactly one year ago with Harrison Bank. From his file, you have noted the following information: Original loan amount: $33,000 Current loan outstanding: $24564.39 Monthly repayment: $900 Next repayment: Due exactly 1 month from now Interest rate on loan:i12=8.1% For the purposes of the remaining questions, use the rounded values given above. Using this information, determine the following: How much principal has Alexei repaid over the last year? Give your answer to the nearest cent, and do NOT include a dollar sign. Answer: How much interest has Alexei been charged over the past year? Give your answer to the nearest cent, and do NOT include dollar sign. Answer: If Alexei continues making monthly repayments of $900, and if the interest rate does not change, how many further FULL repayments does he expect to have to make in order to repay the loan? Do NOT include any final smaller repayment to pay off the remaining balance. Answer:

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Data provided in the question Current outstanding amount 2456439 Monthly repayment 900 Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started