Answered step by step

Verified Expert Solution

Question

1 Approved Answer

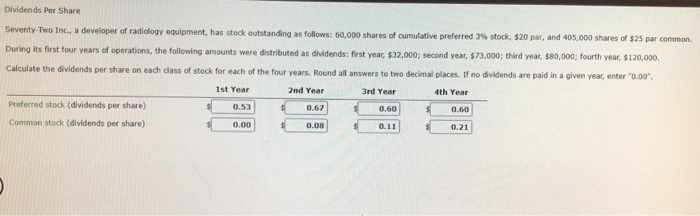

The THIRD YEAR PREFERRED STOCK OF 0.60 is INCORRECT. I need to find the correct answer. Everything else is correct. Dividends Per Share Seventy-Two Inc.,

The THIRD YEAR PREFERRED STOCK OF 0.60 is INCORRECT. I need to find the correct answer. Everything else is correct.

Dividends Per Share Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 60,000 shares of cumulative preferred During its first four years of operations, the following amounts were distributed as dividends: first Calculate the dividends per share on each dlass of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter 0.00 3% stock. S20 par, and 40s,000 shares of $25 par common. year, $32,000; second year, $73,000; third year, $80,000; fourth year, $120,000. 4th Year 2nd Year 3rd Year 1st Year s( 0.53 } s( 0.67) 0.60) 0.00 Preferred stock (dividends per share) 0.21 0.00 Common stock (dividends per share)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started