Answered step by step

Verified Expert Solution

Question

1 Approved Answer

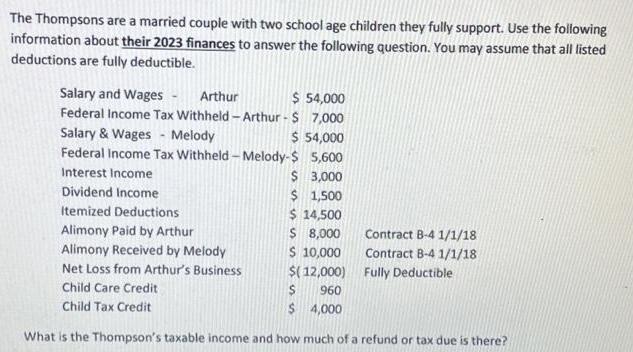

The Thompsons are a married couple with two school age children they fully support. Use the following information about their 2023 finances to answer

The Thompsons are a married couple with two school age children they fully support. Use the following information about their 2023 finances to answer the following question. You may assume that all listed deductions are fully deductible. Salary and Wages Arthur $ 54,000 Federal Income Tax Withheld - Arthur - $ 7,000 Salary & Wages - Melody $ 54,000 Federal Income Tax Withheld-Melody-$ 5,600 Interest Income $ 3,000 $ 1,500 $ 14,500 $ 8,000 $ 10,000 $(12,000) Dividend Income Itemized Deductions Alimony Paid by Arthur Alimony Received by Melody Net Loss from Arthur's Business Child Care Credit $ 960 Child Tax Credit $ 4,000 What is the Thompson's taxable income and how much of a refund or tax due is there? Contract B-4 1/1/18 Contract B-4 1/1/18 Fully Deductible

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Calculate Total Income Arthurs Salary and Wages 54000 Melodys Salary and Wages 54000 Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started