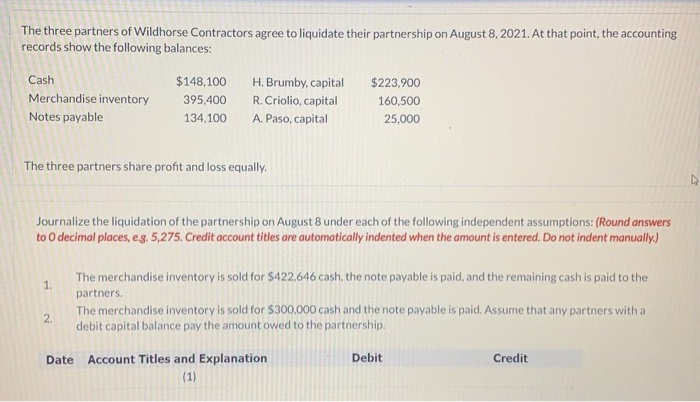

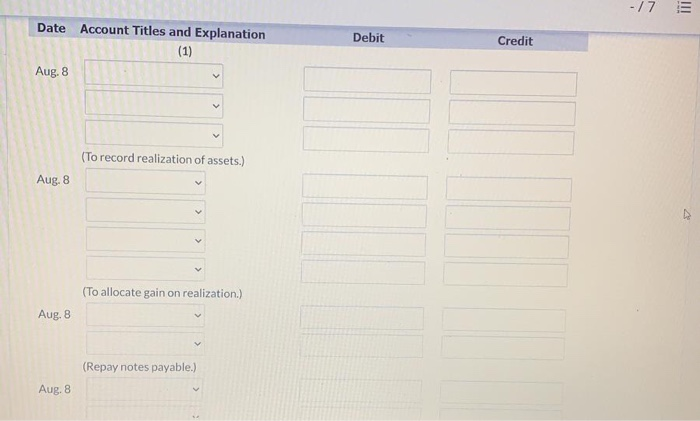

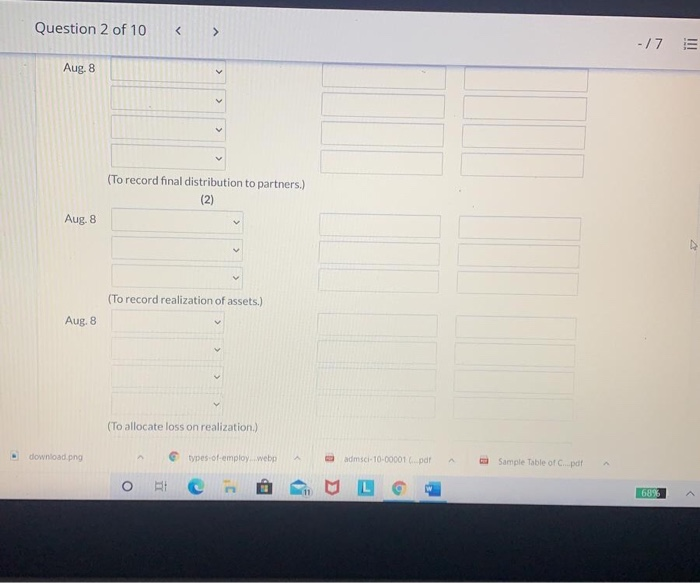

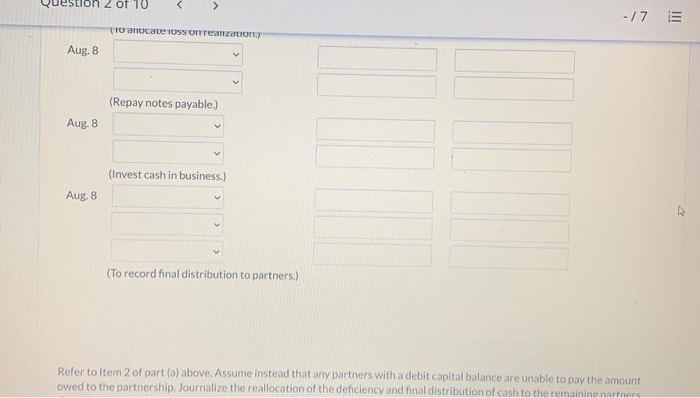

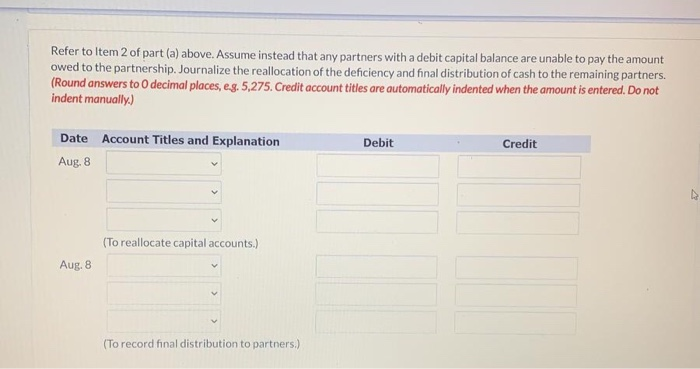

The three partners of Wildhorse Contractors agree to liquidate their partnership on August 8, 2021. At that point, the accounting records show the following balances: Cash Merchandise inventory Notes payable $ 148,100 395,400 134,100 H. Brumby, capital R. Criolio, capital A. Paso, capital $223,900 160,500 25,000 The three partners share profit and loss equally. Journalize the liquidation of the partnership on August 8 under each of the following independent assumptions: (Round answers to decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1 The merchandise inventory is sold for $422,646 cash, the note payable is paid, and the remaining cash is paid to the partners. The merchandise inventory is sold for $300,000 cash and the note payable is paid. Assume that any partners with a debit capital balance pay the amount owed to the partnership 2 Date Debit Credit Account Titles and Explanation (1) -/7 E Debit Credit Date Account Titles and Explanation (1) Aug. 8 (To record realization of assets.) Aug. 8 (To allocate gain on realization.) Aug. 8 (Repay notes payable.) Aug. 8 Question 2 of 10 -/7 E Aug. 8 > v (To record final distribution to partners.) (2) Aug. 8 (To record realization of assets.) Aug. 8 (To allocate loss on realization.) download.png types-of-employ web admsci-10-00001.pdf Sample Table of C.pdf ORP M L C 11 68% uestion 2 of 10 -/7 III (Tanca TOSSUTENZIONE Aug. 8 V (Repay notes payable.) Aug. 8 (Invest cash in business.) Aug. 8 (To record final distribution to partners.) Refer to Item 2 of part(a) above. Assume instead that any partners with a debit capital balance are unable to pay the amount owed to the partnership. Journalize the reallocation of the deficiency and final distribution of cash to the remaining narare Refer to Item 2 of part (a) above. Assume instead that any partners with a debit capital balance are unable to pay the amount owed to the partnership. Journalize the reallocation of the deficiency and final distribution of cash to the remaining partners. (Round answers to decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Aug. 8 Debit Credit (To reallocate capital accounts.) Aug. 8 (To record final distribution to partners.)