Answered step by step

Verified Expert Solution

Question

1 Approved Answer

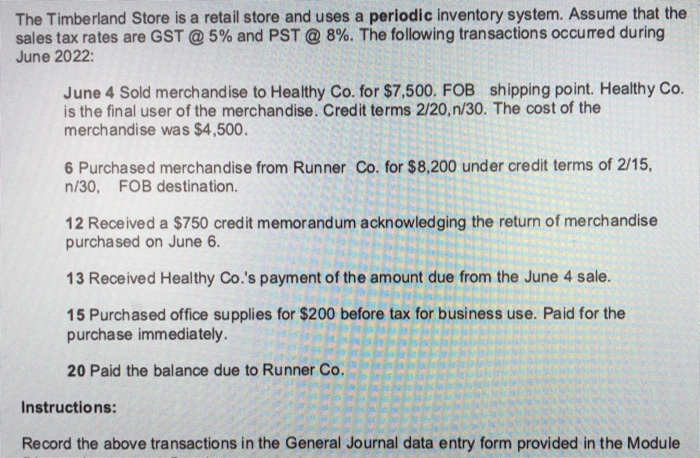

The Timberland Store is a retail store and uses a periodic inventory system. Assume that the sales tax rates are GST @ 5% and

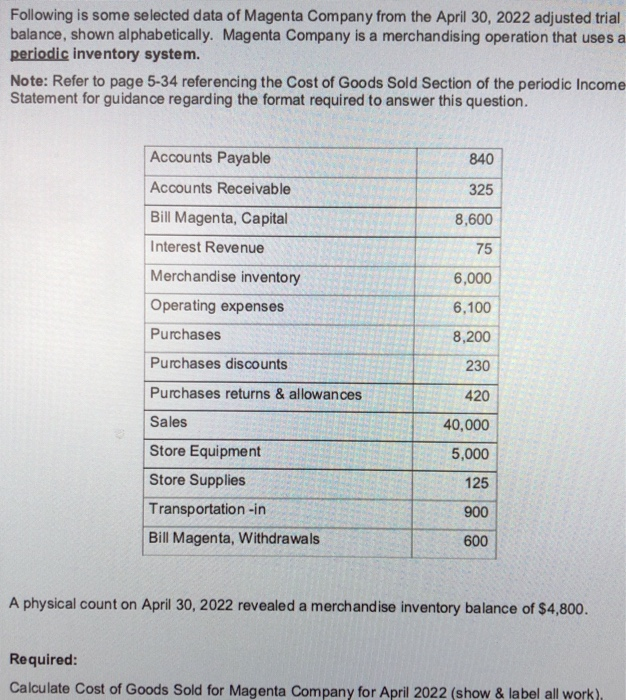

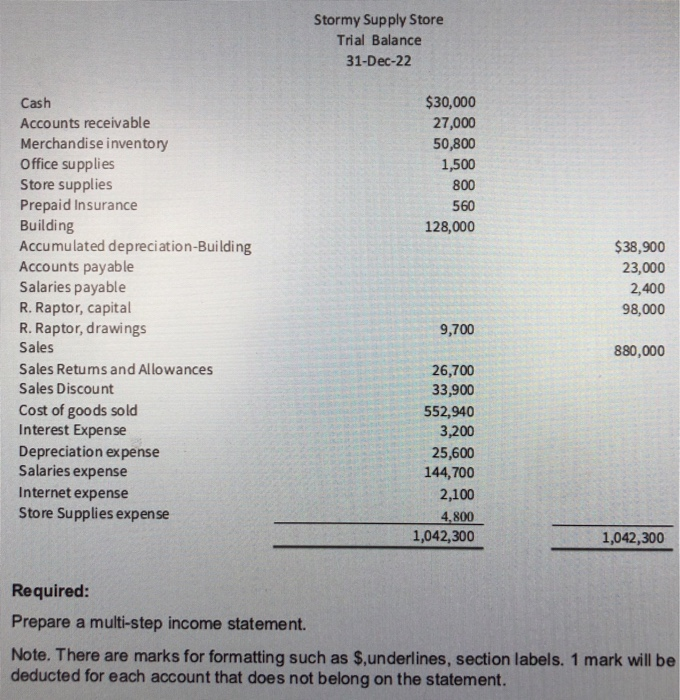

The Timberland Store is a retail store and uses a periodic inventory system. Assume that the sales tax rates are GST @ 5% and PST @ 8%. The following transactions occurred during June 2022: June 4 Sold merchandise to Healthy Co. for $7,500. FOB shipping point. Healthy Co. is the final user of the merchandise. Credit terms 2/20, n/30. The cost of the merchandise was $4,500. 6 Purchased merchandise from Runner Co. for $8,200 under credit terms of 2/15, n/30, FOB destination. 12 Received a $750 credit memorandum acknowledging the return of merchandise purchased on June 6. 13 Received Healthy Co.'s payment of the amount due from the June 4 sale. 15 Purchased office supplies for $200 before tax for business use. Paid for the purchase immediately. 20 Paid the balance due to Runner Co. Instructions: Record the above transactions in the General Journal data entry form provided in the Module Following is some selected data of Magenta Company from the April 30, 2022 adjusted trial balance, shown alphabetically. Magenta Company is a merchandising operation that uses a. periodic inventory system. Note: Refer to page 5-34 referencing the Cost of Goods Sold Section of the periodic Income- Statement for guidance regarding the format required to answer this question. Accounts Payable 840 Accounts Receivable 325 Bill Magenta, Capital 8,600 Interest Revenue 75 Merchandise inventory 6,000 Operating expenses 6,100 Purchases 8,200 Purchases discounts 230 Purchases returns & allowances 420 Sales 40,000 Store Equipment 5,000 Store Supplies 125 Transportation -in 900 Bill Magenta, Withdrawals 600 A physical count on April 30, 2022 revealed a merchandise inventory balance of $4,800. Required: Calculate Cost of Goods Sold for Magenta Company for April 2022 (show & label all work), Stormy Supply Store Trial Balance 31-Dec-22 Cash $30,000 Accounts receivable 27,000 Merchandise inventory Office supplies Store supplies Prepaid Insurance Building Accumulated depreciation-Building Accounts payable Salaries payable R. Raptor, capital R. Raptor, drawings 50,800 1,500 800 560 128,000 $38,900 23,000 2,400 98,000 9,700 Sales 880,000 Sales Retums and Allowances 26,700 33,900 Sales Discount Cost of goods sold Interest Expense Depreciation expense Salaries expense 552,940 3,200 25,600 144,700 Internet expense 2,100 Store Supplies expense 4,800 1,042,300 1,042,300 Required: Prepare a multi-step income statement. Note. There are marks for formatting such as $,underlines, section labels. 1 mark will be deducted for each account that does not belong on the statement.

Step by Step Solution

★★★★★

3.39 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Cost of goods sold statement Purchases 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started