Question

The Tiny Treasures Equity Fund has a NAV on January 1, 2016 of $22.50. It distributes dividend income of $1.75 per unit on January

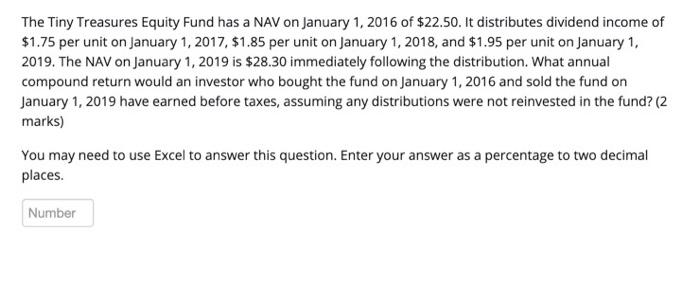

The Tiny Treasures Equity Fund has a NAV on January 1, 2016 of $22.50. It distributes dividend income of $1.75 per unit on January 1, 2017, $1.85 per unit on January 1, 2018, and $1.95 per unit on January 1, 2019. The NAV on January 1, 2019 is $28.30 immediately following the distribution. What annual compound return would an investor who bought the fund on January 1, 2016 and sold the fund on January 1, 2019 have earned before taxes, assuming any distributions were not reinvested in the fund? (2 marks) You may need to use Excel to answer this question. Enter your answer as a percentage to two decimal places. Number

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer NAV1NAV at 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Introduction To Financial Accounting

Authors: Henry Dauderis, David Annand

1st Edition

1517089719, 978-1517089719

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App