Question

XYZ Co. has a program for customers where it provides a free gift after they purchase a product for $280. The gift costs $20

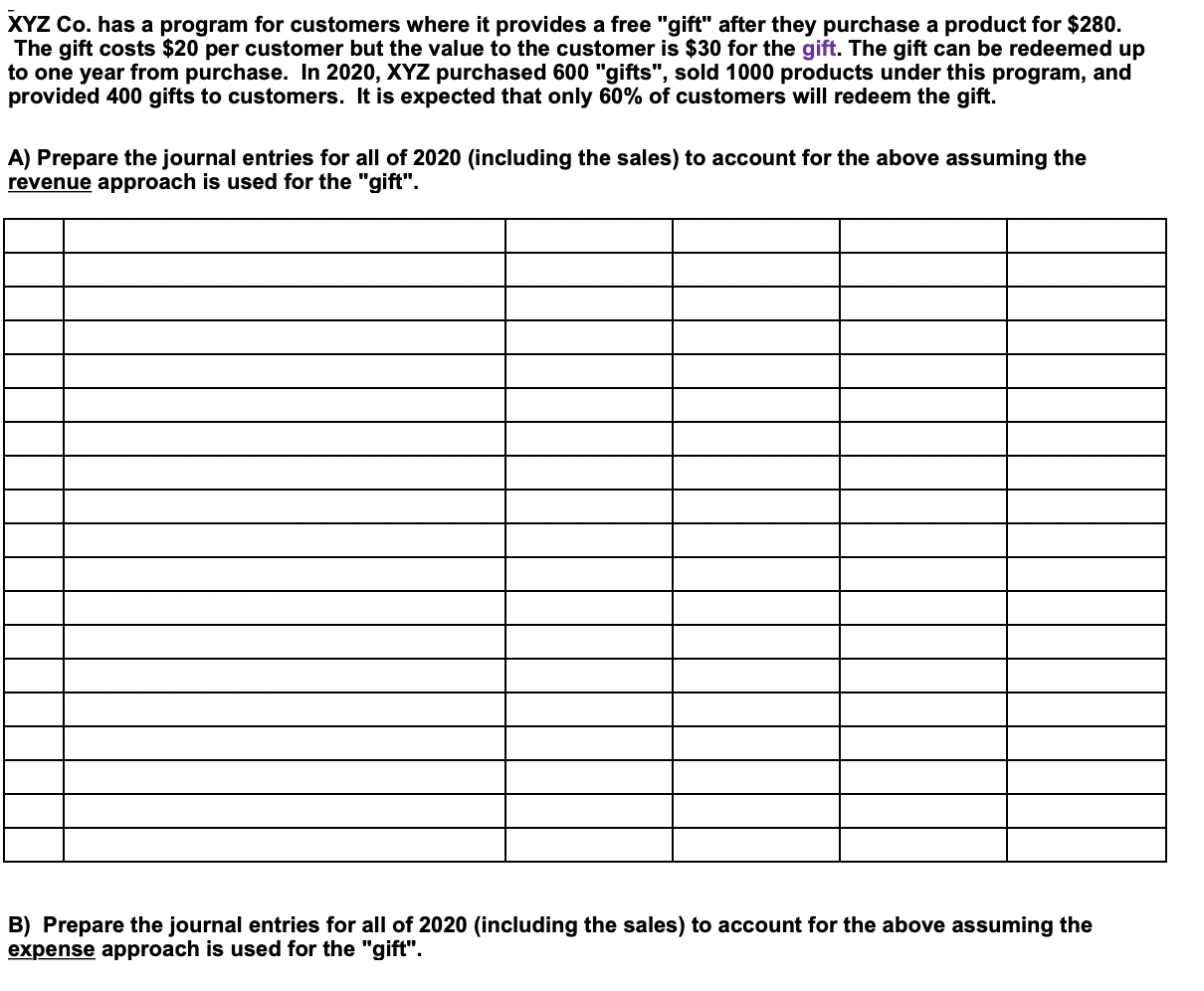

XYZ Co. has a program for customers where it provides a free "gift" after they purchase a product for $280. The gift costs $20 per customer but the value to the customer is $30 for the gift. The gift can be redeemed up to one year from purchase. In 2020, XYZ purchased 600 "gifts", sold 1000 products under this program, and provided 400 gifts to customers. It is expected that only 60% of customers will redeem the gift. A) Prepare the journal entries for all of 2020 (including the sales) to account for the above assuming the revenue approach is used for the "gift". B) Prepare the journal entries for all of 2020 (including the sales) to account for the above assuming the expense approach is used for the "gift".

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Part A Part B Journal entries for 2020 assuming the expense approach is used for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App