Question

The Tire Factory (TTF) is a regional automotive repair chain that provides quick service for simple repairs, such as oil changes, tire rotation, and other

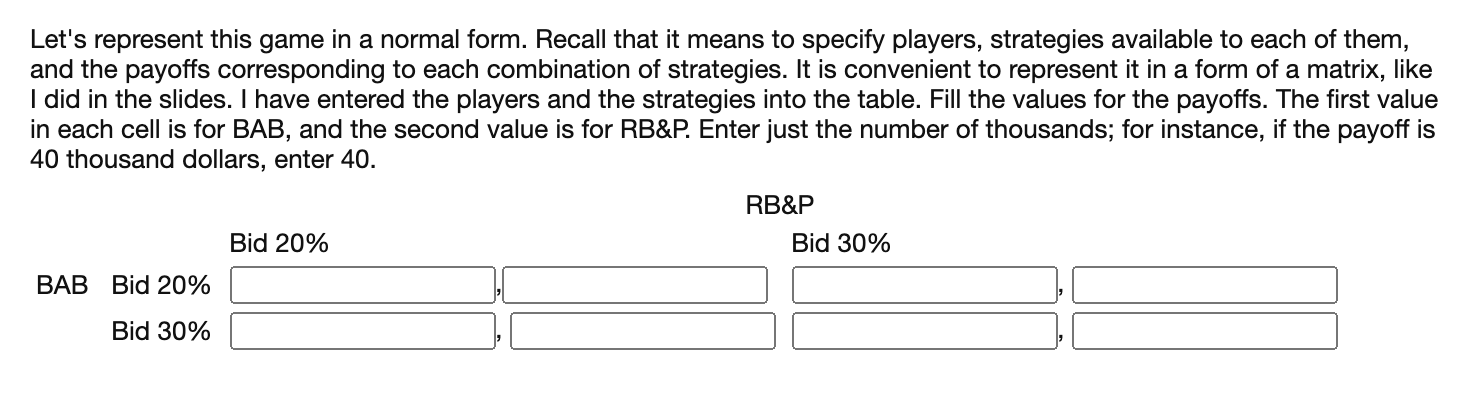

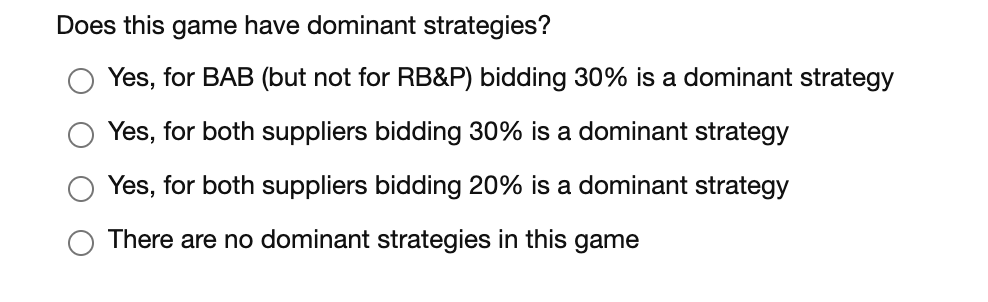

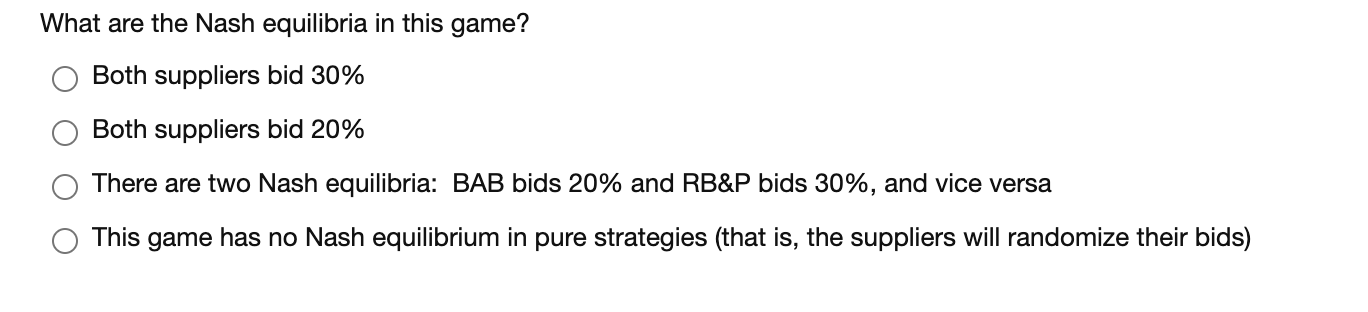

The Tire Factory (TTF) is a regional automotive repair chain that provides quick service for simple repairs, such as oil changes, tire rotation, and other minor automotive maintenance services. They are considering entering into the body repair business. For this purpose, they are considering two potential body shops, Best Auto Body (BAB) and Reliable Body & Paint (RB&P). The two body shops have a similar reputation for quality. The Tire Factory is planning to earn profit by marking up the repair price it pays. Collision repair costs consist of labor and material, which are specific to each repair, and body shops make their profit by marking up those costs (so the customers pay two markups?one by the body shop and the second by TTF). The Tire Factory explained to the managers of the two body shops that it will sign an exclusive contract with the provider who agrees to charge the smallest mark-up, and invited them to propose either a 20% or a 30% mark-up. If both body shops propose the same-mark-up, the TTF will split the business between the two suppliers.

If one supplier wins the auction, this supplier will make a profit of 40 (thousand dollars), and the losing supplier gets zero. If there is a tie, the suppliers will make a profit of 30 (thousand dollars) each in a case they both bid 30%, and 20 (thousand dollars) each in a case they both bid 20%

TFF just got a call from the manager of Best Auto Body asking the name of the second body shop TFF is considering. Analyze this problem and make a recommendation on whether TFF should disclose the identity of the second bidder.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started