Answered step by step

Verified Expert Solution

Question

1 Approved Answer

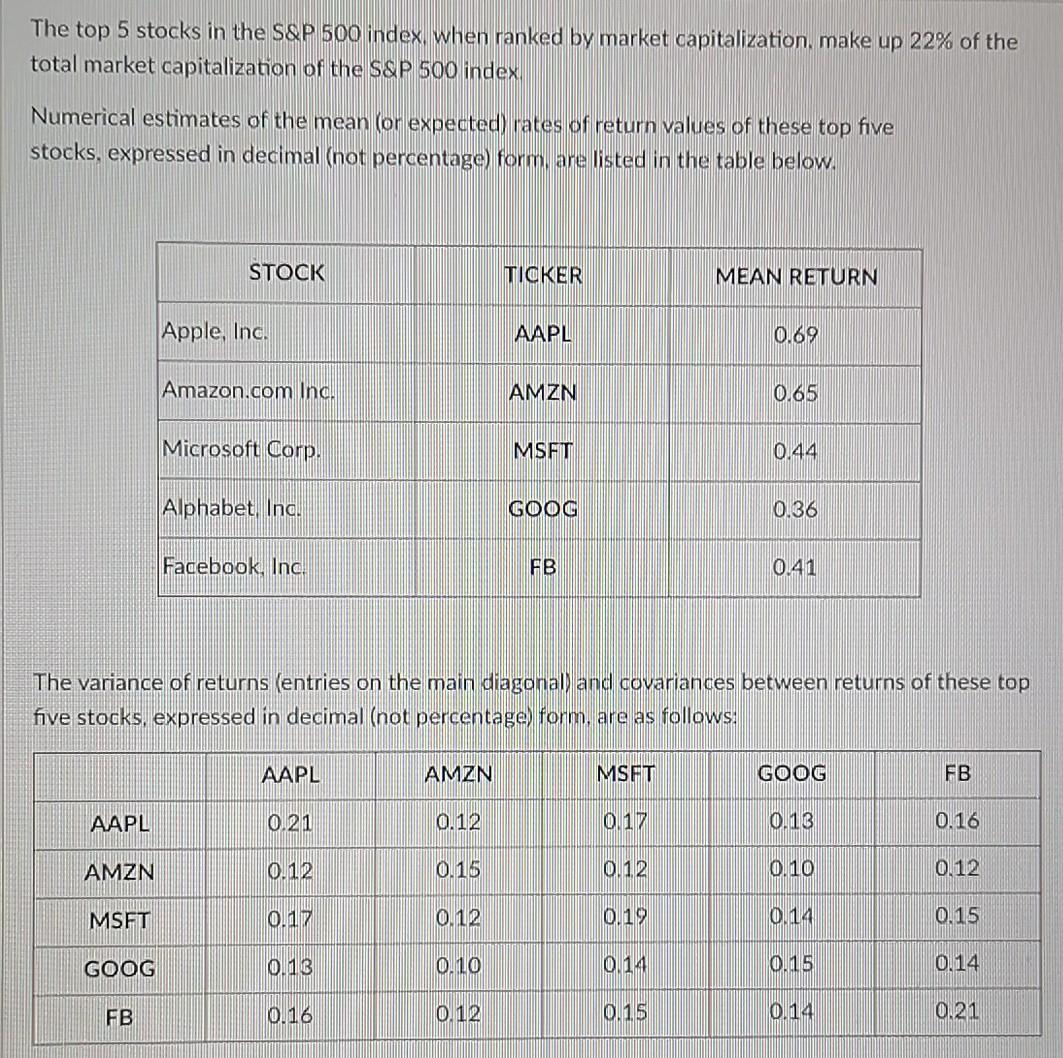

The top 5 stocks in the S&P 500 index, when ranked by market capitalization, make up 22% of the total market capitalization of the S&P

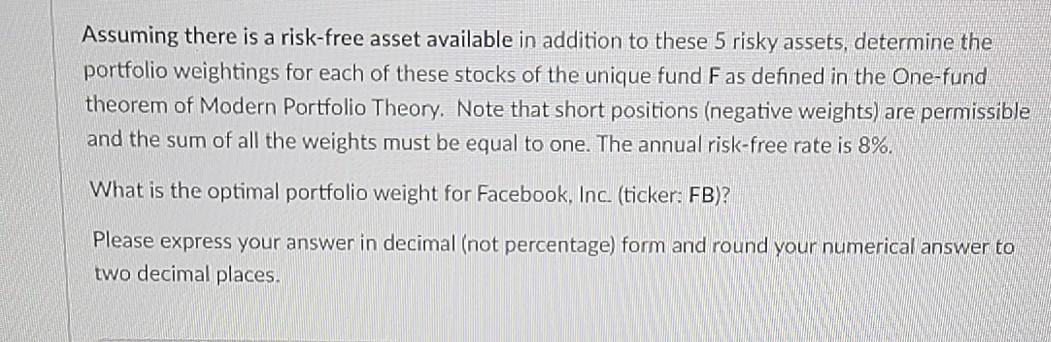

The top 5 stocks in the S&P 500 index, when ranked by market capitalization, make up 22% of the total market capitalization of the S&P 500 index Numerical estimates of the mean (or expected) rates of return values of these top five stocks, expressed in decimal (not percentage) form, are listed in the table below. STOCK TICKER MEAN RETURN Apple, Inc. AAPL 0.69 Amazon.com Indi AMZN 0.65 Microsoft Corp. MSFT 0.44 AlphabetIna. GOOG 0.36 Facebook, Inc. FB 0.41 The variance of returns (entries on the main diagonal and covariances between returns of these top five stocks, expressed in decimal (not percentage) form, are as follows: AAPL AMZN MSET GOOG FB AAPL 0.21 0.12 0.17 0.13 0.16 AMZN 0.12 0.15 0.12 0.10 0.12 MSFT 0.17 0.12 0.19 0.14 0.15 GOOG 0.13 0.10 0.14 0.15 0.14 FB 0.16 0.12 0.15 0.14 0.21 Assuming there is a risk-free asset available in addition to these 5 risky assets, determine the portfolio weightings for each of these stocks of the unique fund Fas defined in the One-fund theorem of Modern Portfolio Theory. Note that short positions (negative weights) are permissible and the sum of all the weights must be equal to one. The annual risk-free rate is 8%. What is the optimal portfolio weight for Facebook, Inc. (ticker: FB)? Please express your answer in decimal (not percentage) form and round your numerical answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started