Answered step by step

Verified Expert Solution

Question

1 Approved Answer

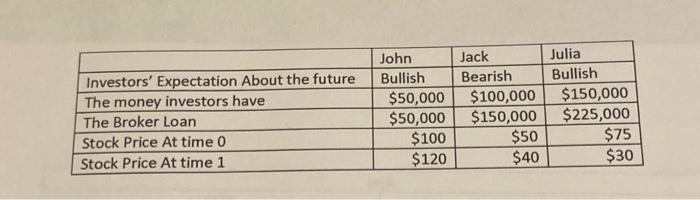

the topic is Investments in Finance.Answer the question below and fill in all blanks! _________________________________________ Investors Expectation About the future The money investors have The

the topic is Investments in Finance.Answer the question below and fill in all blanks!

_________________________________________

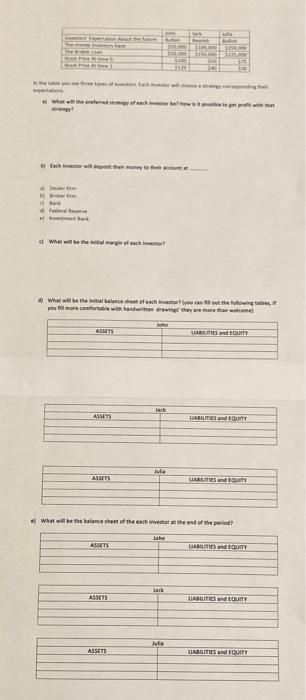

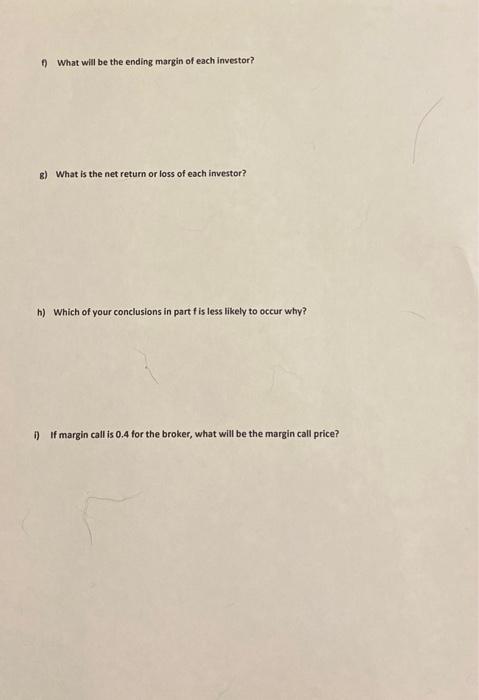

Investors Expectation About the future The money investors have The Broker Loan Stock Price At time 0 Stock Price At time 1 a) Dealer firm b) Broker firm c) Bank d) Federal Reserve e) Investment Bank b) Each investor will deposit their money to their account at c) What will be the initial margin of each investor? ASSETS In the table you see three types of investors. Each investor will choose a strategy corresponding their expectations. ASSETS a) What will the preferred strategy of each investor be? How is it possible to get profit with that strategy? ASSETS John Bullish ASSETS ASSETS ASSETS d) What will be the initial balance sheet of each investor? (you can fill out the following tables, if you fill more comfortable with handwritten drawings' they are more than welcome) John Jack $50,000 $100,000 $50,000 $150,000 Julia $100 $120 lack Bearish John Jack Julia $50 $40 Julia Bullish $150,000 $225,000 e) What will be the balance sheet of the each investor at the end of the period? $75 $30 LIABILITIES and EQUITY LIABILITIES and EQUITY LIABILITIES and EQUITY LIABILITIES and EQUITY LIABILITIES and EQUITY LIABILITIES and EQUITY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started