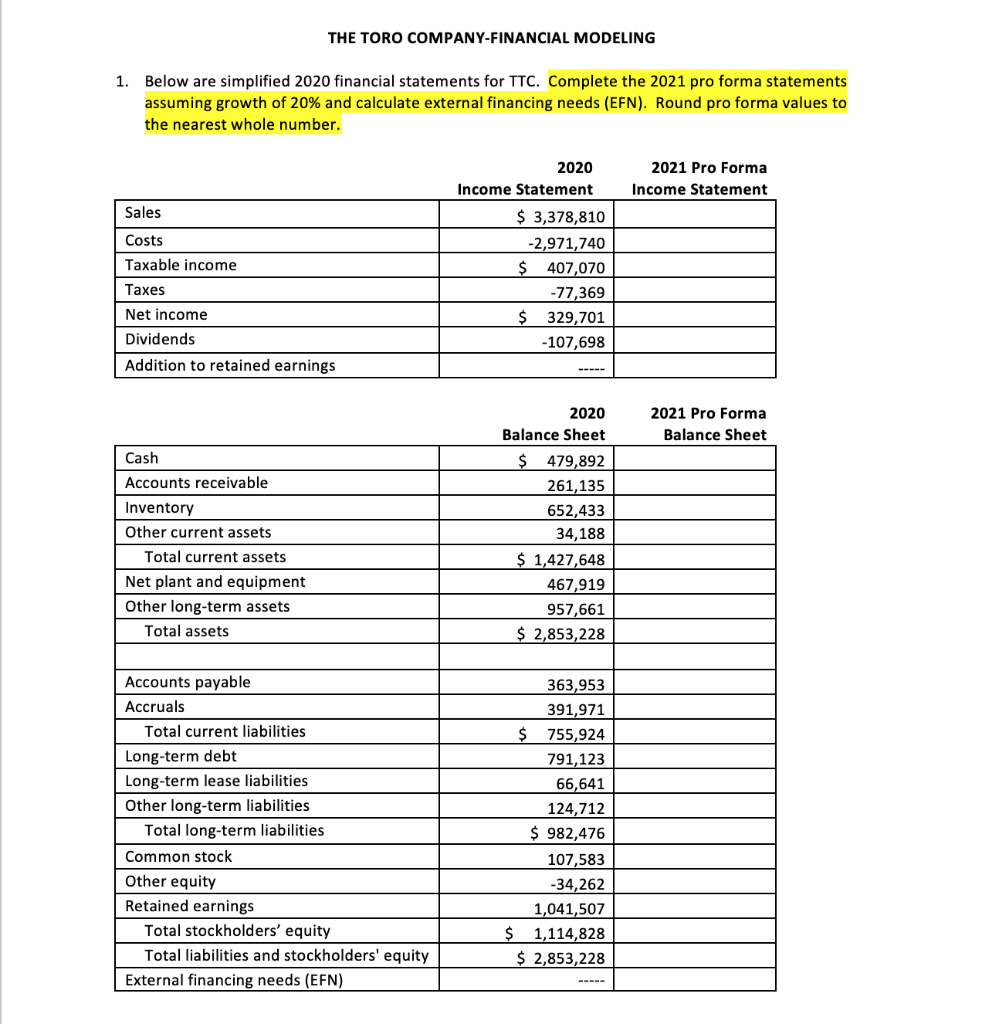

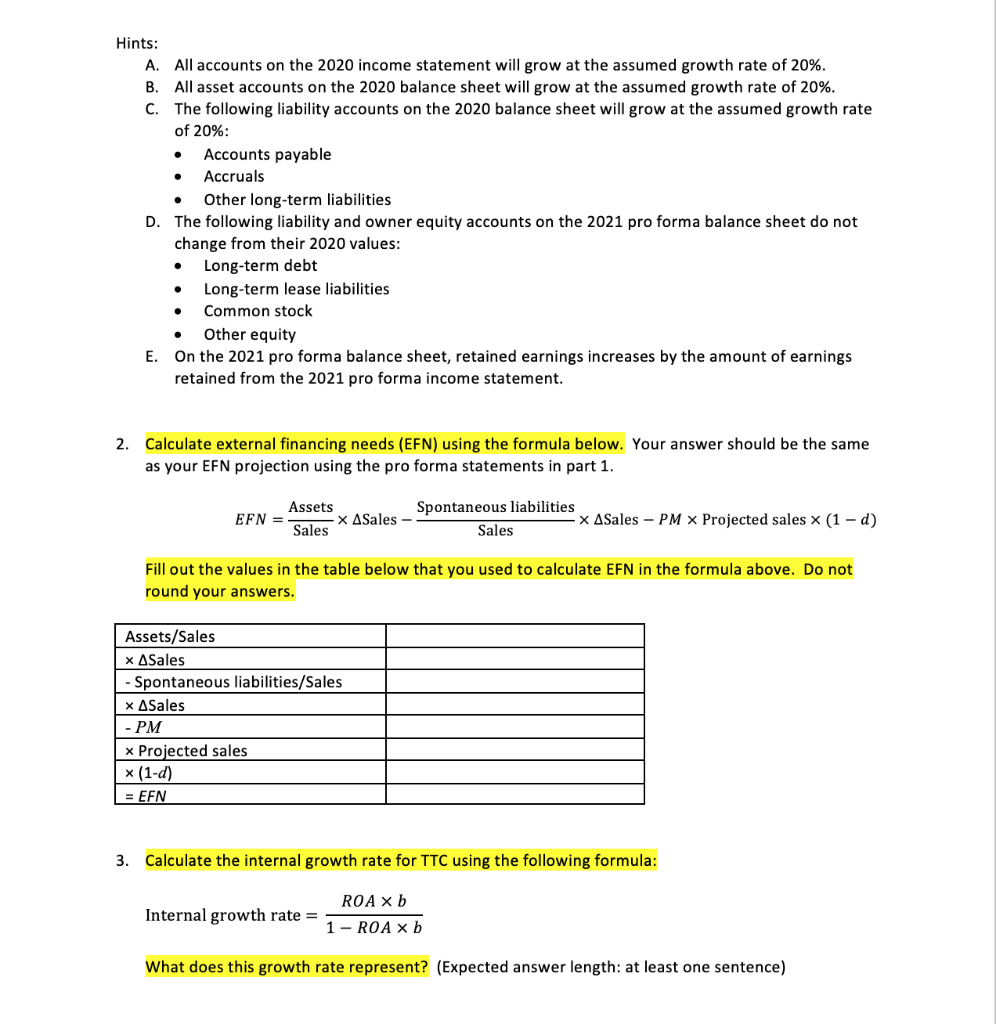

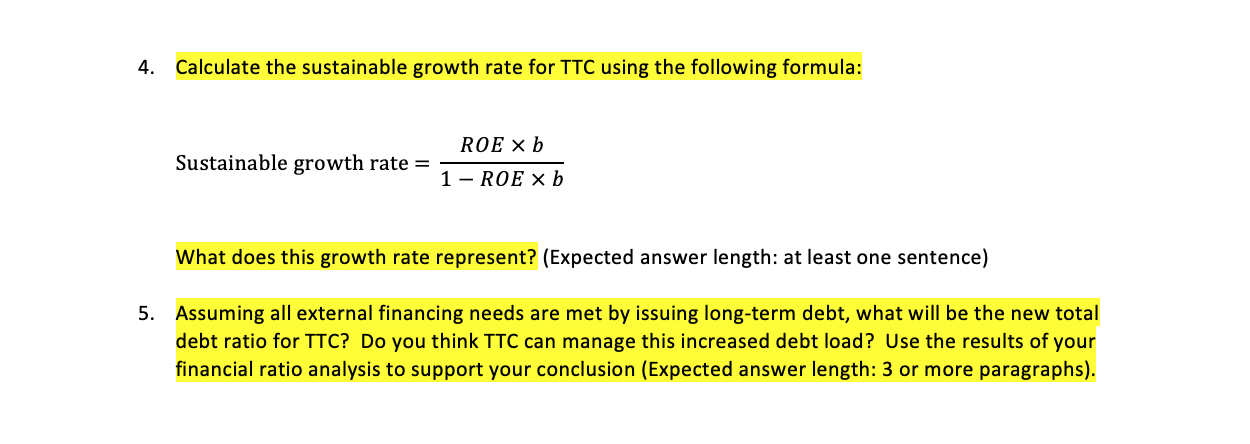

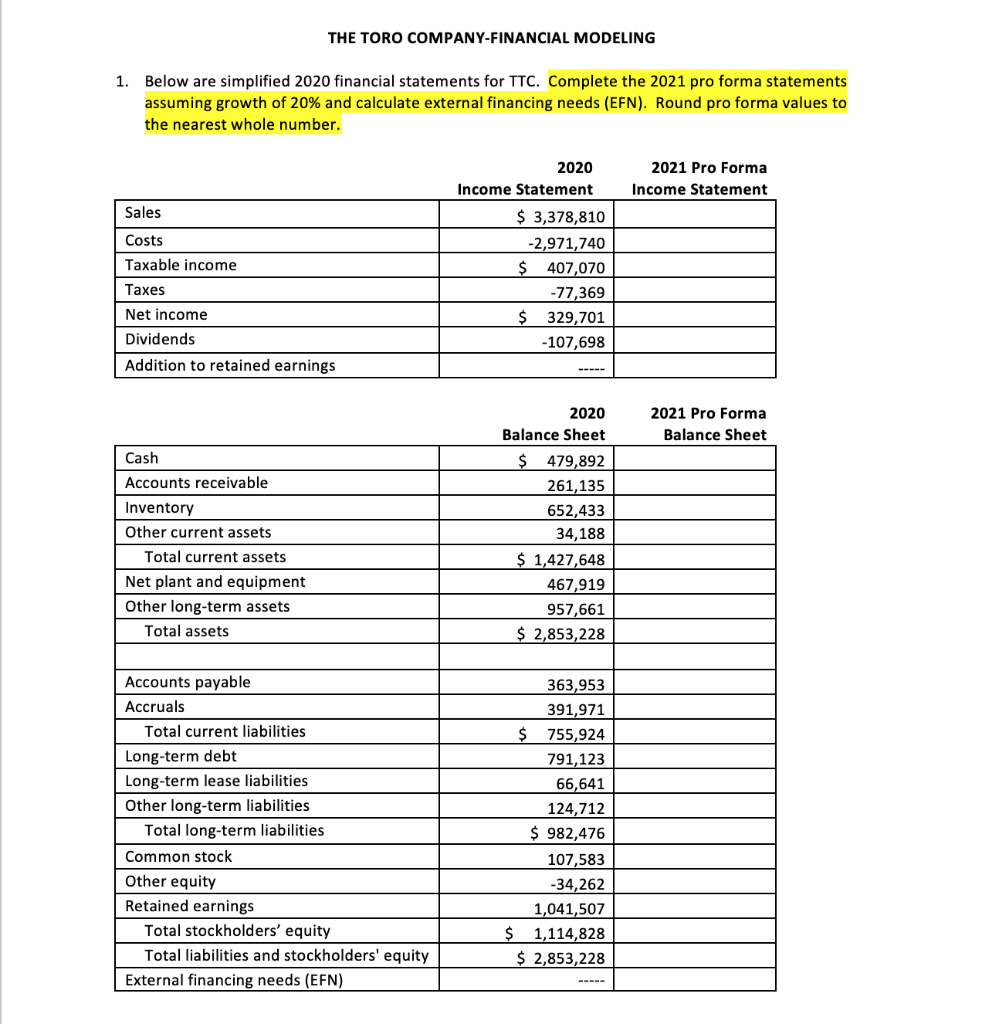

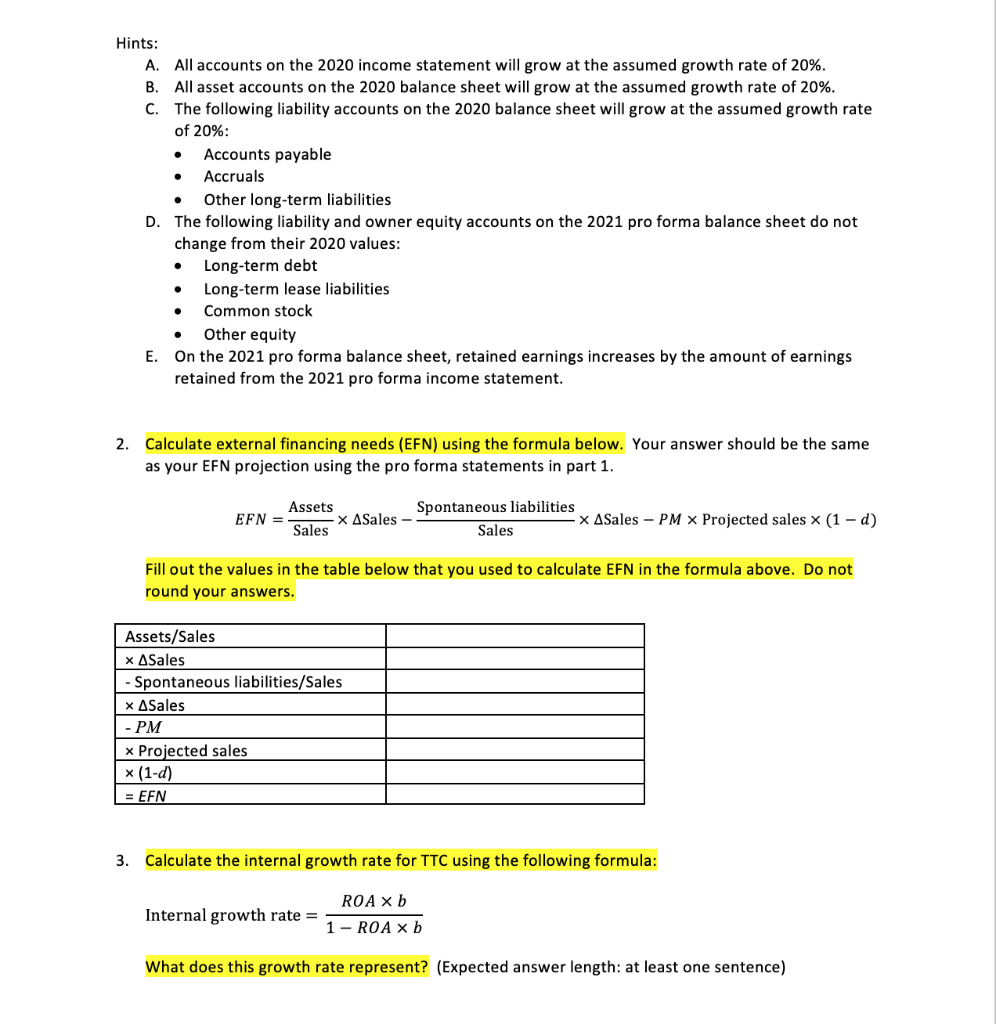

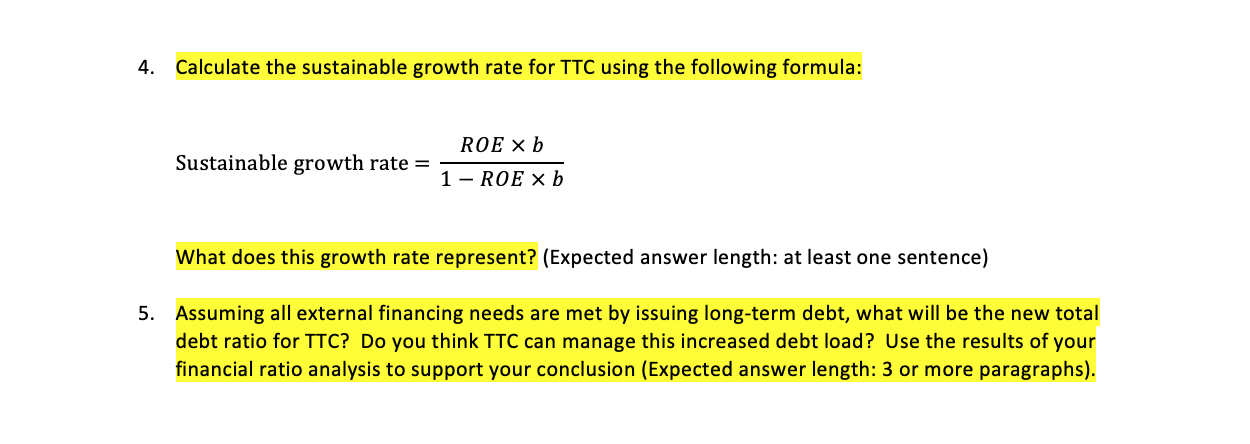

THE TORO COMPANY-FINANCIAL MODELING 1. Below are simplified 2020 financial statements for TTC. Complete the 2021 pro forma statements assuming growth of 20% and calculate external financing needs (EFN). Round pro forma values to the nearest whole number. 2021 Pro Forma Income Statement Sales Costs Taxable income 2020 Income Statement $ 3,378,810 -2,971,740 $ 407,070 -77,369 $ 329,701 -107,698 Taxes Net income Dividends Addition to retained earnings 2021 Pro Forma Balance Sheet Cash Accounts receivable Inventory Other current assets Total current assets Net plant and equipment Other long-term assets Total assets 2020 Balance Sheet $ 479,892 261,135 652,433 34,188 $ 1,427,648 467,919 957,661 $ 2,853,228 Accounts payable Accruals Total current liabilities Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities Common stock Other equity Retained earnings Total stockholders' equity Total liabilities and stockholders' equity External financing needs (EFN) 363,953 391,971 $ 755,924 791,123 66,641 124,712 $ 982,476 107,583 -34,262 1,041,507 $ 1,114,828 $ 2,853,228 . . Hints: A. All accounts on the 2020 income statement will grow at the assumed growth rate of 20%. B. All asset accounts on the 2020 balance sheet will grow at the assumed growth rate of 20%. C. The following liability accounts on the 2020 balance sheet will grow at the assumed growth rate of 20%: Accounts payable Accruals Other long-term liabilities D. The following liability and owner equity accounts on the 2021 pro forma balance sheet do not change from their 2020 values: Long-term debt Long-term lease liabilities Common stock Other equity E. On the 2021 pro forma balance sheet, retained earnings increases by the amount of earnings retained from the 2021 pro forma income statement. . . . . 2. Calculate external financing needs (EFN) using the formula below. Your answer should be the same as your EFN projection using the pro forma statements in part 1. Assets EFN = Spontaneous liabilities X Sales - Sales Sales X ASales - PM X Projected sales x (1 - d) Fill out the values in the table below that you used to calculate EFN in the formula above. Do not round your answers. Assets/Sales X Sales - Spontaneous liabilities/Sales x Sales - PM Projected sales *(1-d) = EFN 3. Calculate the internal growth rate for TTC using the following formula: ROA Xb Internal growth rate = 1 - ROA X b What does this growth rate represent? (Expected answer length: at least one sentence) 4. Calculate the sustainable growth rate for TTC using the following formula: ROE xb Sustainable growth rate = 1 - ROE Xb What does this growth rate represent? (Expected answer length: at least one sentence) 5. Assuming all external financing needs are met by issuing long-term debt, what will be the new total debt ratio for TTC? Do you think TTC can manage this increased debt load? Use the results of your financial ratio analysis to support your conclusion (Expected answer length: 3 or more paragraphs). THE TORO COMPANY-FINANCIAL MODELING 1. Below are simplified 2020 financial statements for TTC. Complete the 2021 pro forma statements assuming growth of 20% and calculate external financing needs (EFN). Round pro forma values to the nearest whole number. 2021 Pro Forma Income Statement Sales Costs Taxable income 2020 Income Statement $ 3,378,810 -2,971,740 $ 407,070 -77,369 $ 329,701 -107,698 Taxes Net income Dividends Addition to retained earnings 2021 Pro Forma Balance Sheet Cash Accounts receivable Inventory Other current assets Total current assets Net plant and equipment Other long-term assets Total assets 2020 Balance Sheet $ 479,892 261,135 652,433 34,188 $ 1,427,648 467,919 957,661 $ 2,853,228 Accounts payable Accruals Total current liabilities Long-term debt Long-term lease liabilities Other long-term liabilities Total long-term liabilities Common stock Other equity Retained earnings Total stockholders' equity Total liabilities and stockholders' equity External financing needs (EFN) 363,953 391,971 $ 755,924 791,123 66,641 124,712 $ 982,476 107,583 -34,262 1,041,507 $ 1,114,828 $ 2,853,228 . . Hints: A. All accounts on the 2020 income statement will grow at the assumed growth rate of 20%. B. All asset accounts on the 2020 balance sheet will grow at the assumed growth rate of 20%. C. The following liability accounts on the 2020 balance sheet will grow at the assumed growth rate of 20%: Accounts payable Accruals Other long-term liabilities D. The following liability and owner equity accounts on the 2021 pro forma balance sheet do not change from their 2020 values: Long-term debt Long-term lease liabilities Common stock Other equity E. On the 2021 pro forma balance sheet, retained earnings increases by the amount of earnings retained from the 2021 pro forma income statement. . . . . 2. Calculate external financing needs (EFN) using the formula below. Your answer should be the same as your EFN projection using the pro forma statements in part 1. Assets EFN = Spontaneous liabilities X Sales - Sales Sales X ASales - PM X Projected sales x (1 - d) Fill out the values in the table below that you used to calculate EFN in the formula above. Do not round your answers. Assets/Sales X Sales - Spontaneous liabilities/Sales x Sales - PM Projected sales *(1-d) = EFN 3. Calculate the internal growth rate for TTC using the following formula: ROA Xb Internal growth rate = 1 - ROA X b What does this growth rate represent? (Expected answer length: at least one sentence) 4. Calculate the sustainable growth rate for TTC using the following formula: ROE xb Sustainable growth rate = 1 - ROE Xb What does this growth rate represent? (Expected answer length: at least one sentence) 5. Assuming all external financing needs are met by issuing long-term debt, what will be the new total debt ratio for TTC? Do you think TTC can manage this increased debt load? Use the results of your financial ratio analysis to support your conclusion (Expected answer length: 3 or more paragraphs)