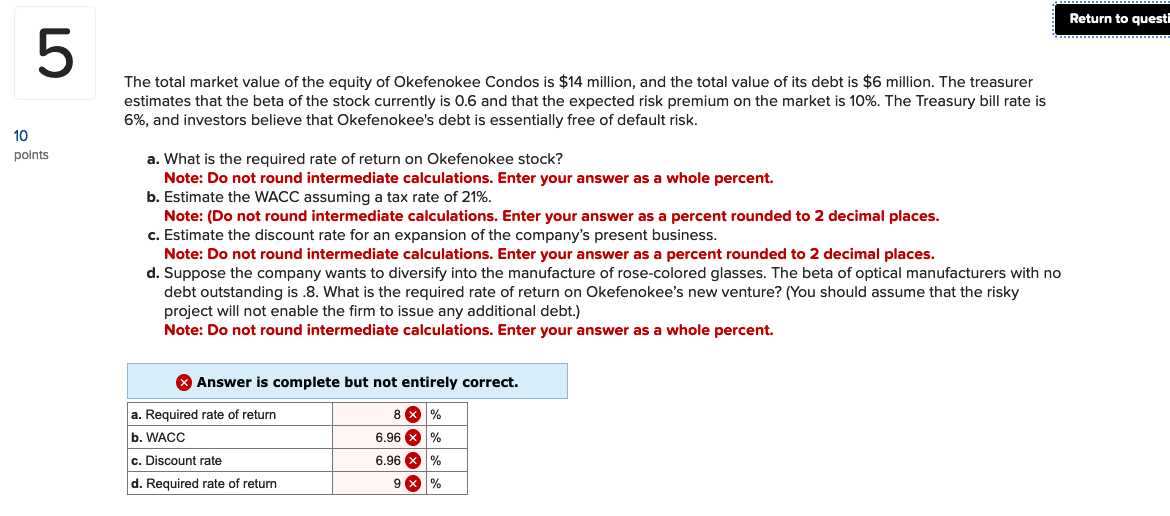

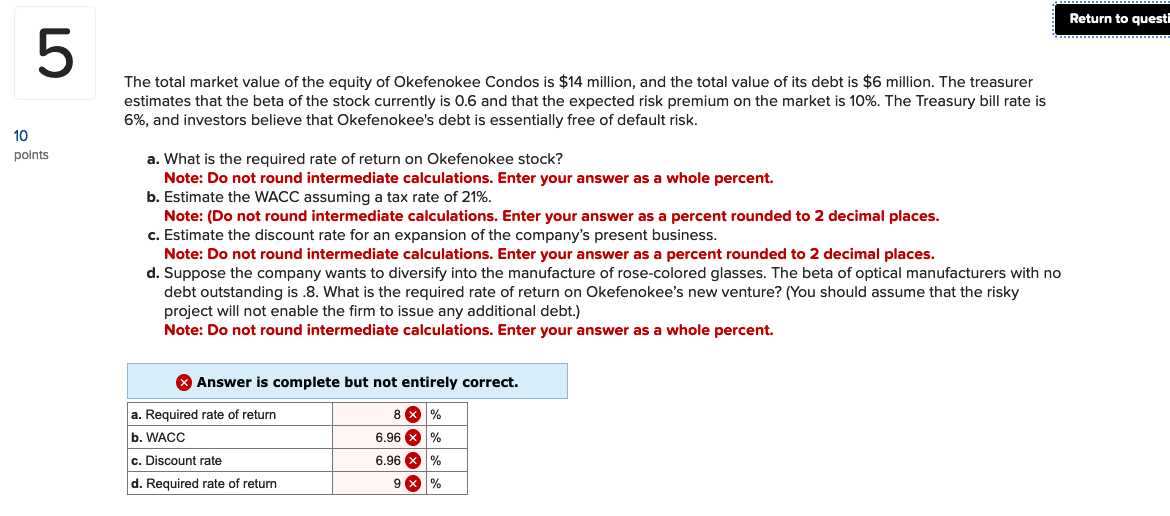

The total market value of the equity of Okefenokee Condos is $14 million, and the total value of its debt is $6 million. The treasurer estimates that the beta of the stock currently is 0.6 and that the expected risk premium on the market is 10%. The Treasury bill rate is 6%, and investors believe that Okefenokee's debt is essentially free of default risk. a. What is the required rate of return on Okefenokee stock? Note: Do not round intermediate calculations. Enter your answer as a whole percent. b. Estimate the WACC assuming a tax rate of 21%. Note: (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. c. Estimate the discount rate for an expansion of the company's present business. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. d. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The beta of optical manufacturers with no debt outstanding is .8 . What is the required rate of return on Okefenokee's new venture? (You should assume that the risky project will not enable the firm to issue any additional debt.) Note: Do not round intermediate calculations. Enter your answer as a whole percent. Answer is complete but not entirely correct. The total market value of the equity of Okefenokee Condos is $14 million, and the total value of its debt is $6 million. The treasurer estimates that the beta of the stock currently is 0.6 and that the expected risk premium on the market is 10%. The Treasury bill rate is 6%, and investors believe that Okefenokee's debt is essentially free of default risk. a. What is the required rate of return on Okefenokee stock? Note: Do not round intermediate calculations. Enter your answer as a whole percent. b. Estimate the WACC assuming a tax rate of 21%. Note: (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. c. Estimate the discount rate for an expansion of the company's present business. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. d. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The beta of optical manufacturers with no debt outstanding is .8 . What is the required rate of return on Okefenokee's new venture? (You should assume that the risky project will not enable the firm to issue any additional debt.) Note: Do not round intermediate calculations. Enter your answer as a whole percent. Answer is complete but not entirely correct