Question

The Tower Inc. (as lessor) leased a building under a 15 year operating lease with annual payments of $15,000 payable in arrears. The cost

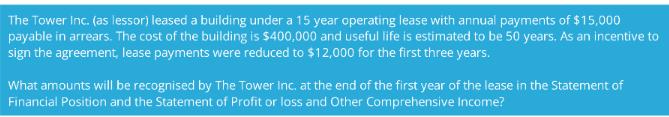

The Tower Inc. (as lessor) leased a building under a 15 year operating lease with annual payments of $15,000 payable in arrears. The cost of the building is $400,000 and useful life is estimated to be 50 years. As an incentive to sign the agreement, lease payments were reduced to $12,000 for the first three years. What amounts will be recognised by The Tower Inc. at the end of the first year of the lease in the Statement of Financial Position and the Statement of Profit or loss and Other Comprehensive Income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears that youre asking about accounting treatment for a lease agreement under International Financial Reporting Standards IFRS for The Tower Inc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

8th Edition

1260881245, 9781260881240

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App