Answered step by step

Verified Expert Solution

Question

1 Approved Answer

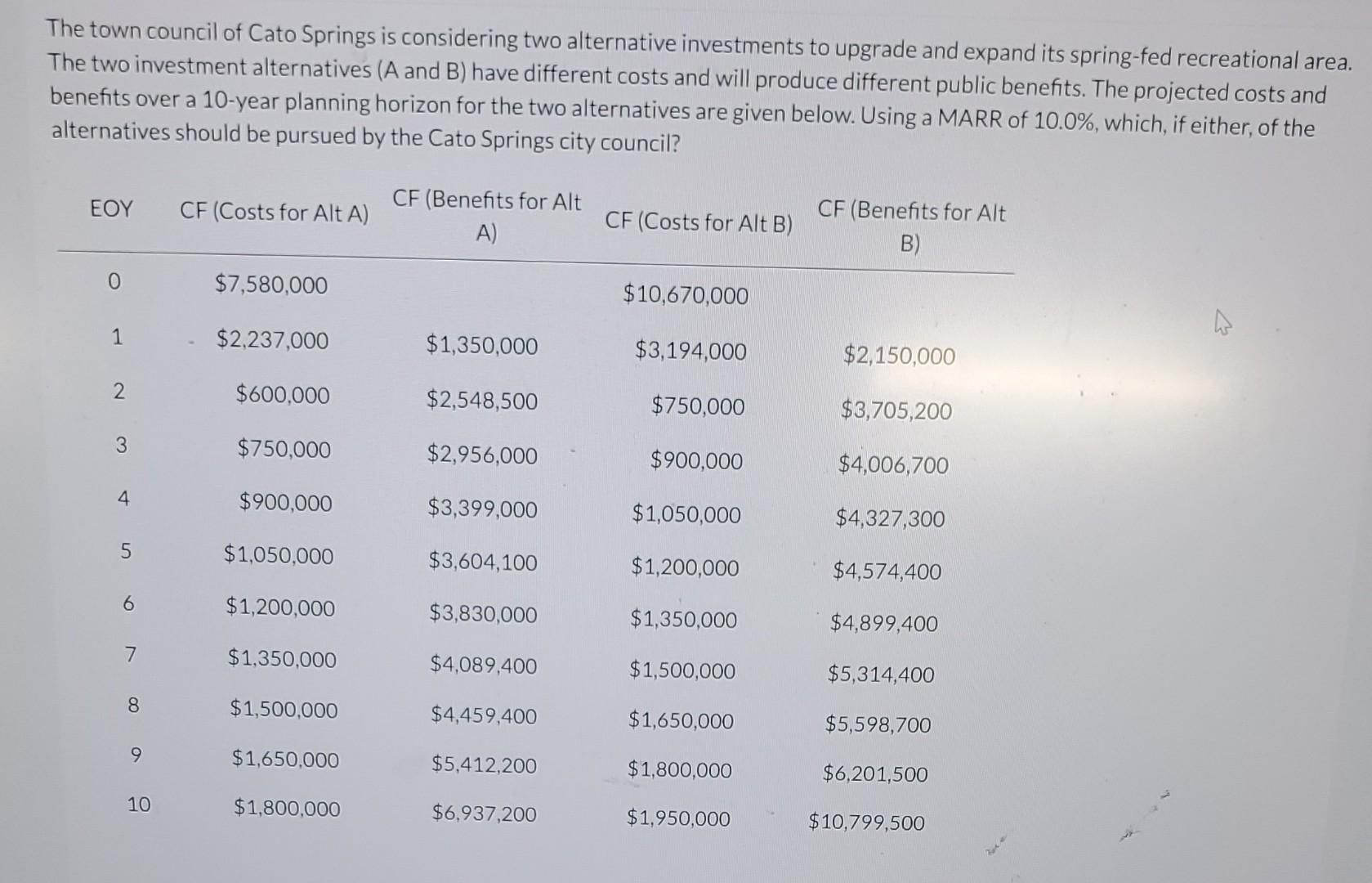

The town council of Cato Springs is considering two alternative investments to upgrade and expand its spring-fed recreational area. The two investment alternatives ( A

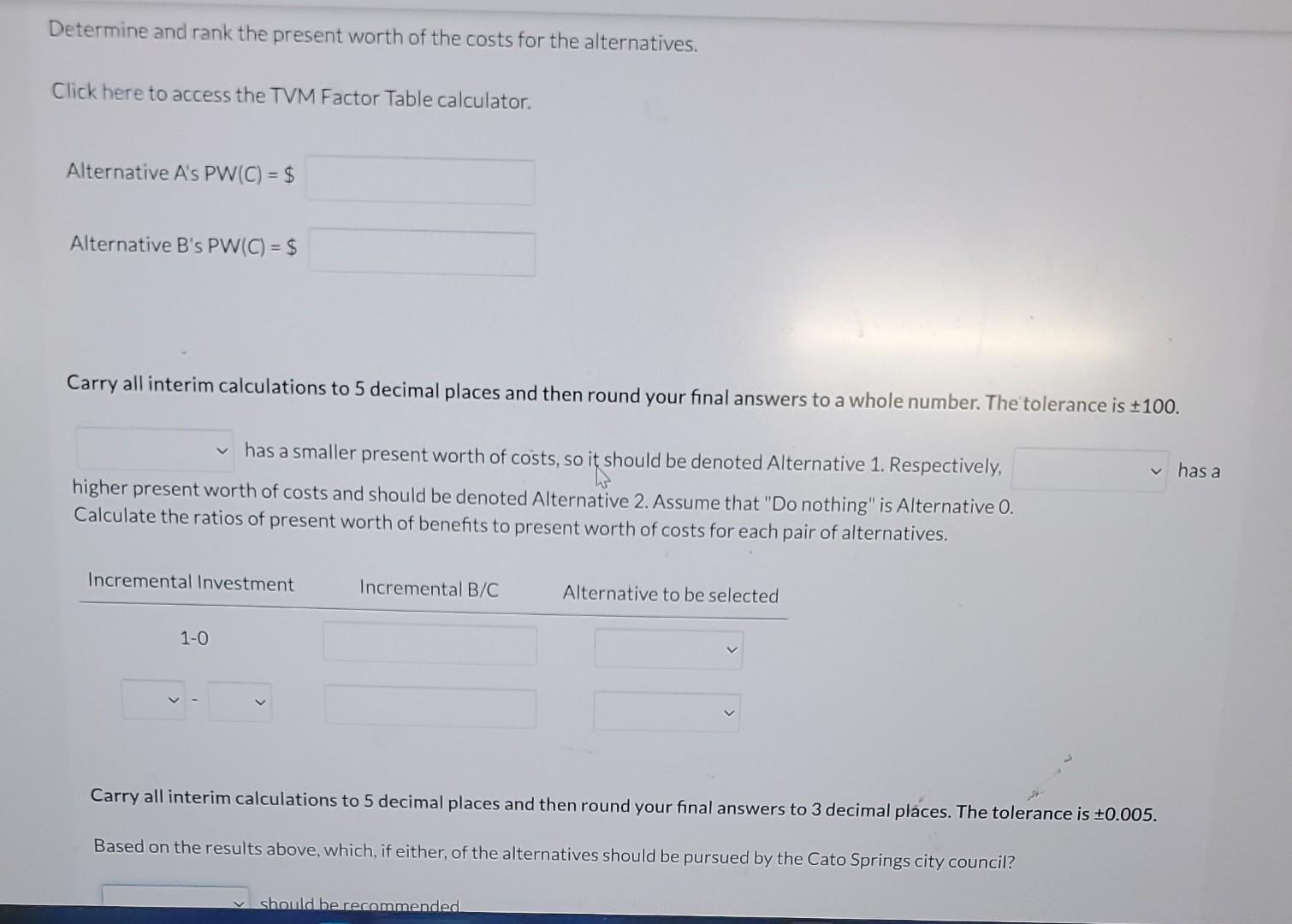

The town council of Cato Springs is considering two alternative investments to upgrade and expand its spring-fed recreational area. The two investment alternatives ( A and B ) have different costs and will produce different public benefits. The projected costs and benefits over a 10-year planning horizon for the two alternatives are given below. Using a MARR of 10.0\%, which, if either, of the alternatives should be pursued by the Cato Springs citv council? Determine and rank the present worth of the costs for the alternatives. Click here to access the TVM Factor Table calculator. Alternative AsPW(C)=$ Alternative BsPW(C)=$ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is \pm 100 . has a smaller present worth of costs, so it should be denoted Alternative 1. Respectively, has a higher present worth of costs and should be denoted Alternative 2. Assume that "Do nothing" is Alternative 0. Calculate the ratios of present worth of benefits to present worth of costs for each pair of alternatives. Carry all interim calculations to 5 decimal places and then round your final answers to 3 decimal places. The tolerance is \pm 0.005 . Based on the results above, which, if either, of the alternatives should be pursued by the Cato Springs city council? The town council of Cato Springs is considering two alternative investments to upgrade and expand its spring-fed recreational area. The two investment alternatives ( A and B ) have different costs and will produce different public benefits. The projected costs and benefits over a 10-year planning horizon for the two alternatives are given below. Using a MARR of 10.0\%, which, if either, of the alternatives should be pursued by the Cato Springs citv council? Determine and rank the present worth of the costs for the alternatives. Click here to access the TVM Factor Table calculator. Alternative AsPW(C)=$ Alternative BsPW(C)=$ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is \pm 100 . has a smaller present worth of costs, so it should be denoted Alternative 1. Respectively, has a higher present worth of costs and should be denoted Alternative 2. Assume that "Do nothing" is Alternative 0. Calculate the ratios of present worth of benefits to present worth of costs for each pair of alternatives. Carry all interim calculations to 5 decimal places and then round your final answers to 3 decimal places. The tolerance is \pm 0.005 . Based on the results above, which, if either, of the alternatives should be pursued by the Cato Springs city council

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started