Question

The Town of Willingdon adopted the following General Fund budget for the fiscal year beginning July 1: Estimated revenues: Taxes $ 14,000,000 Intergovernmental revenues 1,250,000

The Town of Willingdon adopted the following General Fund budget for the fiscal year beginning July 1:

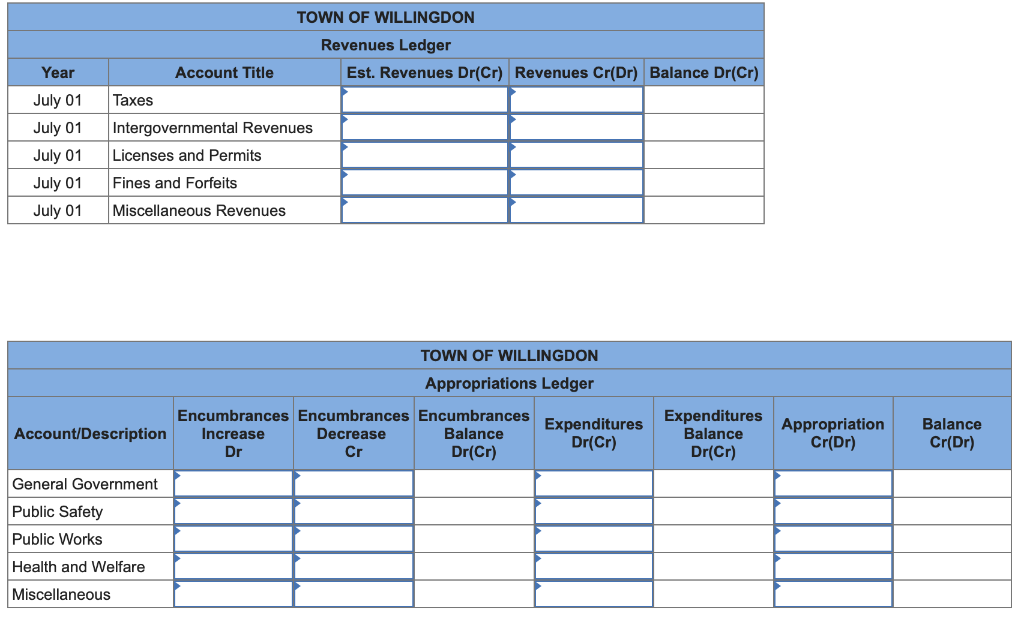

Estimated revenues: Taxes $ 14,000,000

Intergovernmental revenues 1,250,000

Licenses and permits 460,000

Fines and forfeits 200,000

Miscellaneous revenues 150,000

Total estimated revenues $ 16,060,000

Appropriations:

General government $ 7,750,000

Public safety 5,900,000

Public works 1,450,000

Health and welfare 850,000

Miscellaneous 50,000 T

otal appropriations $ 16,000,000

Required

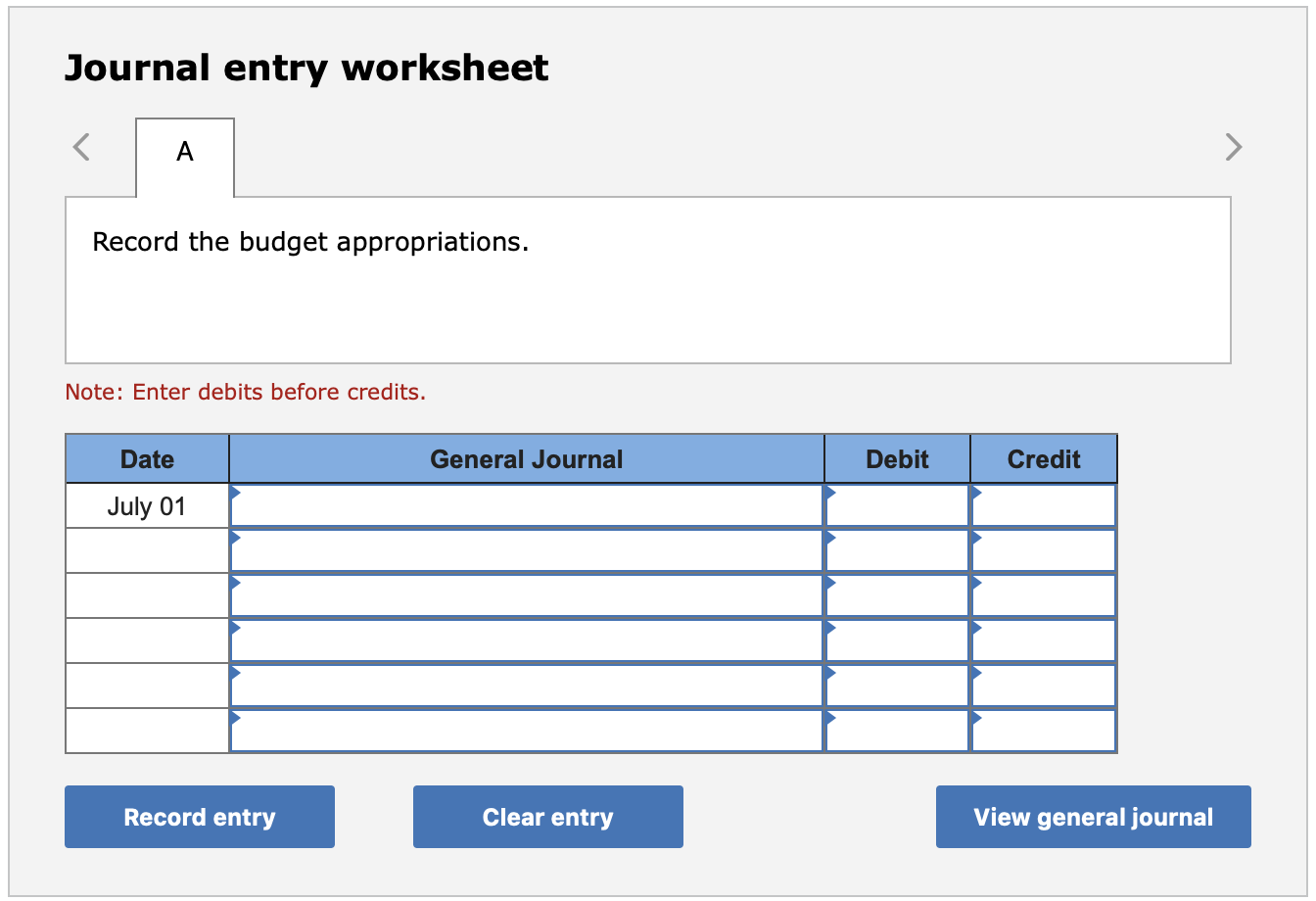

a-1. Prepare the general journal entries to record the adopted budget at the beginning of the fiscal year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

a-2. Show entries in the subsidiary ledger accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started