Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The transactions below pertain to Affordable Computers' second month (October) of operations. 1. Paid $11,000 to the supplier to complete payment on the furniture and

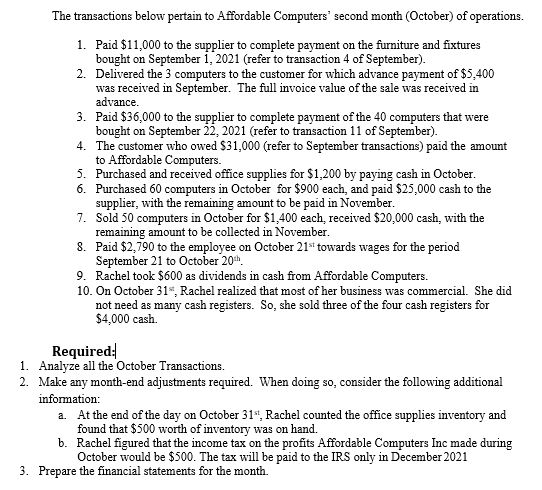

The transactions below pertain to Affordable Computers' second month (October) of operations. 1. Paid $11,000 to the supplier to complete payment on the furniture and fixtures bought on September 1, 2021 (refer to transaction 4 of September). 2. Delivered the 3 computers to the customer for which advance payment of $5,400 was received in September. The full invoice value of the sale was received in advance. 3. Paid $36,000 to the supplier to complete payment of the 40 computers that were bought on September 22, 2021 (refer to transaction 11 of September). 4. The customer who owed $31,000 (refer to September transactions) paid the amount to Affordable Computers. 5. Purchased and received office supplies for $1,200 by paying cash in October. 6. Purchased 60 computers in October for $900 each, and paid $25,000 cash to the supplier, with the remaining amount to be paid in November. 7. Sold 50 computers in October for $1,400 each, received $20,000cash, with the remaining amount to be collected in November. 8. Paid $2,790 to the employee on October 21st towards wages for the period September 21 to October 20th. 9. Rachel took $600 as dividends in cash from Affordable Computers. 10. On October 31th, Rachel realized that most of her business was commercial. She did not need as many cash registers. So, she sold three of the four cash registers for $4,000 cash. Required: 1. Analyze all the October Transactions. 2. Make any month-end adjustments required. When doing so, consider the following additional information: a. At the end of the day on October 31st, Rachel counted the office supplies inventory and found that $500 worth of inventory was on hand. b. Rachel figured that the income tax on the profits Affordable Computers Inc made during October would be $500. The tax will be paid to the IRS only in December 2021 3. Prepare the financial statements for the month

The transactions below pertain to Affordable Computers' second month (October) of operations. 1. Paid $11,000 to the supplier to complete payment on the furniture and fixtures bought on September 1, 2021 (refer to transaction 4 of September). 2. Delivered the 3 computers to the customer for which advance payment of $5,400 was received in September. The full invoice value of the sale was received in advance. 3. Paid $36,000 to the supplier to complete payment of the 40 computers that were bought on September 22, 2021 (refer to transaction 11 of September). 4. The customer who owed $31,000 (refer to September transactions) paid the amount to Affordable Computers. 5. Purchased and received office supplies for $1,200 by paying cash in October. 6. Purchased 60 computers in October for $900 each, and paid $25,000 cash to the supplier, with the remaining amount to be paid in November. 7. Sold 50 computers in October for $1,400 each, received $20,000cash, with the remaining amount to be collected in November. 8. Paid $2,790 to the employee on October 21st towards wages for the period September 21 to October 20th. 9. Rachel took $600 as dividends in cash from Affordable Computers. 10. On October 31th, Rachel realized that most of her business was commercial. She did not need as many cash registers. So, she sold three of the four cash registers for $4,000 cash. Required: 1. Analyze all the October Transactions. 2. Make any month-end adjustments required. When doing so, consider the following additional information: a. At the end of the day on October 31st, Rachel counted the office supplies inventory and found that $500 worth of inventory was on hand. b. Rachel figured that the income tax on the profits Affordable Computers Inc made during October would be $500. The tax will be paid to the IRS only in December 2021 3. Prepare the financial statements for the month Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started