Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. . The transactions related to the petty cash fund of Colt Company for the year 2020 are as follows: On November 1, 2020, a

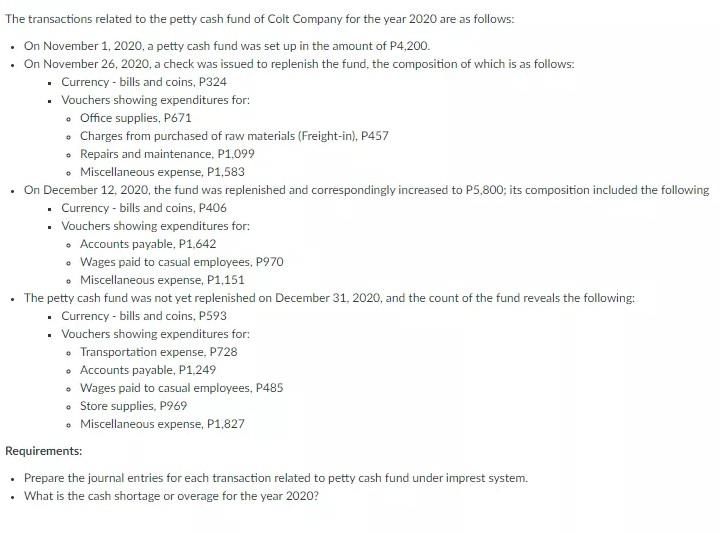

. . The transactions related to the petty cash fund of Colt Company for the year 2020 are as follows: On November 1, 2020, a petty cash fund was set up in the amount of P4,200. . On November 26, 2020, a check was issued to replenish the fund, the composition of which is as follows. . Currency - bills and coins, P324 Vouchers showing expenditures for: Office supplies, P671 Charges from purchased of raw materials (Freight-in), P457 Repairs and maintenance, P1,099 Miscellaneous expense, P1,583 On December 12, 2020, the fund was replenished and correspondingly increased to P5,800; its composition included the following Currency - bills and coins, P406 Vouchers showing expenditures for: Accounts payable, P1.642 . Wages paid to casual employees, P970 . Miscellaneous expense, P1.151 The petty cash fund was not yet replenished on December 31, 2020, and the count of the fund reveals the following: Currency - bills and coins, P593 Vouchers showing expenditures for: Transportation expense, P728 Accounts payable, P1,249 Wages paid to casual employees, P485 Store supplies, P969 Miscellaneous expense, P1,827 Requirements: Prepare the journal entries for each transaction related to petty cash fund under imprest system. What is the cash shortage or overage for the year 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started