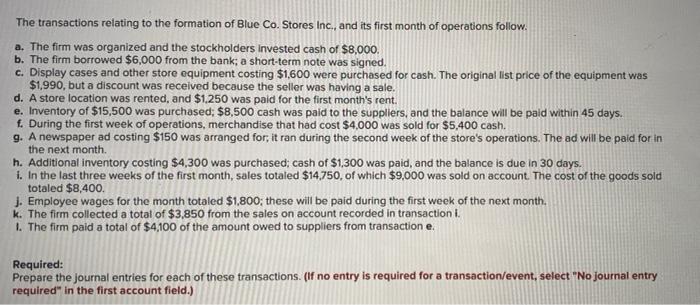

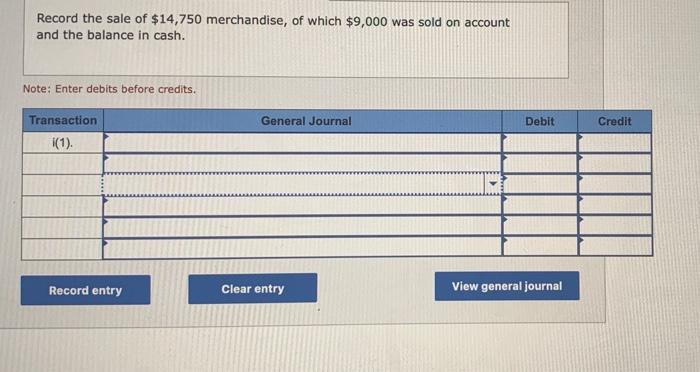

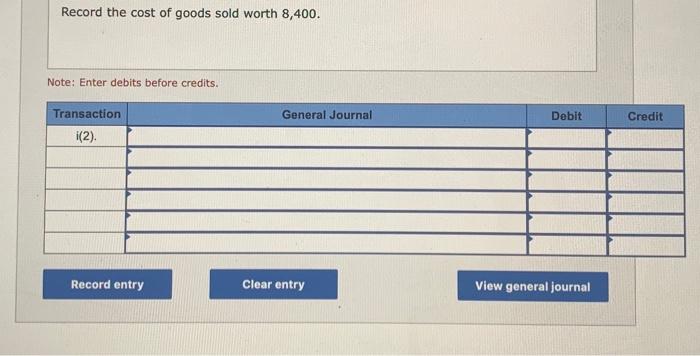

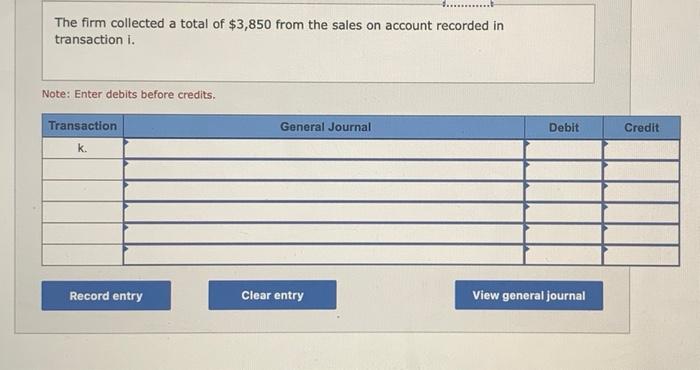

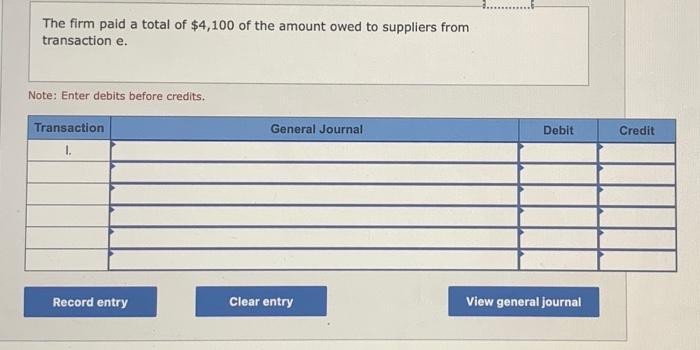

The transactions relating to the formation of Blue Co. Stores Inc., and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $8,000. b. The firm borrowed $6,000 from the bank; a short-term note was signed. c. Display cases and other store oquipment costing $1,600 were purchased for cash. The original list price of the equipment was $1,990, but a discount was received because the seller was having a sale. d. A store location was rented, and $1,250 was paid for the first month's rent. e. Inventory of $15,500 was purchased; $8,500 cash was paid to the suppliers, and the balance will be paid within 45 days. f. During the first week of operations, merchandise that had cost $4,000 was sold for $5,400 cash. g. A newspaper ad costing $150 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $4,300 was purchased; cash of $1,300 was paid, and the balance is due in 30 days. i. In the last three weeks of the first month, sales totaled $14,750, of which $9,000 was sold on account. The cost of the goods sold totaled $8,400. J. Employee wages for the month totaled $1,800; these will be paid during the first week of the next month. k. The firm collected a total of $3.850 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,100 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record the sale of $14,750 merchandise, of which $9,000 was sold on account and the balance in cash. Note: Enter debits before credits. Record the cost of goods sold worth 8,400 . Note: Enter debits before credits. Employee wages for the month totaled $1,800; these will be paid during the first week of the next month. Note: Enter debits before credits. The firm collected a total of $3,850 from the sales on account recorded in transaction i. Note: Enter debits before credits. The firm paid a total of $4,100 of the amount owed to suppliers from transaction e. Note: Enter debits before credits