The treasurer for Brookdale Clothing must decide how much money the company needs to borrow in July. The balance sheet for June 30, 2004

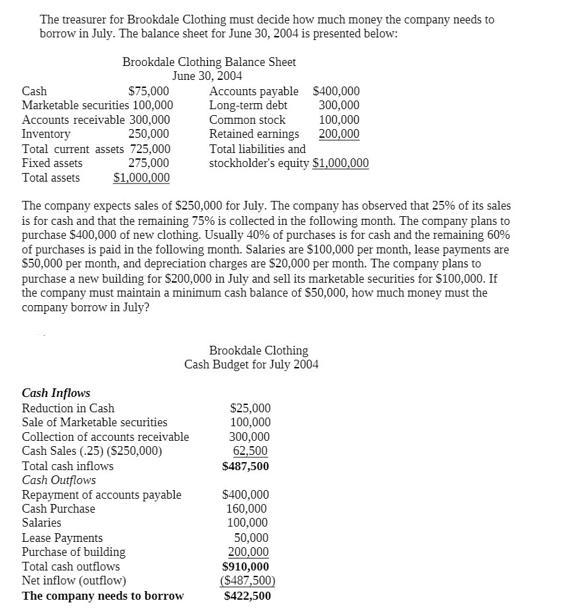

The treasurer for Brookdale Clothing must decide how much money the company needs to borrow in July. The balance sheet for June 30, 2004 is presented below: Brookdale Clothing Balance Sheet June 30, 2004 Cash $75,000 Marketable securities 100,000 Accounts receivable 300,000 Inventory 250,000 Total current assets 725,000 275,000 $1,000,000 Fixed assets Total assets Cash Inflows Reduction in Cash Sale of Marketable securities Collection of accounts receivable Cash Sales (25) ($250,000) Total cash inflows Cash Outflows Repayment of accounts payable Cash Purchase Salaries Accounts payable Long-term debt Lease Payments Purchase of building Total cash outflows Net inflow (outflow) The company needs to borrow Common stock Retained earnings The company expects sales of $250,000 for July. The company has observed that 25% of its sales is for cash and that the remaining 75% is collected in the following month. The company plans to purchase $400,000 of new clothing. Usually 40% of purchases is for cash and the remaining 60% of purchases is paid in the following month. Salaries are $100,000 per month, lease payments are $50,000 per month, and depreciation charges are $20,000 per month. The company plans to purchase a new building for $200,000 in July and sell its marketable securities for $100,000. If the company must maintain a minimum cash balance of $50,000, how much money must the company borrow in July? $400,000 300,000 Total liabilities and stockholder's equity $1,000,000 100,000 200,000 Brookdale Clothing Cash Budget for July 2004 $25,000 100,000 300,000 62,500 $487,500 $400,000 160,000 100,000 50,000 200,000 $910,000 ($487,500) $422,500

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Cash Inflows Cash sales 25 of 250000 sales 62500 Collection of accou...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started