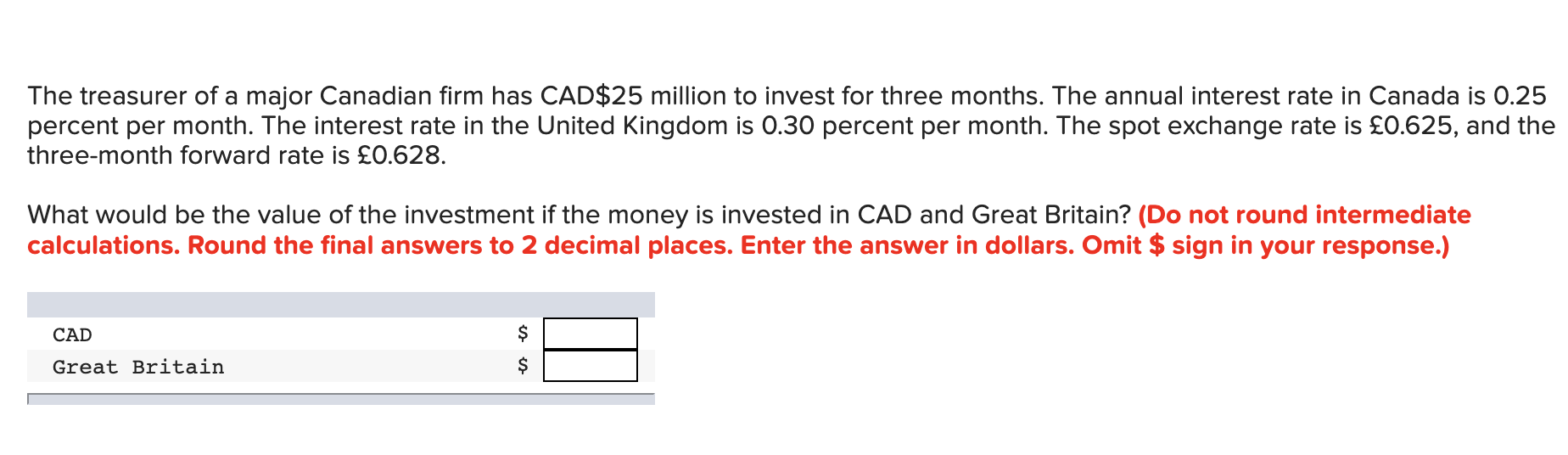

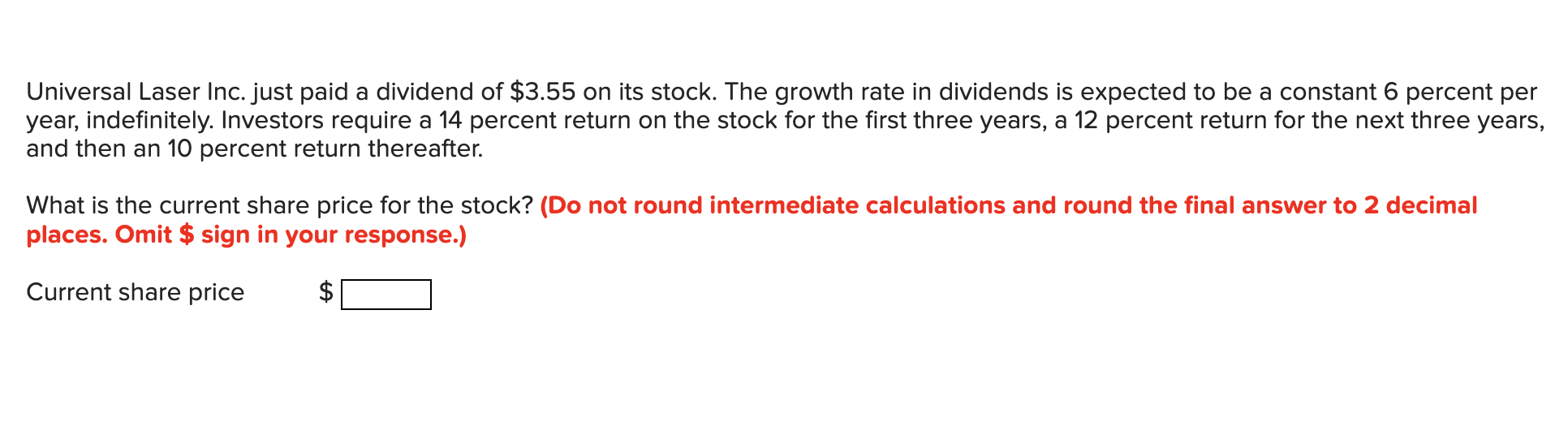

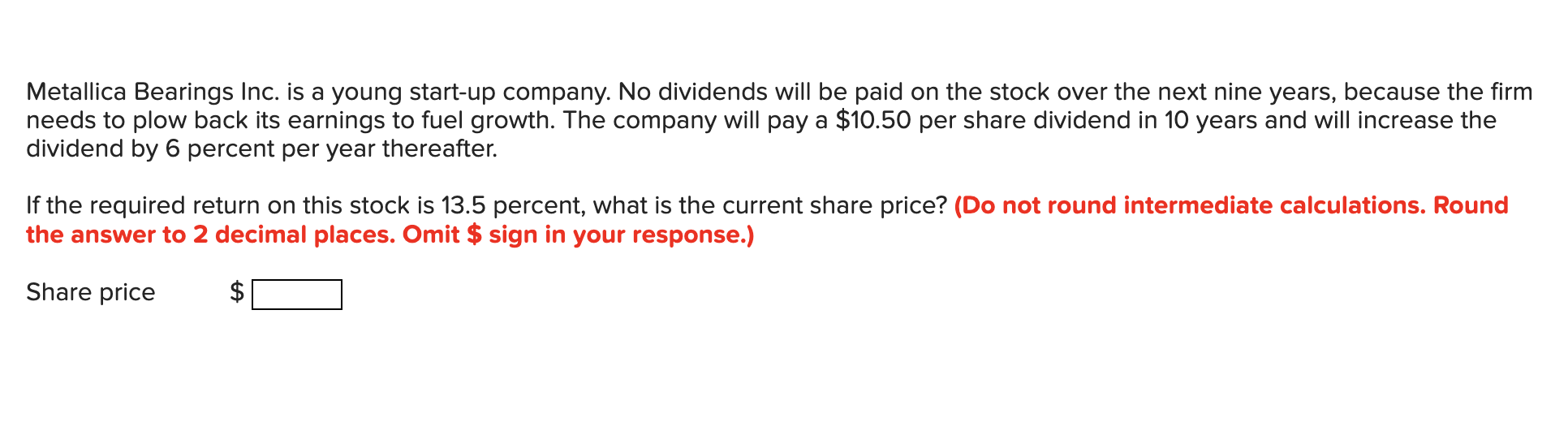

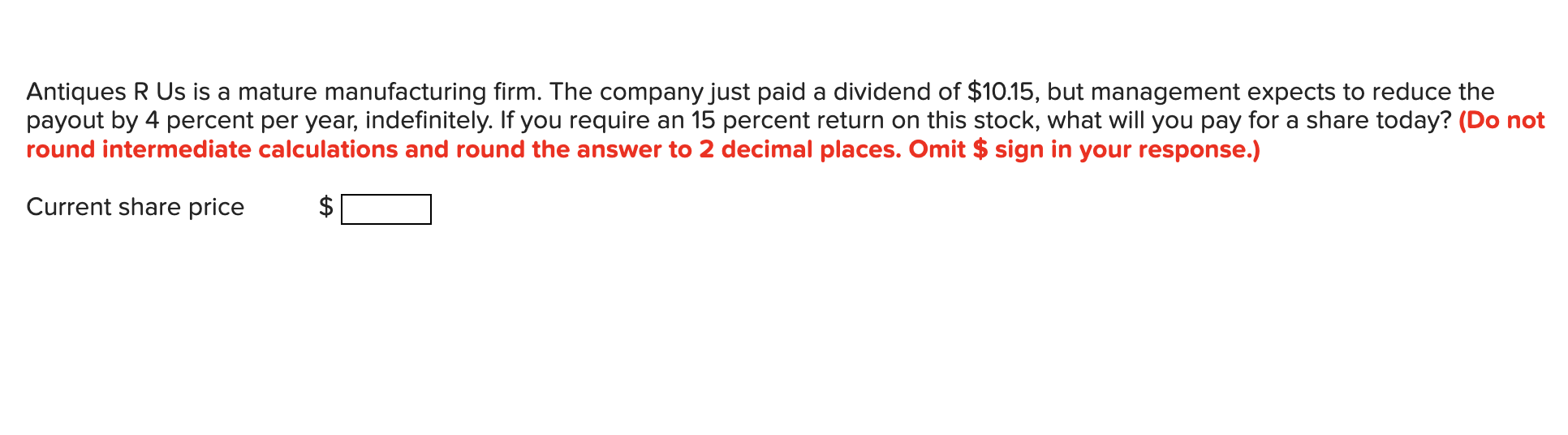

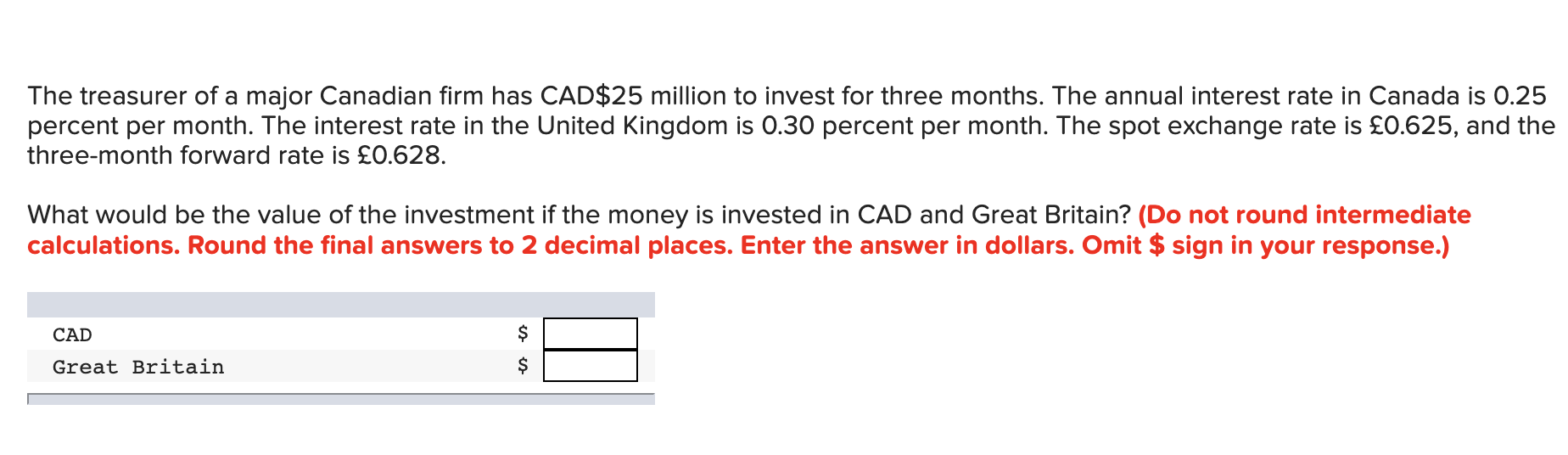

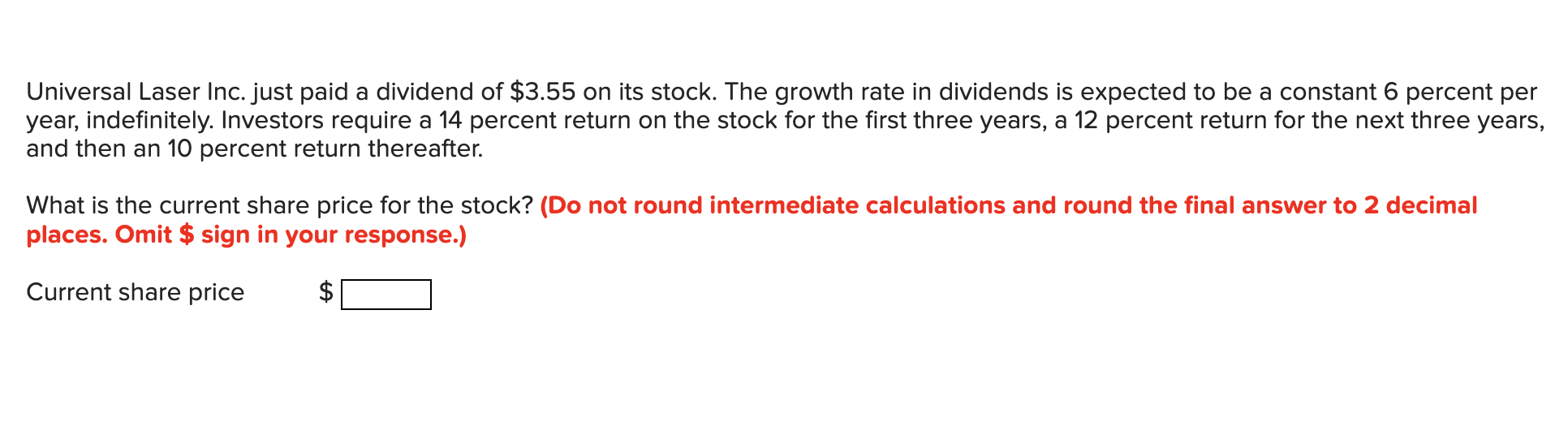

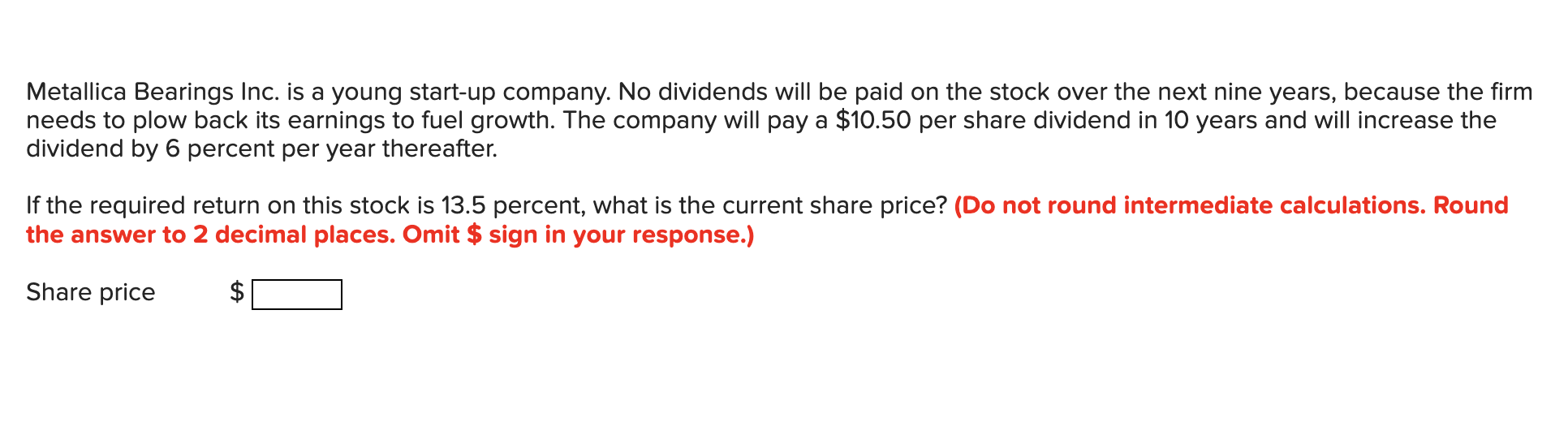

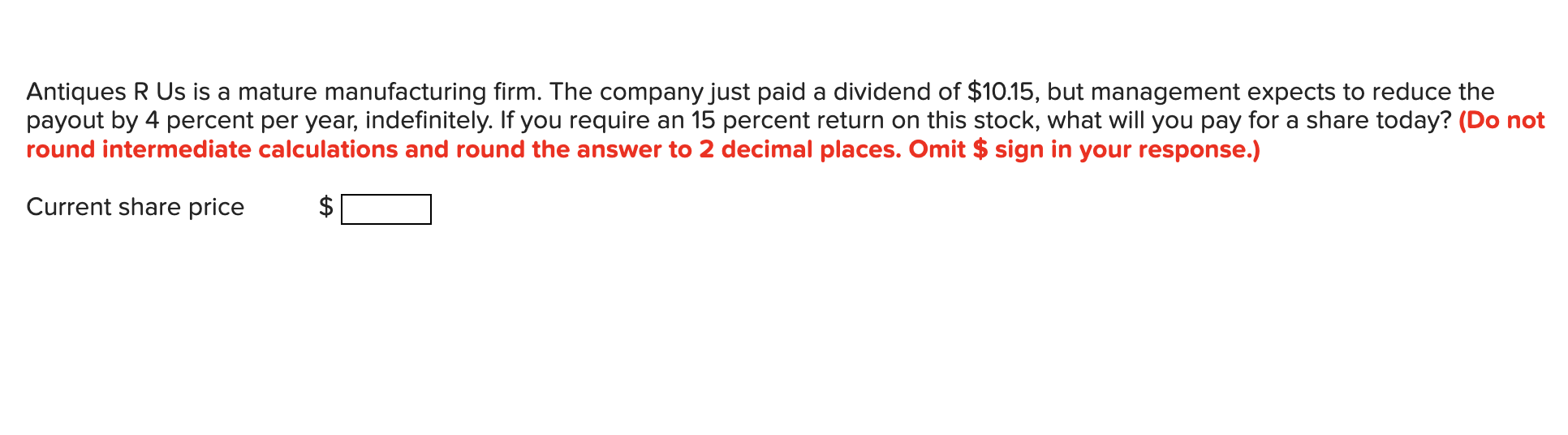

The treasurer of a major Canadian firm has CAD$25 million to invest for three months. The annual interest rate in Canada is 0.25 percent per month. The interest rate in the United Kingdom is 0.30 percent per month. The spot exchange rate is 0.625, and the three-month forward rate is 0.628. What would be the value of the investment if the money is invested in CAD and Great Britain? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Enter the answer in dollars. Omit $ sign in your response.) CAD $ Great Britain $ Universal Laser Inc. just paid a dividend of $3.55 on its stock. The growth rate in dividends is expected to be a constant 6 percent per year, indefinitely. Investors require a 14 percent return on the stock for the first three years, a 12 percent return for the next three years, and then an 10 percent return thereafter. What is the current share price for the stock? (Do not round intermediate calculations and round the final answer to 2 decimal places. Omit $ sign in your response.) Current share price $ ta Metallica Bearings Inc. is a young start-up company. No dividends will be paid on the stock over the next nine years, because the firm needs to plow back its earnings to fuel growth. The company will pay a $10.50 per share dividend in 10 years and will increase the dividend by 6 percent per year thereafter. If the required return on this stock is 13.5 percent, what is the current share price? (Do not round intermediate calculations. Round the answer to 2 decimal places. Omit $ sign in your response.) Share price $ Antiques R Us is a mature manufacturing firm. The company just paid a dividend of $10.15, but management expects to reduce the payout by 4 percent per year, indefinitely. If you require an 15 percent return on this stock, what will you pay for a share today? (Do not round intermediate calculations and round the answer to 2 decimal places. Omit $ sign in your response.) Current share price $ The treasurer of a major Canadian firm has CAD$25 million to invest for three months. The annual interest rate in Canada is 0.25 percent per month. The interest rate in the United Kingdom is 0.30 percent per month. The spot exchange rate is 0.625, and the three-month forward rate is 0.628. What would be the value of the investment if the money is invested in CAD and Great Britain? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Enter the answer in dollars. Omit $ sign in your response.) CAD $ Great Britain $ Universal Laser Inc. just paid a dividend of $3.55 on its stock. The growth rate in dividends is expected to be a constant 6 percent per year, indefinitely. Investors require a 14 percent return on the stock for the first three years, a 12 percent return for the next three years, and then an 10 percent return thereafter. What is the current share price for the stock? (Do not round intermediate calculations and round the final answer to 2 decimal places. Omit $ sign in your response.) Current share price $ ta Metallica Bearings Inc. is a young start-up company. No dividends will be paid on the stock over the next nine years, because the firm needs to plow back its earnings to fuel growth. The company will pay a $10.50 per share dividend in 10 years and will increase the dividend by 6 percent per year thereafter. If the required return on this stock is 13.5 percent, what is the current share price? (Do not round intermediate calculations. Round the answer to 2 decimal places. Omit $ sign in your response.) Share price $ Antiques R Us is a mature manufacturing firm. The company just paid a dividend of $10.15, but management expects to reduce the payout by 4 percent per year, indefinitely. If you require an 15 percent return on this stock, what will you pay for a share today? (Do not round intermediate calculations and round the answer to 2 decimal places. Omit $ sign in your response.) Current share price $