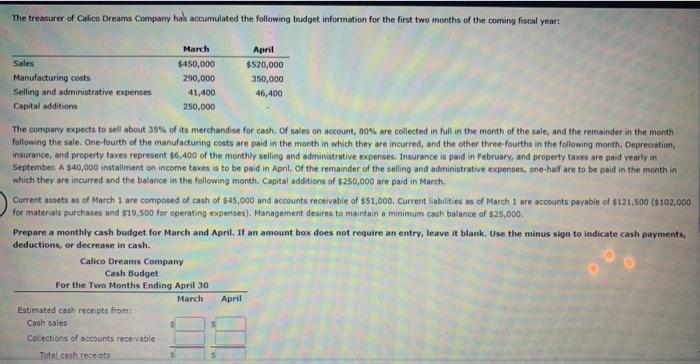

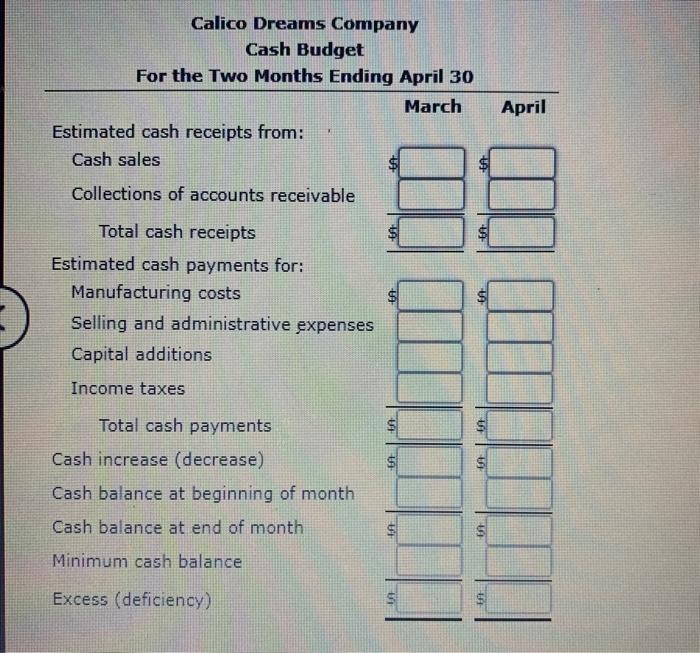

The treasurer of Calico Dreams Company has accumulated the following budget information for the first two months of the coming fiscal year: March April Sales $450,000 $520,000 Manufacturing costs 290,000 350,000 Selling and administrative expenses 41,400 46,400 Capital additions 250,000 The company expects to sell about 35% of its merchandise for cash. Of sales on account, 60% are collected in full in the month of the sale, and the remainder in the month following the sale. One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourtha in the following month. Depreciation insurance, and property taxen represent $6,400 of the monthly selling and administrative expenses. Insurance is paid in February, and property taxes are paid yearly in September. A 540,000 installment on income taxes is to be paid in April of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are paid in March Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of 551,000. Current liabilities as of March 1 are accounts payable of 5121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $25,000 Prepare a monthly cash budget for March and April. If an amount box does not require an entry, leave it blank. Use the minus sign to indicate cash payments, deductions, or decrease in cash. Calico Dreams Company Cash Budget For the Two Months Ending April 30 March Estimated cash receipts from: Cash sales Collections of accounts receivable Total cash receipts April Calico Dreams Company Cash Budget For the Two Months Ending April 30 March Estimated cash receipts from: Cash sales April $ Collections of accounts receivable Total cash receipts Estimated cash payments for: Manufacturing costs Selling and administrative expenses Capital additions $ $ Income taxes $ $ A Total cash payments Cash increase (decrease) Cash balance at beginning of month Cash balance at end of month UT $ Minimum cash balance Excess (deficiency) S FA