Question

The treasurer of Kelly Bottling Company (a corporation) currently has $100,000 invested in preferred stock yielding 8 percent. He appreciates the tax advantages of preferred

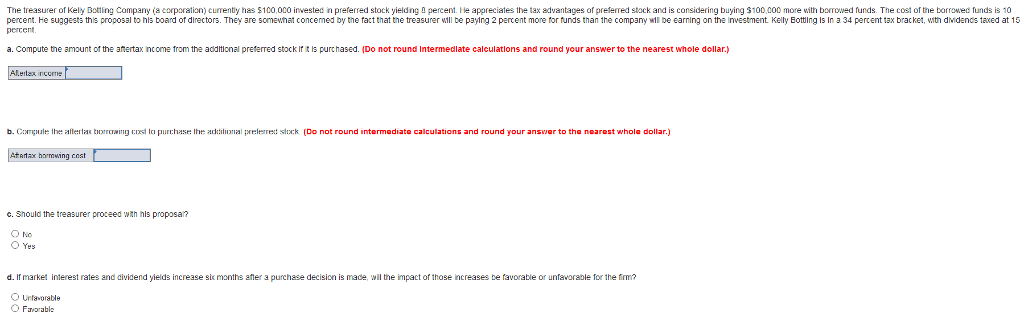

The treasurer of Kelly Bottling Company (a corporation) currently has $100,000 invested in preferred stock yielding 8 percent. He appreciates the tax advantages of preferred stock and is considering buying $100,000 more with borrowed funds. The cost of the borrowed funds is 10 percent. He suggests this proposal to his board of directors. They are somewhat concerned by the fact that the treasurer will be paying 2 percent more for funds than the company will be earning on the investment. Kelly Bottling is in a 34 percent tax bracket, with dividends taxed at 15 percent.

a. Compute the amount of the aftertax income from the additional preferred stock if it is purchased. (Do not round intermediate calculations and round your answer to the nearest whole dollar.)

b. Compute the aftertax borrowing cost to purchase the additional preferred stock. (Do not round intermediate calculations and round your answer to the nearest whole dollar.)

c. Should the treasurer proceed with his proposal?

| No | |

| Yes |

d. If market interest rates and dividend yields increase six months after a purchase decision is made, will the impact of those increases be favorable or unfavorable for the firm?

| Unfavorable | |

| Favorable |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started