Question

The Treasury Department conducts an auction of a new series of 5-year T-note. Their objective is to borrow $100 million. (a) You are a

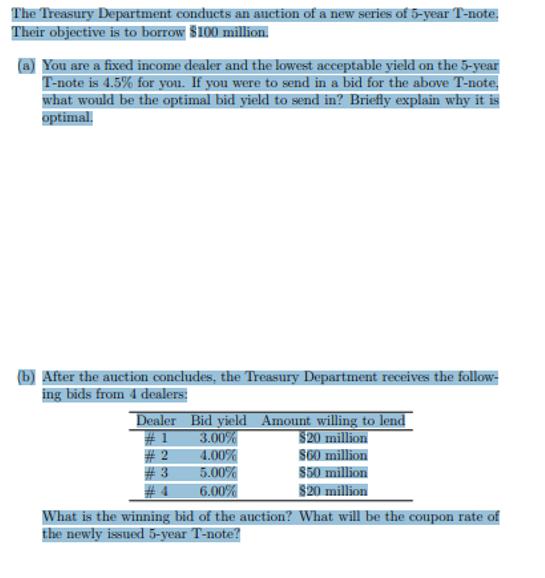

The Treasury Department conducts an auction of a new series of 5-year T-note. Their objective is to borrow $100 million. (a) You are a fixed income dealer and the lowest acceptable yield on the 5-year T-note is 4.5% for you. If you were to send in a bid for the above T-note, what would be the optimal bid yield to send in? Briefly explain why it is optimal. (b) After the auction concludes, the Treasury Department receives the follow- ing bids from 4 dealers: Dealer Bid yield Amount willing to lend $20 million $60 million $50 million $20 million #2 #3 #4 3.00% 4.00% 5.00% 6.00% What is the winning bid of the auction? What will be the coupon rate of the newly issued 5-year T-note?

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the optimal bid yield to send in we need to strike a balance between getting the allo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Decision Modeling With Spreadsheets

Authors: Nagraj Balakrishnan, Barry Render, Jr. Ralph M. Stair

3rd Edition

136115837, 978-0136115830

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App