Question

The Treasury has auctioned off 1 billion $ worth of T-bonds with a maturity of 10 years and semi-annual coupon payments. In this particular auction,

The Treasury has auctioned off 1 billion $ worth of T-bonds with a maturity of 10 years and semi-annual coupon payments. In this particular auction, $57 million worth of non-competitive bids were submitted.

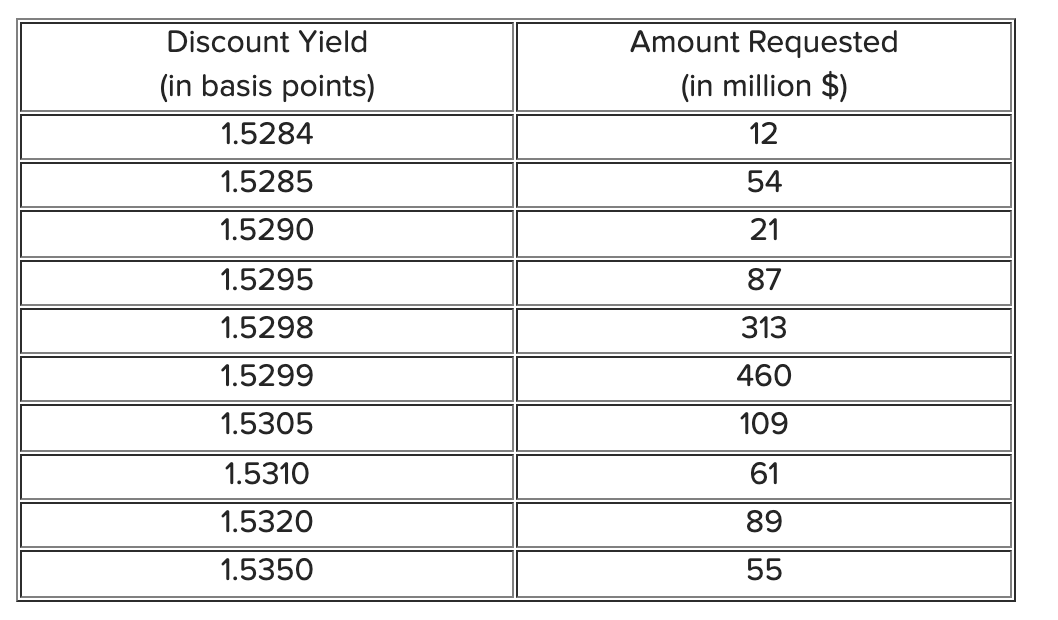

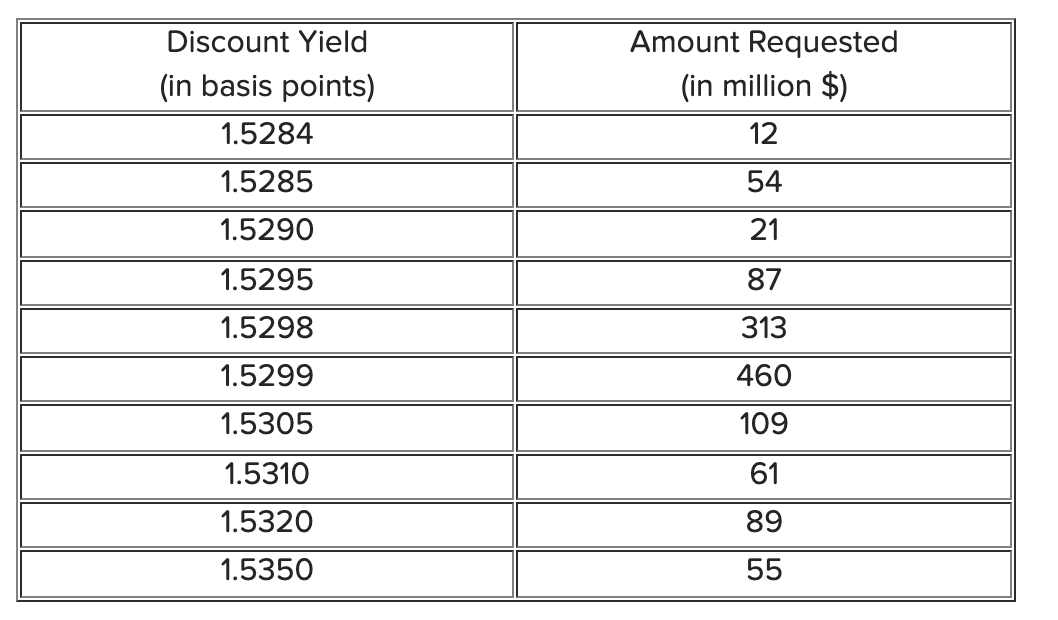

Investors submitted the following competitive bids and corresponding requested amounts:

Calculate the "High Yield" of this auction.

The coupon rate is set based on the "High Yield" (the winning bid), which you identified in the previous problem. The coupon is the nearest multiple of 0.125 percent below the winning discount yield. Recall that in this particular auction, the Treasury sold T-bonds with a maturity of 10 years and semi-annual coupon payments.

Investors submitted the following competitive bids and corresponding requested amounts:

Calculate the Stop-Out Price of this auction as a percentage of face value

Discount Yield (in basis points) 1.5284 Amount Requested (in million $) 12 54 1.5285 1.5290 21 87 313 1.5295 1.5298 1.5299 1.5305 460 109 1.5310 61 1.5320 89 1.5350 55 Discount Yield (in basis points) 1.5284 Amount Requested (in million $) 12 54 1.5285 1.5290 21 87 313 1.5295 1.5298 1.5299 1.5305 460 109 1.5310 61 1.5320 89 1.5350 55 Discount Yield (in basis points) 1.5284 Amount Requested (in million $) 12 54 1.5285 1.5290 21 87 313 1.5295 1.5298 1.5299 1.5305 460 109 1.5310 61 1.5320 89 1.5350 55 Discount Yield (in basis points) 1.5284 Amount Requested (in million $) 12 54 1.5285 1.5290 21 87 313 1.5295 1.5298 1.5299 1.5305 460 109 1.5310 61 1.5320 89 1.5350 55Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started