Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the trevor toy company manufactures tot building block sets for children... The Trevor Toy Company manufactures toy building block sets for children. Trevor is planning

the trevor toy company manufactures tot building block sets for children...

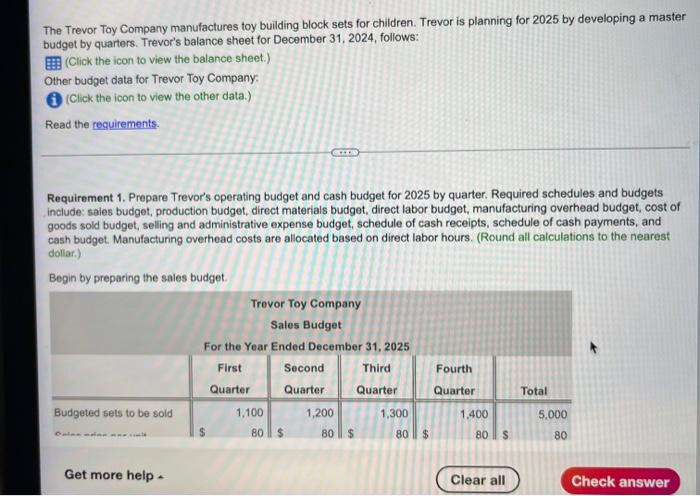

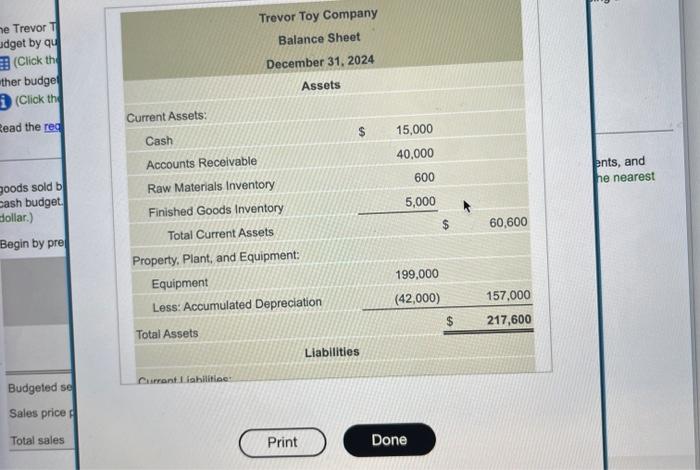

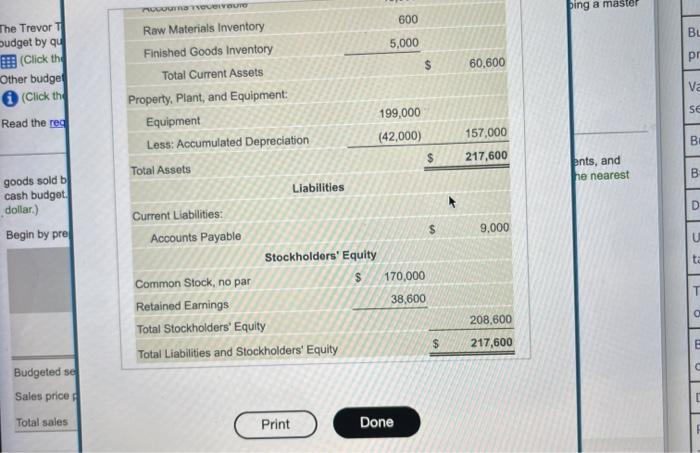

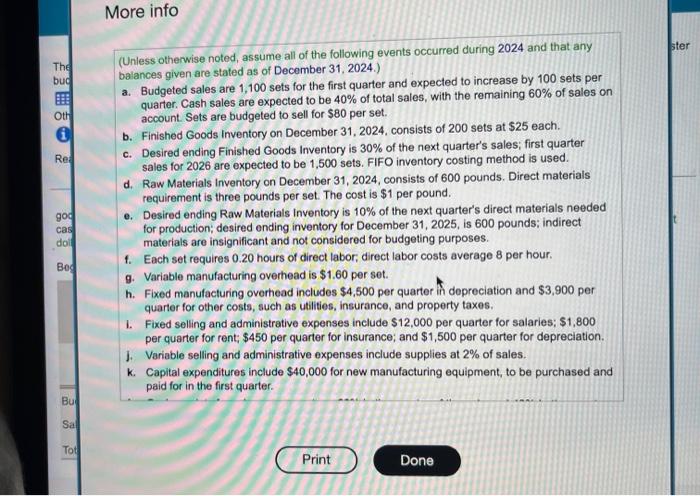

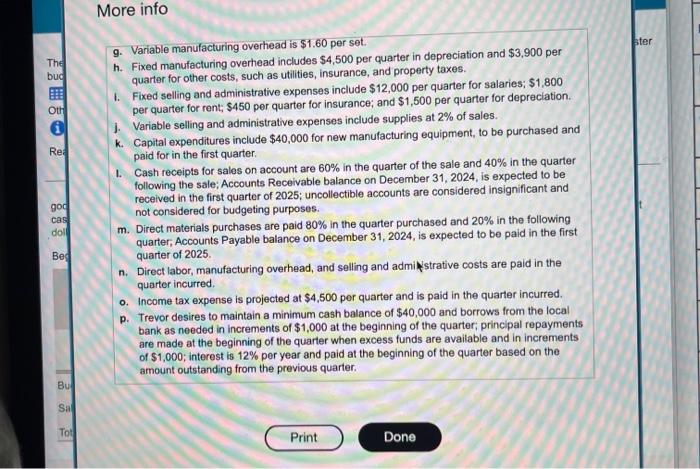

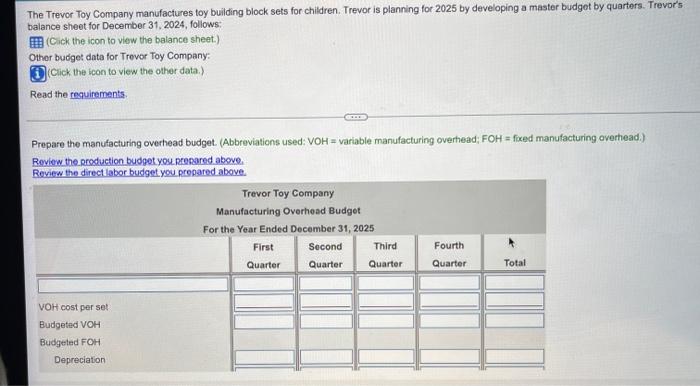

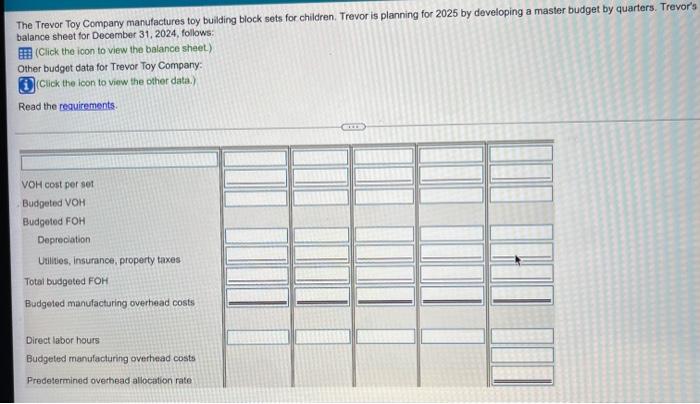

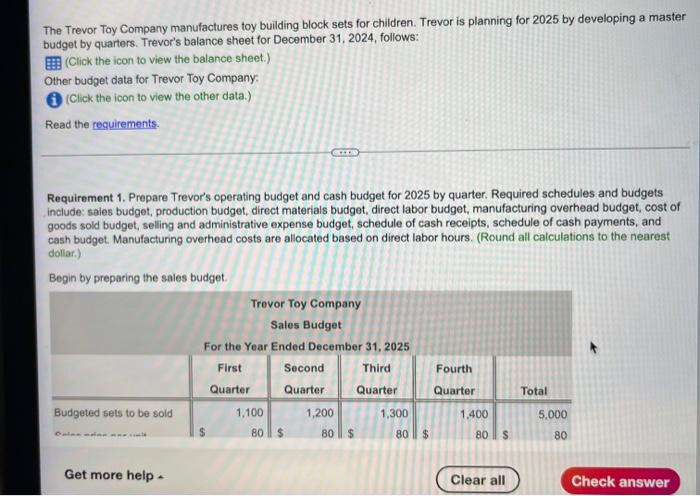

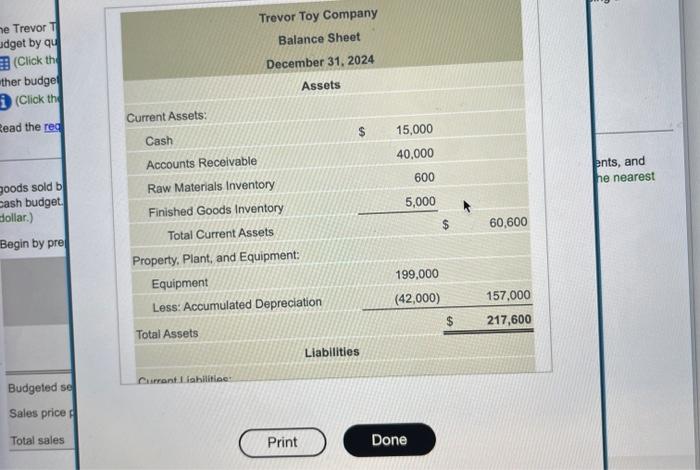

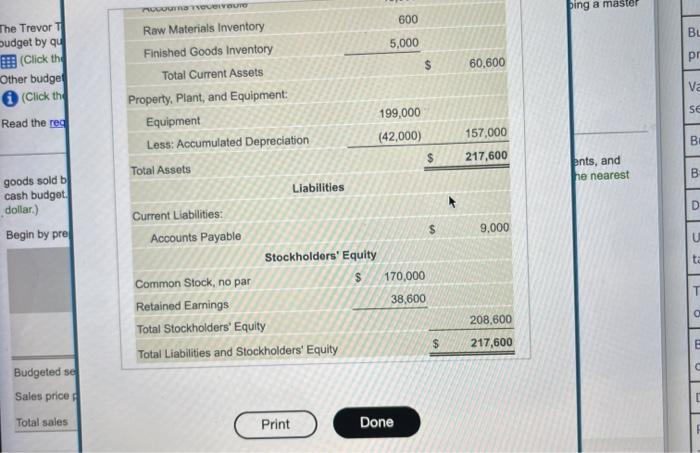

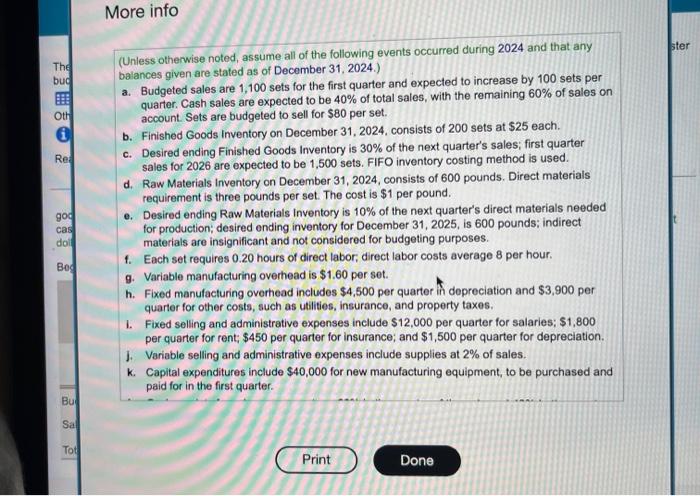

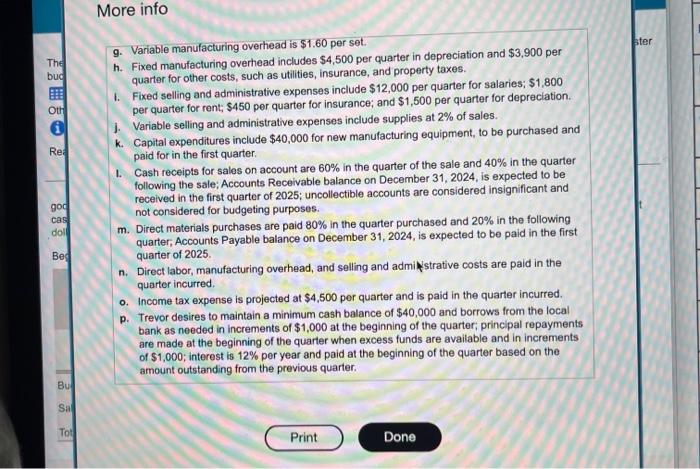

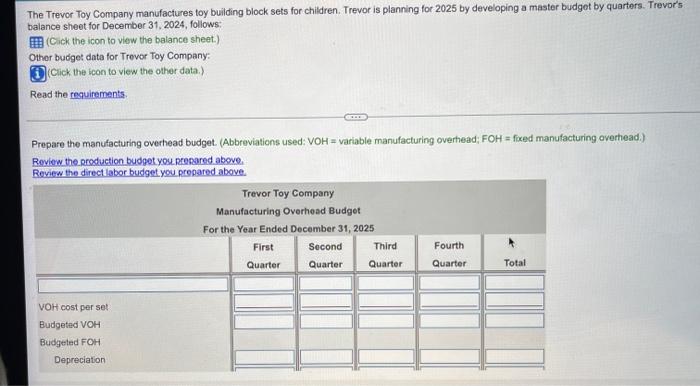

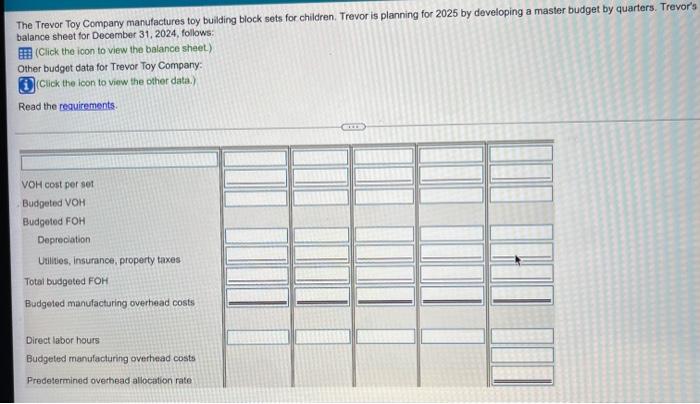

The Trevor Toy Company manufactures toy building block sets for children. Trevor is planning for 2025 by developing a master budget by quarters. Trevor's balance sheet for December 31, 2024, follows: (Click the icon to view the balance sheet.) Other budget data for Trevor Toy Company: (i) (Click the icon to view the other data.) Read the requirements. Requirement 1. Prepare Trevor's operating budget and cash budget for 2025 by quarter. Required schedules and budgets include: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative expense budget, schedule of cash receipts, schedule of cash payments, and cash budget. Manufacturing overhead costs are allocated based on direct labor hours. (Round all calculations to the nearest dollar.) Begin by preparing the sales budget. Get more help - (Unless otherwise noted, assume all of the following events occurred during 2024 and that any balances given are stated as of December 31, 2024.) a. Budgeted sales are 1,100 sets for the first quarter and expected to increase by 100 sets per quarter. Cash sales are expected to be 40% of total sales, with the remaining 60% of sales on account. Sets are budgeted to sell for $80 per set. b. Finished Goods inventory on December 31, 2024, consists of 200 sets at $25 each. c. Desired ending Finished Goods Inventory is 30% of the next quarter's sales; first quarter sales for 2026 are expected to be 1,500 sets. FIFO inventory costing method is used. d. Raw Materials Inventory on December 31, 2024, consists of 600 pounds. Direct materials requirement is three pounds per set. The cost is $1 per pound. e. Desired ending Raw Materials Inventory is 10% of the next quarter's direct materials needed for production; desired ending inventory for December 31,2025 , is 600 pounds; indirect materials are insignificant and not considered for budgeting purposes. f. Each set requires 0.20 hours of direct labor; direct labor costs average 8 per hour. g. Variable manufacturing overhead is $1.60 per set. h. Fixed manufacturing overhead includes $4,500 per quarter in depreciation and $3,900 per quarter for other costs, such as utilities, insurance, and property taxes. 1. Fixed selling and administrative expenses include $12,000 per quarter for salaries; $1,800 per quarter for rent; $450 per quarter for insurance; and $1,500 per quarter for depreciation. j. Variable selling and administrative expenses include supplies at 2% of sales. k. Capital expenditures include $40,000 for new manufacturing equipment, to be purchased and paid for in the first quarter. g. Variable manufacturing overhead is $1.60 per set. h. Fixed manufacturing overhead includes $4,500 per quarter in depreciation and $3,900 per quarter for other costs, such as utilities, insurance, and property taxes. 1. Fixed selling and administrative expenses include $12,000 per quarter for salaries; $1,800 per quarter for rent; $450 per quarter for insurance; and $1,500 per quarter for depreciation. j. Variable selling and administrative expenses include supplies at 2% of sales. k. Capital expenditures include $40,000 for new manufacturing equipment, to be purchased and paid for in the first quarter. 1. Cash receipts for sales on account are 60% in the quarter of the sale and 40% in the quarter following the sale; Accounts Receivable balance on December 31,2024 , is expected to be received in the first quarter of 2025; uncollectible accounts are considered insignificant and not considered for budgeting purposes. m. Direct materials purchases are paid 80% in the quarter purchased and 20% in the following quarter, Accounts Payable balance on December 31,2024 , is expected to be paid in the first quarter of 2025 . n. Direct labor, manufacturing overhead, and selling and admilstrative costs are paid in the quarter incurred. o. Income tax expense is projected at $4,500 per quarter and is paid in the quarter incurred. p. Trevor desires to maintain a minimum cash balance of $40,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter; principal repayments are made at the beginning of the quarter when excess funds are available and in increments of $1,000; interest is 12% per year and paid at the beginning of the quarter based on the amount outstanding from the previous quarter. The Trevor Toy Company manufactures toy building block sets for children. Trevor is planning for 2025 by developing a master budget by quarters. Trevor's balance sheet for Decerrber 31,2024 , follows: (Cick the icon to view the balance sheet.) Othor budget data for Trevor Toy Company: Cick the icon to view the other data.) Read the reguirements. Prepare the manufacturing overhead budget. (Abbreviations used: VOH = variable manufacturing overhead; FOH = fixed manufacturing overhead.) Roview the production budget you presared above. Reyew the direct labor budget you propared above. The Trevor Toy Company manulactures toy building block sets for children. Trevor is planning for 2025 by developing a master budget by quarters. Trevor's balance sheet for December 31,2024 , follows: (Click the icon to view the balance sheet) Other budget data for Trevor Toy Company: (Click the icon to view the ofher data.) Read the resuirements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started