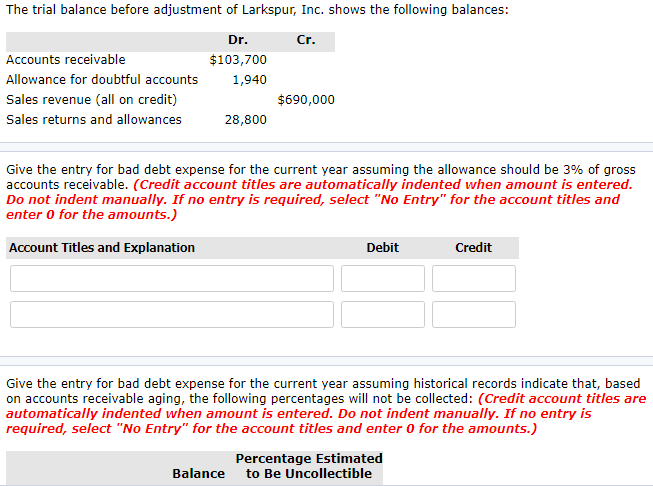

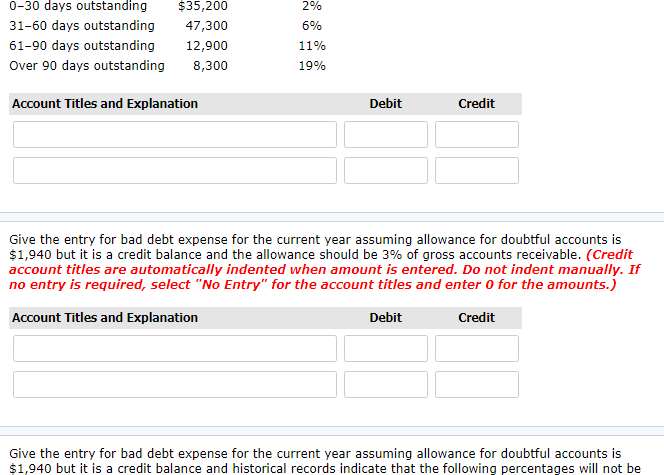

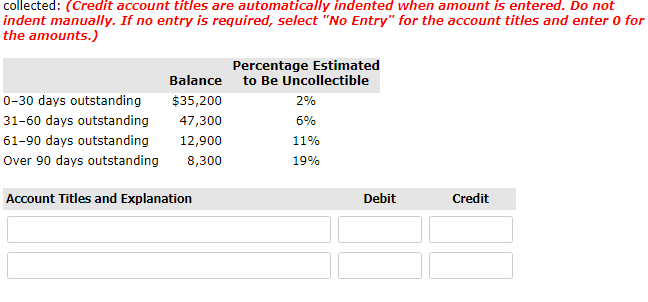

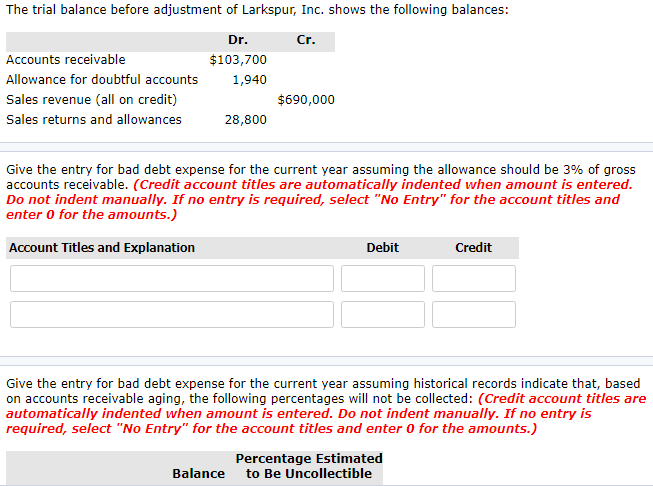

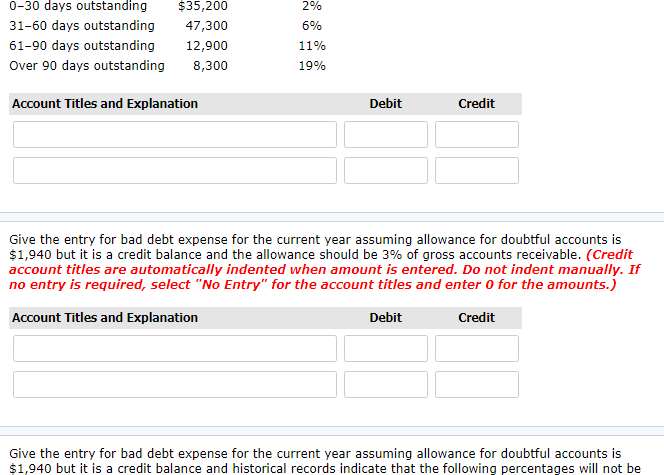

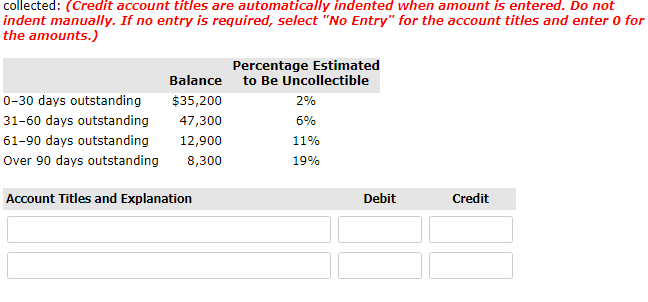

The trial balance before adjustment of Larkspur, Inc. shows the following balances: Cr. Dr. $103,700 1,940 Accounts receivable Allowance for doubtful accounts Sales revenue (all on credit) Sales returns and allowances $690,000 28,800 Give the entry for bad debt expense for the current year assuming the allowance should be 3% of gross accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Give the entry for bad debt expense for the current year assuming historical records indicate that, based on accounts receivable aging, the following percentages will not be collected: (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Percentage Estimated Balance to Be Uncollectible 0-30 days outstanding 31-60 days outstanding 61-90 days outstanding Over 90 days outstanding $35,200 47,300 12,900 8,300 2% 6% 11% 19% Account Titles and Explanation Debit Credit Give the entry for bad debt expense for the current year assuming allowance for doubtful accounts is $1,940 but it is a credit balance and the allowance should be 3% of gross accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Give the entry for bad debt expense for the current year assuming allowance for doubtful accounts is $1,940 but it is a credit balance and historical records indicate that the following percentages will not be collected: (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Percentage Estimated Balance to Be Uncollectible 0-30 days outstanding $35,200 2% 31-60 days outstanding 47,300 61-90 days outstanding 12,900 11% Over 90 days outstanding 8,300 19% 6% Account Titles and Explanation Debit Credit