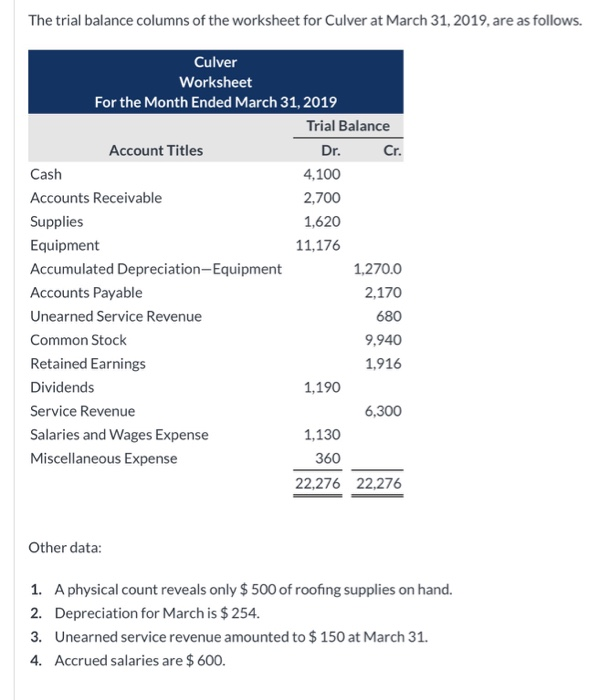

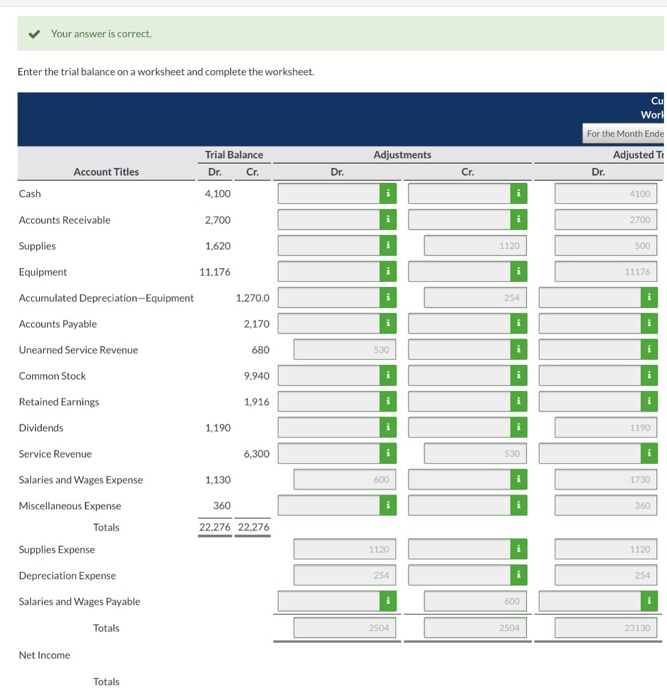

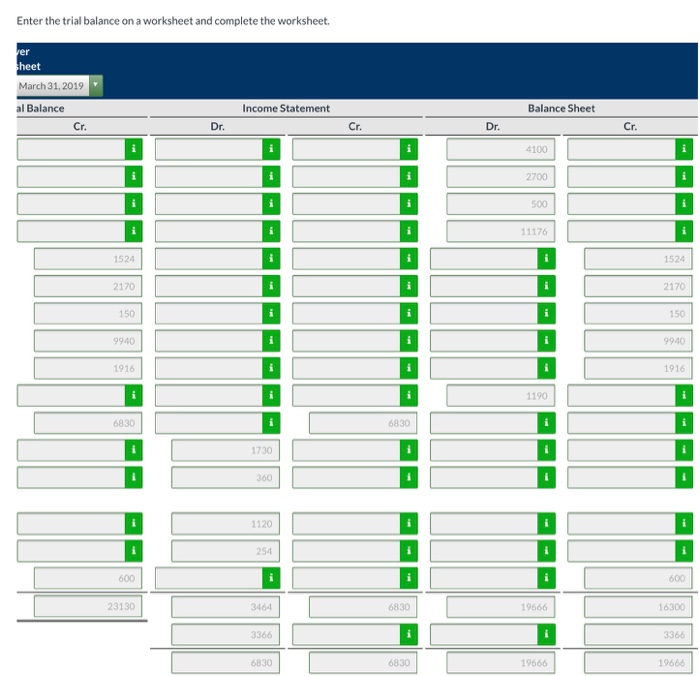

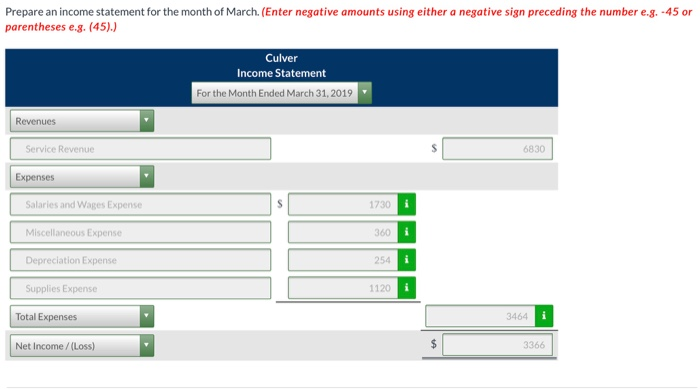

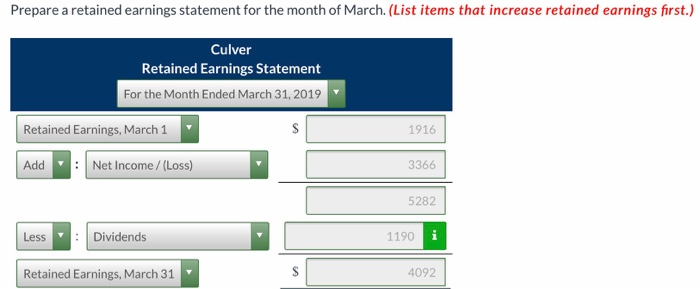

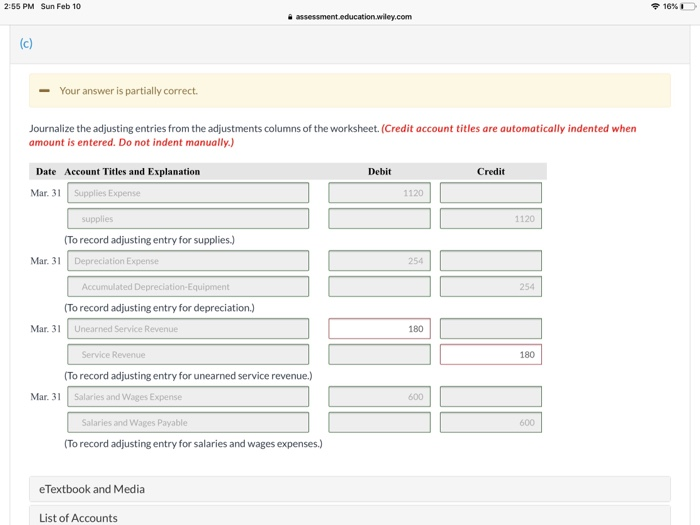

The trial balance columns of the worksheet for Culver at March 31, 2019, are as follows. Culver Worksheet For the Month Ended March 31, 2019 Trial Balance Account Titles Cr 4.100 2,700 1,620 11,176 Cash Accounts Receivable Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Common Stock Retained Earnings Dividends Service Revenue Salaries and Wages Expense Miscellaneous Expense 1,270.0 2,170 680 9,940 1,916 1,190 6,300 1,130 360 22,276 22,276 Other data: 1. A physical count reveals only $500 of roofing supplies on hand. 2. Depreciation for March is $254 3. Unearned service revenue amounted to $150 at March 31. . Accrued salaries are $ 600. Enter the trial balance on a worksheet and complete the worksheet. er heet March 31, 2019 al Balance Income Statement Balance Sheet Cr. Dr. Cr. Dr Cr 4100 2700 500 1524 2170 150 1524 2170 150 9940 9940 1916 1916 1190 6830 6830 1730 360 1120 254 600 600 23130 6830 19666 16300 6830 6830 19666 19666 Prepare an income statement for the month of March. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Culver Income Statement For the Month Ended March 31, 2019 Revenues Service Revenue 6830 Expenses 1730 360 254 1120 Salaries and Wages Expense Depreciation Expense Supplies Expense Total Expenses 3464 Net Income / (Loss) 3366 Prepare a retained earnings statement for the month of March. (List items that increase retained earnings first.) Culver Retained Earnings Statement For the Month Ended March 31, 2019 Retained Earnings, March 1 1916 Add Net Income/ (Loss) 3366 5282 Less Dividends 1190 Retained Earnings, March 31 4092 2:55 PM Sun Feb 10 16%. 1 Your answer is partially correct. Journalize the adjusting entries from the adjustments columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 31 Supplies Expense 1120 supplies 1120 To record adjusting entry for supplies.) Mar. 31 Depreciation Expense 254 254 To record adjusting entry for depreciation.) Mar. 31 Unearned Service Revenue 180 Service Revenue 180 To record adjusting entry for unearned service revenue.) Salaries and Wages Expense Mar. 3 600 Salaries and Wages Payable 600 To record adjusting entry for salaries and wages expenses.) eTextbook and Media List of Accounts