Question

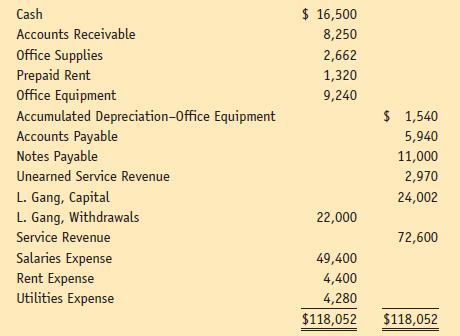

The trial balance for Financial Strategies Service on December 31, 20xx, is as follows: Financial Strategies Service Trial Balance December 31, 20xx The following information

The trial balance for Financial Strategies Service on December 31, 20xx, is as follows:

Financial Strategies Service Trial Balance December 31, 20xx

The following information is also available:

a. Ending inventory of office supplies, $264.

b. Prepaid rent expired, $440.

c. Depreciation of office equipment for the period, $660.

d. Accrued interest expense at the end of the period, $550.

e. Accrued salaries at the end of the period, $330.

f. Service revenue still unearned at the end of the period, $1,166.

g. Service revenue earned but unrecorded $2,200.

Required

1. Open T accounts for the accounts in the trial balance plus the following: Interest Payable; Salaries Payable; Office Supplies Expense; Depreciation Expense?Office Equipment; and Interest Expense. Enter the balances shown on the trial balance.

2. Determine the adjusting entries and post them directly to the T accounts.

3. Prepare an adjusted trial balance.

4. User Insight: Which financial statements do each of the above adjustments affect? Which financial statement is not affected by the adjustments?

Cash $ 16,500 Accounts Receivable 8,250 Office Supplies Prepaid Rent Office Equipment 2,662 1,320 9,240 $ 1,540 Accumulated Depreciation-Office Equipment Accounts Payable Notes Payable 5,940 11,000 Unearned Service Revenue 2,970 L. Gang, Capital L. Gang, Withdrawals 24,002 22,000 Service Revenue 72,600 Salaries Expense 49,400 Rent Expense 4,400 Utilities Expense 4,280 $118,052 $118,052

Step by Step Solution

There are 3 Steps involved in it

Step: 1

T accounts for the accounts is also known as ledger accounts which shows the transactions occurred during the year and which carries the final figure to trial balance 1 and 2 Below are the T accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started