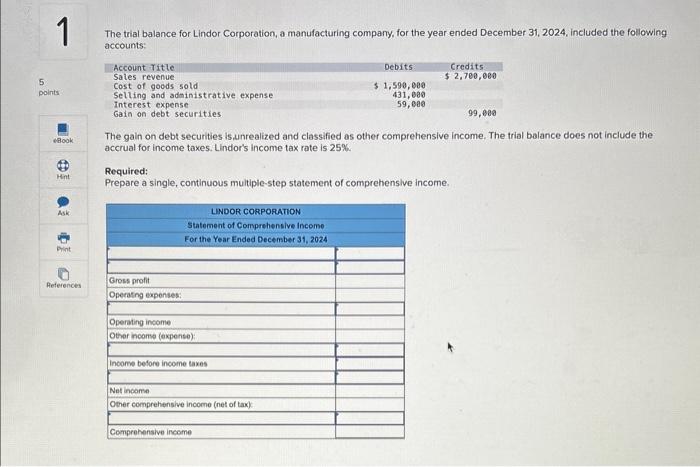

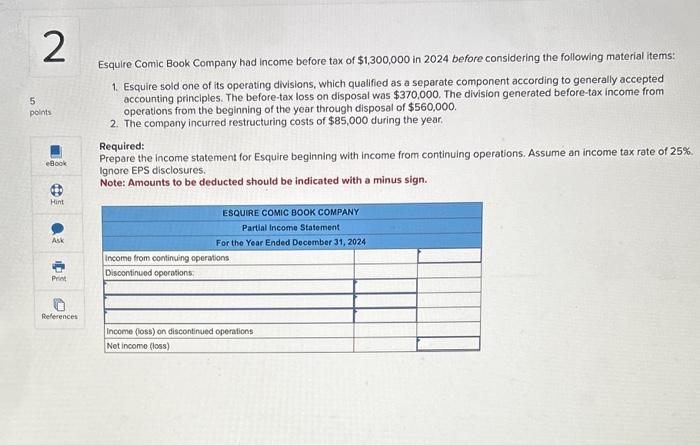

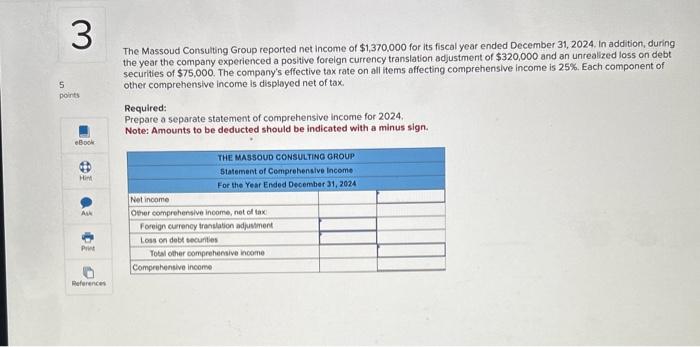

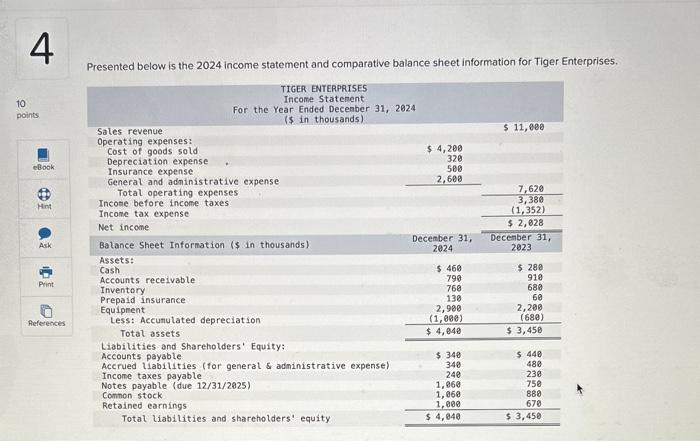

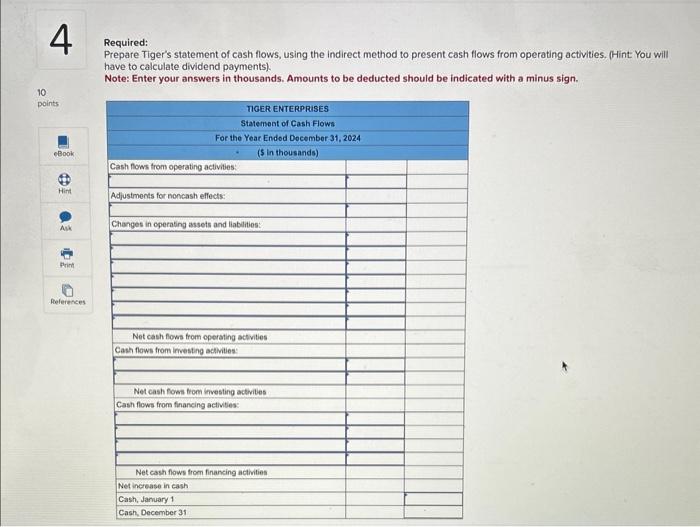

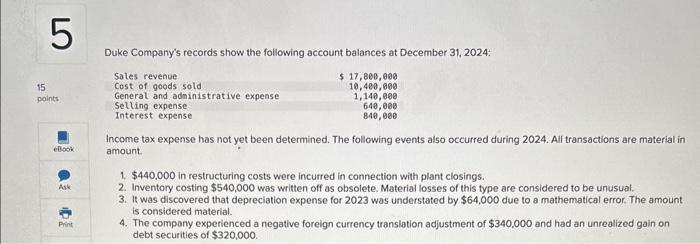

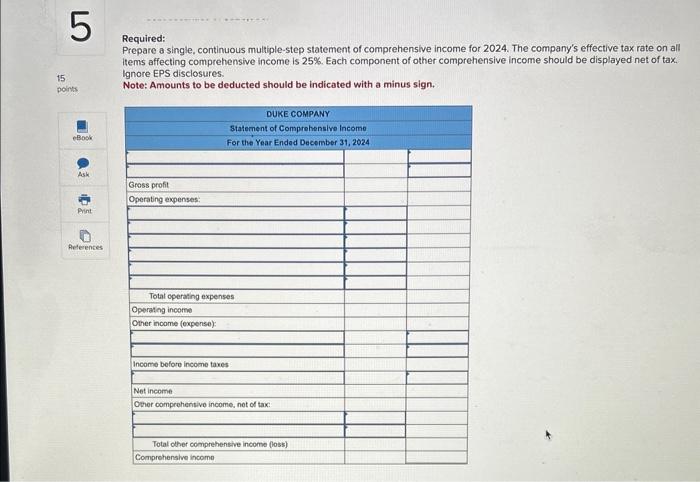

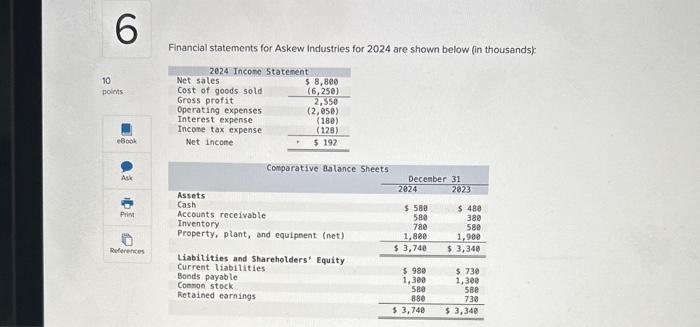

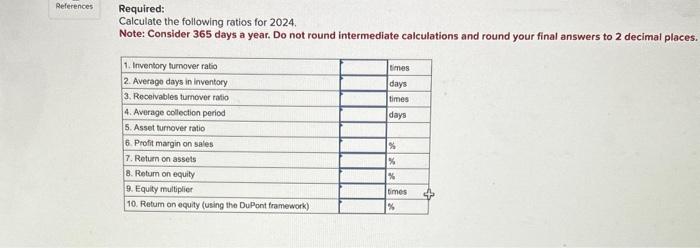

The trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2024, included the following accounts: The gain on debt securities is unrealized and classified as other comprehenslve income. The trial balance does not include the accrual for income taxes. Lindor's income tax rate is 25%. Required: Prepare a single, continuous multiple-step statement of comprehensive income. Esquire Comic Book Company had income before tax of $1,300,000 in 2024 before considering the following material items: 1. Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting principles. The before-tax loss on disposal was $370,000. The division generated before-tax income from operations from the beginning of the year through disposal of $560,000. 2. The company incurred restructuring costs of $85,000 during the year. Required: Prepare the income statement for Esquire beginning with income from continuing operations. Assume an income tax rate of 25% Ignore EPS disclosures. Note: Amounts to be deducted should be indicated with a minus sign. The Massoud Consulting Group reported net income of $1,370,000 for its fiscal year ended December 31, 2024, In addition, during the year the company experienced a positive foreign currency translation adjustment of $320,000 and an unrealized loss on debt. securities of $75,000. The company's effective tax rate on all items affecting comprehenslve income is 25%, Each component of other comprehensive income is displayed net of tax. Required: Prepare a separate statement of comprehensive income for 2024. Note: Amounts to be deducted should be indicated with a minus sign. Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tiger's statement of cash flows, using the indirect method to present cash flows from operating activities. (Hint You will have to calculate dividend payments). Note: Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. Duke Company's records show the following account balances at December 31, 2024 . Income tax expense has not yet been determined. The following events also occurred during 2024. Alf transactions are material in amount. 1. $440.000 in restructuring costs were incurred in connection with plant closings. 2. Inventory costing $540,000 was written off as obsolete. Material losses of this type are considered to be unusual. 3. It was discovered that depreciation expense for 2023 was understated by $64,000 due to a mathematical error. The amount is considered material. 4. The company experienced a negative foreign currency translation adjustment of $340,000 and had an unrealized gain on debt securities of $320,000. Required: Prepare a single, continuous multiple-step statement of comprehensive income for 2024. The company's effective tax rate on all items affecting comprehensive income is 25%. Each component of other comprehensive income should be displayed net of tax. lgnore EPS disclosures. Note: Amounts to be deducted should be indicated with a minus sign. Financial statements for Askew industries for 2024 are shown below (in thousands): Required: Calculate the following ratios for 2024 . Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places