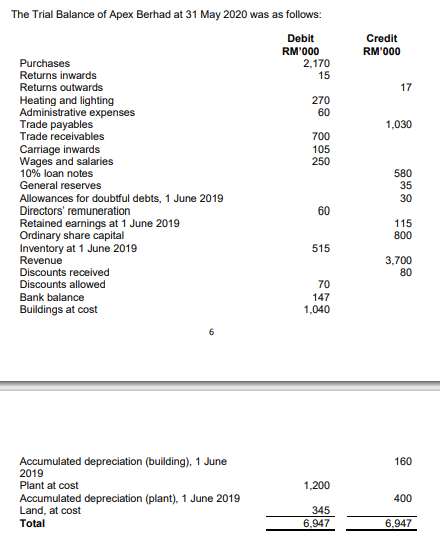

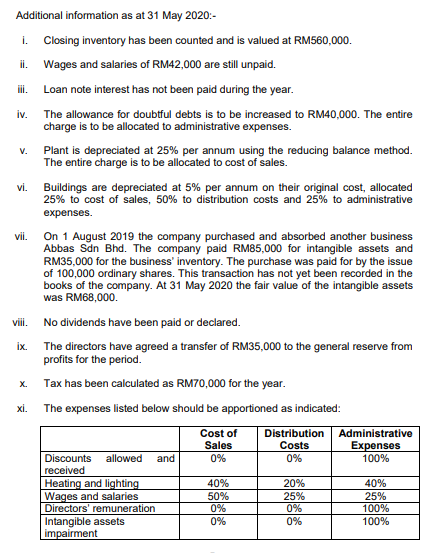

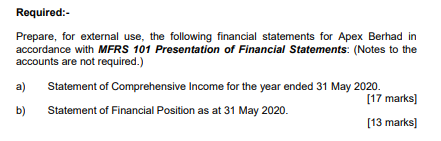

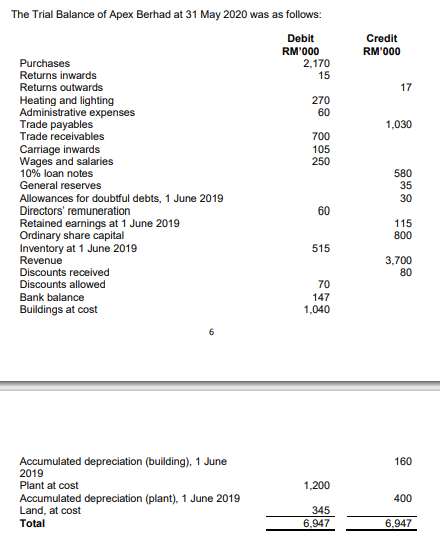

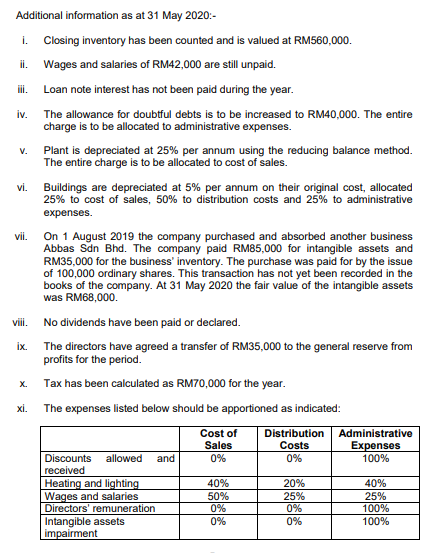

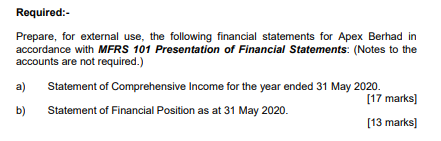

The Trial Balance of Apex Berhad at 31 May 2020 was as follows: Debit RM'000 2,170 15 Credit RM'000 17 270 60 1,030 700 105 250 Purchases Returns inwards Returns outwards Heating and lighting Administrative expenses Trade payables Trade receivables Carriage inwards Wages and salaries 10% loan notes General reserves Allowances for doubtful debts, 1 June 2019 Directors' remuneration Retained earnings at 1 June 2019 Ordinary share capital Inventory at 1 June 2019 Revenue Discounts received Discounts allowed Bank balance Buildings at cost 580 35 30 60 115 800 515 3,700 80 70 147 1,040 6 160 1,200 Accumulated depreciation (building), 1 June 2019 Plant at cost Accumulated depreciation (plant), 1 June 2019 Land, at cost Total 400 345 6.947 6.947 V. Additional information as at 31 May 2020:- i. Closing inventory has been counted and is valued at RM560,000. ii. Wages and salaries of RM42,000 are still unpaid. Loan note interest has not been paid during the year. iv. The allowance for doubtful debts is to be increased to RM40,000. The entire charge is to be allocated to administrative expenses. Plant is depreciated at 25% per annum using the reducing balance method. The entire charge is to be allocated to cost of sales. vi. Buildings are depreciated at 5% per annum on their original cost, allocated 25% to cost of sales, 50% to distribution costs and 25% to administrative expenses. vii. On 1 August 2019 the company purchased and absorbed another business Abbas Sdn Bhd. The company paid RM85,000 for intangible assets and RM35,000 for the business' inventory. The purchase was paid for by the issue of 100,000 ordinary shares. This transaction has not yet been recorded in the books of the company. At 31 May 2020 the fair value of the intangible assets was RM68,000 vili. No dividends have been paid or declared. ix. The directors have agreed a transfer of RM35,000 to the general reserve from profits for the period. X. Tax has been calculated as RM70,000 for the year. The expenses listed below should be apportioned as indicated: Cost of Distribution Administrative Sales Expenses Discounts allowed 0% 100% received Heating and lighting 40% 20% 40% Wages and salaries 50% 25% 25% Directors' remuneration 0% 100% Intangible assets 0% 100% impairment xi. Costs 0% and 0% 0% Required:- Prepare, for external use, the following financial statements for Apex Berhad in accordance with MFRS 101 Presentation of Financial Statements: (Notes to the accounts are not required.) a) Statement of Comprehensive Income for the year ended 31 May 2020. [17 marks] b) Statement of Financial Position as at 31 May 2020. [13 marks) The Trial Balance of Apex Berhad at 31 May 2020 was as follows: Debit RM'000 2,170 15 Credit RM'000 17 270 60 1,030 700 105 250 Purchases Returns inwards Returns outwards Heating and lighting Administrative expenses Trade payables Trade receivables Carriage inwards Wages and salaries 10% loan notes General reserves Allowances for doubtful debts, 1 June 2019 Directors' remuneration Retained earnings at 1 June 2019 Ordinary share capital Inventory at 1 June 2019 Revenue Discounts received Discounts allowed Bank balance Buildings at cost 580 35 30 60 115 800 515 3,700 80 70 147 1,040 6 160 1,200 Accumulated depreciation (building), 1 June 2019 Plant at cost Accumulated depreciation (plant), 1 June 2019 Land, at cost Total 400 345 6.947 6.947 V. Additional information as at 31 May 2020:- i. Closing inventory has been counted and is valued at RM560,000. ii. Wages and salaries of RM42,000 are still unpaid. Loan note interest has not been paid during the year. iv. The allowance for doubtful debts is to be increased to RM40,000. The entire charge is to be allocated to administrative expenses. Plant is depreciated at 25% per annum using the reducing balance method. The entire charge is to be allocated to cost of sales. vi. Buildings are depreciated at 5% per annum on their original cost, allocated 25% to cost of sales, 50% to distribution costs and 25% to administrative expenses. vii. On 1 August 2019 the company purchased and absorbed another business Abbas Sdn Bhd. The company paid RM85,000 for intangible assets and RM35,000 for the business' inventory. The purchase was paid for by the issue of 100,000 ordinary shares. This transaction has not yet been recorded in the books of the company. At 31 May 2020 the fair value of the intangible assets was RM68,000 vili. No dividends have been paid or declared. ix. The directors have agreed a transfer of RM35,000 to the general reserve from profits for the period. X. Tax has been calculated as RM70,000 for the year. The expenses listed below should be apportioned as indicated: Cost of Distribution Administrative Sales Expenses Discounts allowed 0% 100% received Heating and lighting 40% 20% 40% Wages and salaries 50% 25% 25% Directors' remuneration 0% 100% Intangible assets 0% 100% impairment xi. Costs 0% and 0% 0% Required:- Prepare, for external use, the following financial statements for Apex Berhad in accordance with MFRS 101 Presentation of Financial Statements: (Notes to the accounts are not required.) a) Statement of Comprehensive Income for the year ended 31 May 2020. [17 marks] b) Statement of Financial Position as at 31 May 2020. [13 marks)