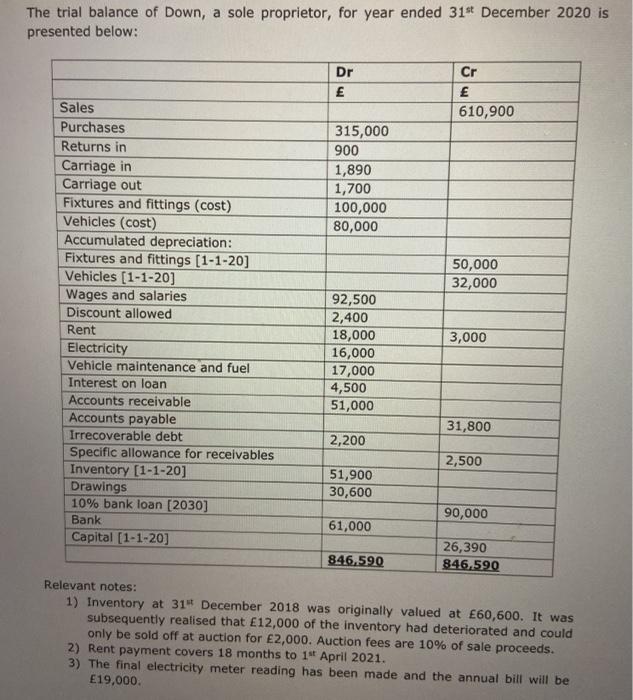

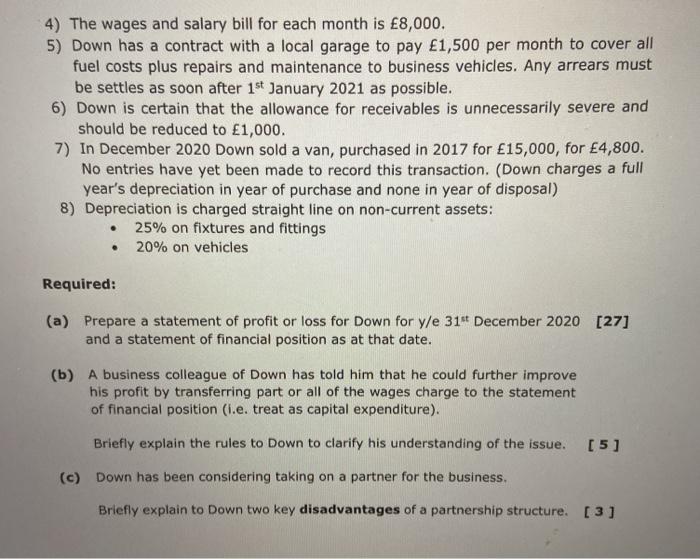

The trial balance of Down, a sole proprietor, for year ended 31st December 2020 is presented below: Dr Cr 610,900 315,000 900 1,890 1,700 100,000 80,000 50,000 32,000 Sales Purchases Returns in Carriage in Carriage out Fixtures and fittings (cost) Vehicles (cost) Accumulated depreciation: Fixtures and fittings (1-1-20] Vehicles (1-1-20) Wages and salaries Discount allowed Rent Electricity Vehicle maintenance and fuel Interest on loan Accounts receivable Accounts payable Irrecoverable debt Specific allowance for receivables Inventory (1-1-20) Drawings 10% bank loan [2030] Bank Capital (1-1-20] 3,000 92,500 2,400 18,000 16,000 17,000 4,500 51,000 31,800 2,200 2,500 51,900 30,600 90,000 61,000 846,590 26,390 846.590 Relevant notes: 1) Inventory at 31 December 2018 was originally valued at 60,600. It was subsequently realised that 12,000 of the inventory had deteriorated and could only be sold off at auction for 2,000. Auction fees are 10% of sale proceeds. 2) Rent payment covers 18 months to 1st April 2021. 3) The final electricity meter reading has been made and the annual bill will be E19,000. 4) The wages and salary bill for each month is 8,000. 5) Down has a contract with a local garage to pay 1,500 per month to cover all fuel costs plus repairs and maintenance to business vehicles. Any arrears must be settles as soon after 1st January 2021 as possible. 6) Down is certain that the allowance for receivables is unnecessarily severe and should be reduced to 1,000. 7) In December 2020 Down sold a van, purchased in 2017 for 15,000, for 4,800. No entries have yet been made to record this transaction. (Down charges a full year's depreciation in year of purchase and none in year of disposal) 8) Depreciation is charged straight line on non-current assets: 25% on fixtures and fittings 20% on vehicles . Required: (a) Prepare a statement of profit or loss for Down for y/e 31st December 2020 [27] and a statement of financial position as at that date. (b) A business colleague of Down has told him that he could further improve his profit by transferring part or all of the wages charge to the statement of financial position (i.e. treat as capital expenditure). Briefly explain the rules to Down to clarify his understanding of the issue. [5] (c) Down has been considering taking on a partner for the business. Briefly explain to Down two key disadvantages of a partnership structure. [3] The trial balance of Down, a sole proprietor, for year ended 31st December 2020 is presented below: Dr Cr 610,900 315,000 900 1,890 1,700 100,000 80,000 50,000 32,000 Sales Purchases Returns in Carriage in Carriage out Fixtures and fittings (cost) Vehicles (cost) Accumulated depreciation: Fixtures and fittings (1-1-20] Vehicles (1-1-20) Wages and salaries Discount allowed Rent Electricity Vehicle maintenance and fuel Interest on loan Accounts receivable Accounts payable Irrecoverable debt Specific allowance for receivables Inventory (1-1-20) Drawings 10% bank loan [2030] Bank Capital (1-1-20] 3,000 92,500 2,400 18,000 16,000 17,000 4,500 51,000 31,800 2,200 2,500 51,900 30,600 90,000 61,000 846,590 26,390 846.590 Relevant notes: 1) Inventory at 31 December 2018 was originally valued at 60,600. It was subsequently realised that 12,000 of the inventory had deteriorated and could only be sold off at auction for 2,000. Auction fees are 10% of sale proceeds. 2) Rent payment covers 18 months to 1st April 2021. 3) The final electricity meter reading has been made and the annual bill will be E19,000. 4) The wages and salary bill for each month is 8,000. 5) Down has a contract with a local garage to pay 1,500 per month to cover all fuel costs plus repairs and maintenance to business vehicles. Any arrears must be settles as soon after 1st January 2021 as possible. 6) Down is certain that the allowance for receivables is unnecessarily severe and should be reduced to 1,000. 7) In December 2020 Down sold a van, purchased in 2017 for 15,000, for 4,800. No entries have yet been made to record this transaction. (Down charges a full year's depreciation in year of purchase and none in year of disposal) 8) Depreciation is charged straight line on non-current assets: 25% on fixtures and fittings 20% on vehicles . Required: (a) Prepare a statement of profit or loss for Down for y/e 31st December 2020 [27] and a statement of financial position as at that date. (b) A business colleague of Down has told him that he could further improve his profit by transferring part or all of the wages charge to the statement of financial position (i.e. treat as capital expenditure). Briefly explain the rules to Down to clarify his understanding of the issue. [5] (c) Down has been considering taking on a partner for the business. Briefly explain to Down two key disadvantages of a partnership structure. [3]