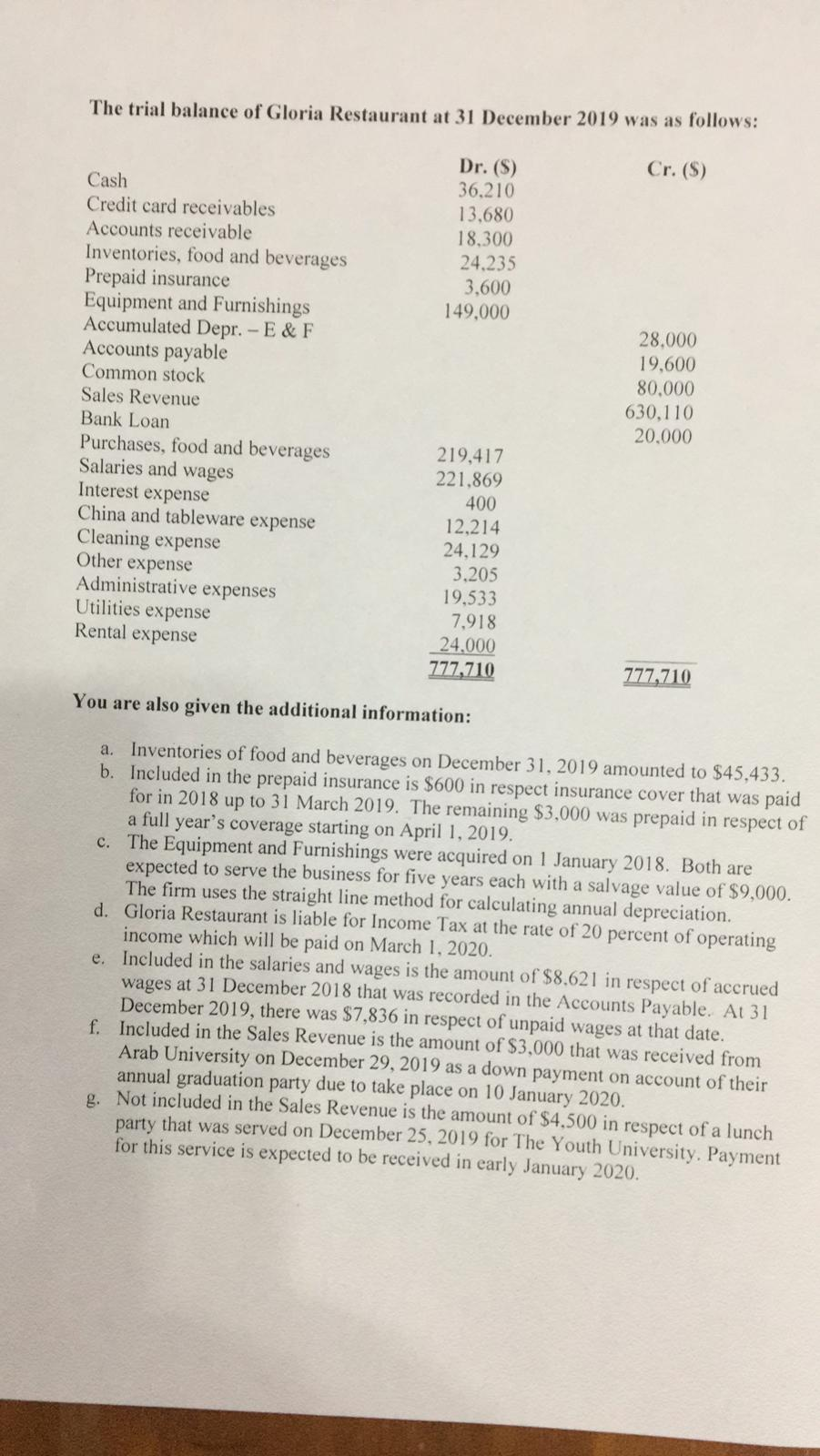

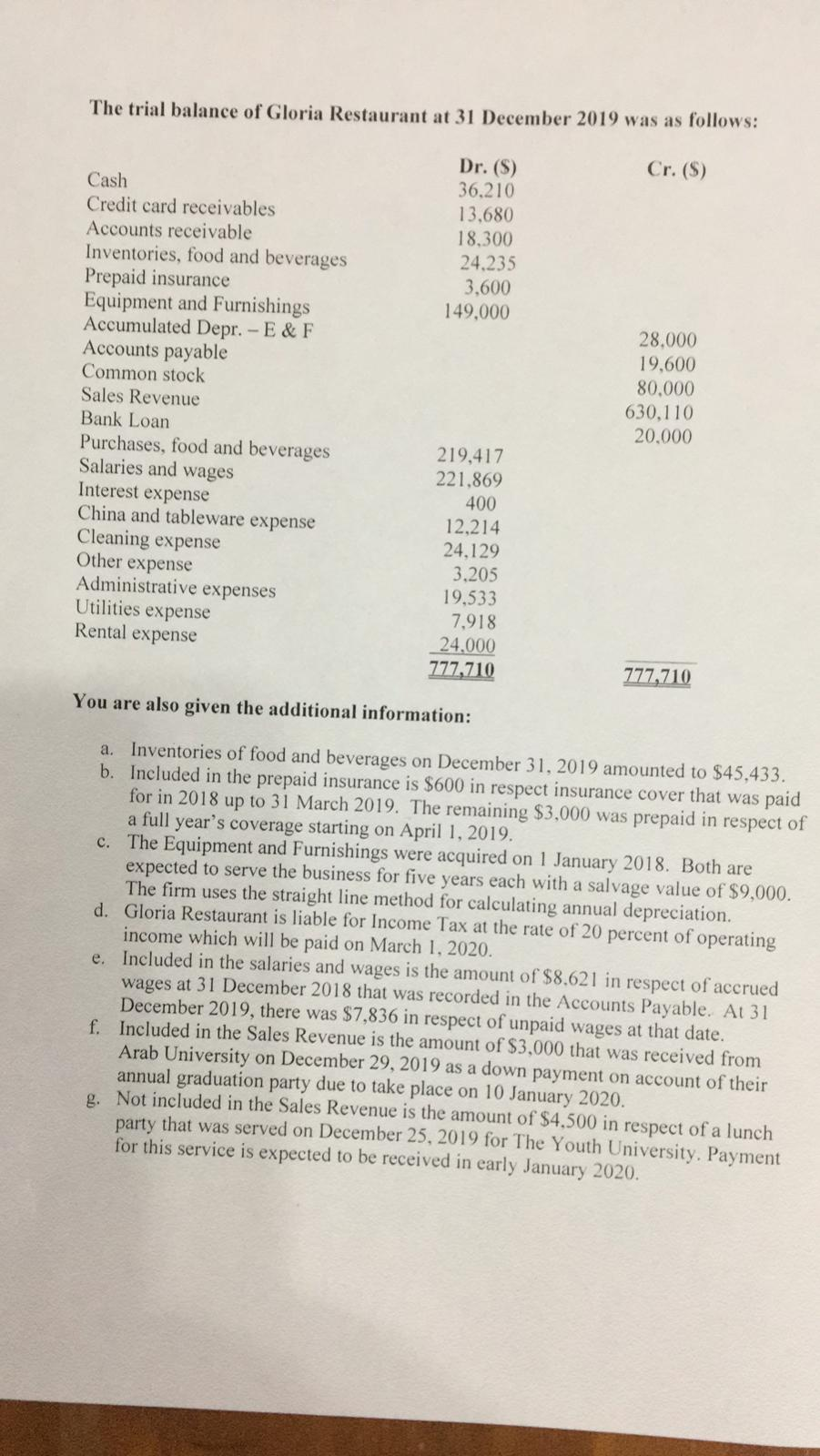

The trial balance of Gloria Restaurant at 31 December 2019 was as follows: Cr. (S) Dr. (S) 36.210 13.680 18,300 24.235 3,600 149,000 Cash Credit card receivables Accounts receivable Inventories, food and beverages Prepaid insurance Equipment and Furnishings Accumulated Depr. - E & F Accounts payable Common stock Sales Revenue Bank Loan Purchases, food and beverages Salaries and wages Interest expense China and tableware expense Cleaning expense Other expense Administrative expenses Utilities expense Rental expense 28.000 19,600 80.000 630,110 20.000 219,417 221.869 400 12,214 24.129 3.205 19,533 7,918 24.000 777,710 777,710 You are also given the additional information: a. Inventories of food and beverages on December 31, 2019 amounted to $45,433. b. Included in the prepaid insurance is $600 in respect insurance cover that was paid for in 2018 up to 31 March 2019. The remaining $3,000 was prepaid in respect of a full year's coverage starting on April 1, 2019, c. The Equipment and Furnishings were acquired on 1 January 2018. Both are expected to serve the business for five years each with a salvage value of $9,000. The firm uses the straight line method for calculating annual depreciation. d. Gloria Restaurant is liable for Income Tax at the rate of 20 percent of operating income which will be paid on March 1, 2020. Included in the salaries and wages is the amount of $8.621 in respect of accrued wages at 31 December 2018 that was recorded in the Accounts Payable. At 31 December 2019, there was $7,836 in respect of unpaid wages at that date. f. Included in the Sales Revenue is the amount of $3,000 that was received from Arab University on December 29, 2019 as a down payment on account of their annual graduation party due to take place on 10 January 2020. g. Not included in the Sales Revenue is the amount of $4,500 in respect of a lunch party that was served on December 25, 2019 for The Youth University. Payment for this service is expected to be received in early January 2020. h. At year end, you are informed that employee meals costing $9,420 were provided to the employees for free. The Company's practice is to charge these to other expenses. No accounting action in this respect was taken by 31 December 2019. i. The Bank Loan carries annual interest rate of 12%. The Loan was taken on January 2019. Principal repayments are scheduled at $4,000 annually payable on 1 February each year, starting 1 February 2020. You are required to prepare an income statement for the year ended December 31, 2019 and a balance sheet as at that date. The trial balance of Gloria Restaurant at 31 December 2019 was as follows: Cr. (S) Dr. (S) 36.210 13.680 18,300 24.235 3,600 149,000 Cash Credit card receivables Accounts receivable Inventories, food and beverages Prepaid insurance Equipment and Furnishings Accumulated Depr. - E & F Accounts payable Common stock Sales Revenue Bank Loan Purchases, food and beverages Salaries and wages Interest expense China and tableware expense Cleaning expense Other expense Administrative expenses Utilities expense Rental expense 28.000 19,600 80.000 630,110 20.000 219,417 221.869 400 12,214 24.129 3.205 19,533 7,918 24.000 777,710 777,710 You are also given the additional information: a. Inventories of food and beverages on December 31, 2019 amounted to $45,433. b. Included in the prepaid insurance is $600 in respect insurance cover that was paid for in 2018 up to 31 March 2019. The remaining $3,000 was prepaid in respect of a full year's coverage starting on April 1, 2019, c. The Equipment and Furnishings were acquired on 1 January 2018. Both are expected to serve the business for five years each with a salvage value of $9,000. The firm uses the straight line method for calculating annual depreciation. d. Gloria Restaurant is liable for Income Tax at the rate of 20 percent of operating income which will be paid on March 1, 2020. Included in the salaries and wages is the amount of $8.621 in respect of accrued wages at 31 December 2018 that was recorded in the Accounts Payable. At 31 December 2019, there was $7,836 in respect of unpaid wages at that date. f. Included in the Sales Revenue is the amount of $3,000 that was received from Arab University on December 29, 2019 as a down payment on account of their annual graduation party due to take place on 10 January 2020. g. Not included in the Sales Revenue is the amount of $4,500 in respect of a lunch party that was served on December 25, 2019 for The Youth University. Payment for this service is expected to be received in early January 2020. h. At year end, you are informed that employee meals costing $9,420 were provided to the employees for free. The Company's practice is to charge these to other expenses. No accounting action in this respect was taken by 31 December 2019. i. The Bank Loan carries annual interest rate of 12%. The Loan was taken on January 2019. Principal repayments are scheduled at $4,000 annually payable on 1 February each year, starting 1 February 2020. You are required to prepare an income statement for the year ended December 31, 2019 and a balance sheet as at that date