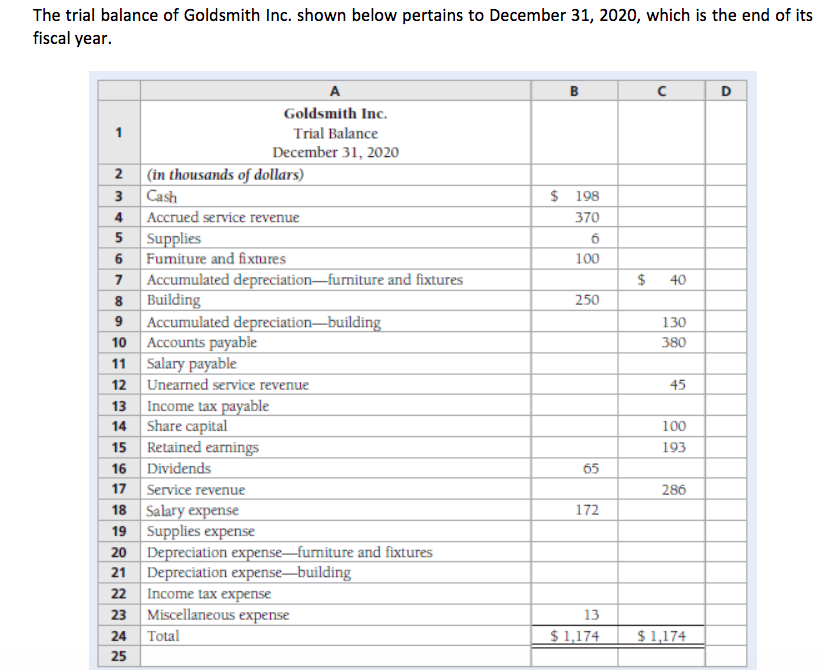

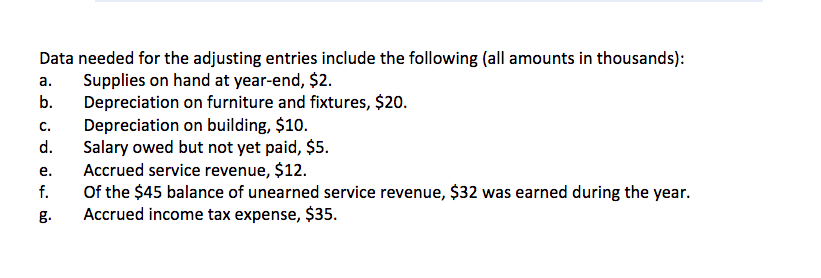

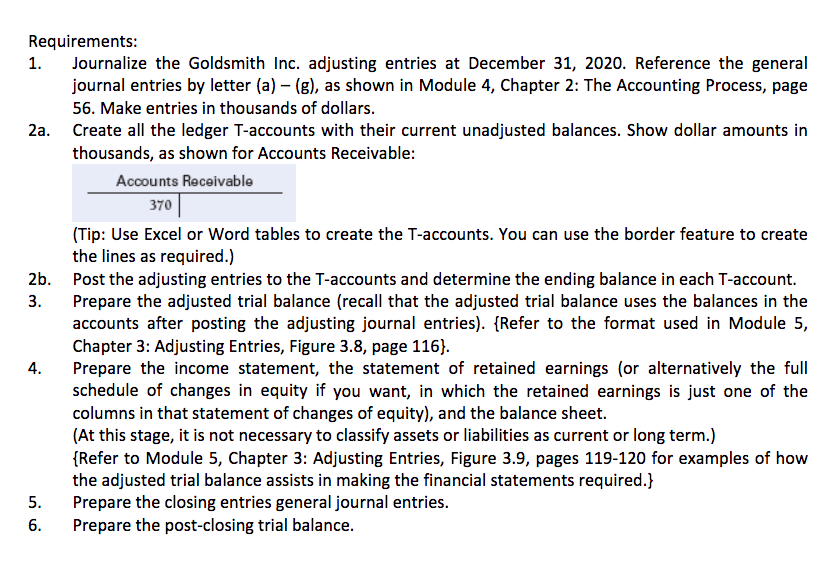

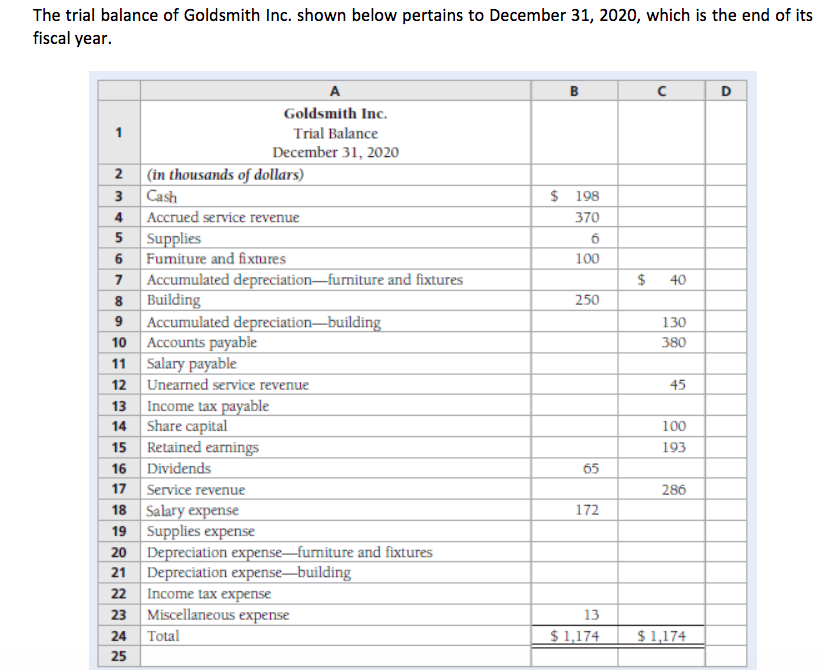

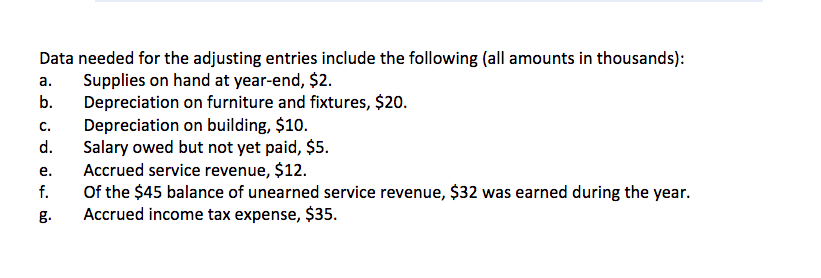

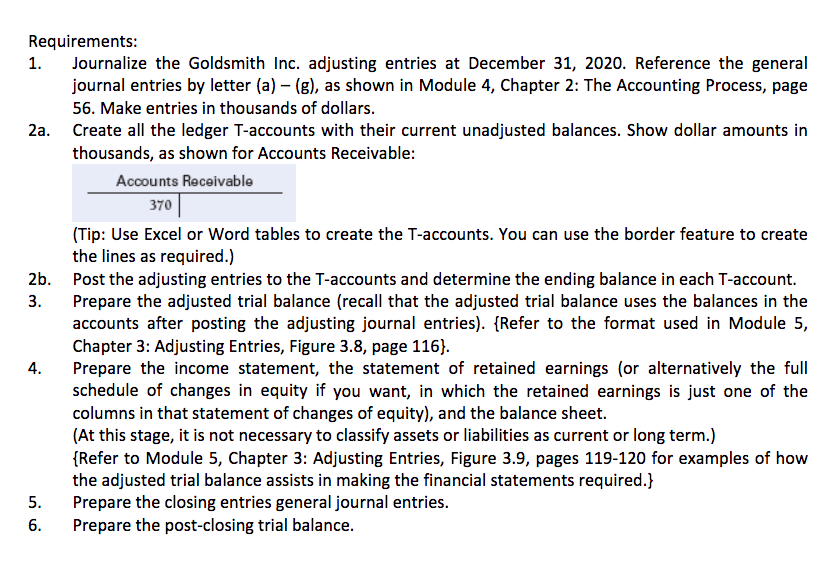

The trial balance of Goldsmith Inc. shown below pertains to December 31, 2020, which is the end of its fiscal year. D $ 198 370 6 100 $ 40 250 130 380 Goldsmith Inc. Trial Balance December 31, 2020 (in thousands of dollars) Cash Accrued service revenue Supplies Fumiture and fixtures Accumulated depreciationfurniture and fixtures Building Accumulated depreciationbuilding Accounts payable Salary payable Unearned service revenue Income tax payable Share capital Retained earnings Dividends Service revenue Salary expense Supplies expense Depreciation expense-furniture and fixtures Depreciation expense-building Income tax expense Miscellaneous expense Total 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 45 100 193 286 172 13 $ 1.174 $1,174 sooou Data needed for the adjusting entries include the following (all amounts in thousands): Supplies on hand at year-end, $2. b. Depreciation on furniture and fixtures, $20. Depreciation on building, $10. d. Salary owed but not yet paid, $5. e. Accrued service revenue, $12. Of the $45 balance of unearned service revenue, $32 was earned during the year. Accrued income tax expense, $35. Requirements: 1. Journalize the Goldsmith Inc. adjusting entries at December 31, 2020. Reference the general journal entries by letter (a) -(8), as shown in Module 4, Chapter 2: The Accounting Process, page 56. Make entries in thousands of dollars. 2a. Create all the ledger T-accounts with their current unadjusted balances. Show dollar amounts in thousands, as shown for Accounts Receivable: Accounts Receivable 370 (Tip: Use Excel or Word tables to create the T-accounts. You can use the border feature to create the lines as required.) 2b. Post the adjusting entries to the T-accounts and determine the ending balance in each T-account. 3. Prepare the adjusted trial balance (recall that the adjusted trial balance uses the balances in the accounts after posting the adjusting journal entries). {Refer to the format used in Module 5, Chapter 3: Adjusting Entries, Figure 3.8, page 116). Prepare the income statement, the statement of retained earnings (or alternatively the full schedule of changes in equity if you want, in which the retained earnings is just one of the columns in that statement of changes of equity), and the balance sheet. (At this stage, it is not necessary to classify assets or liabilities as current or long term.) {Refer to Module 5, Chapter 3: Adjusting Entries, Figure 3.9, pages 119-120 for examples of how the adjusted trial balance assists in making the financial statements required.} Prepare the closing entries general journal entries. 6. Prepare the post-closing trial balance