Answered step by step

Verified Expert Solution

Question

1 Approved Answer

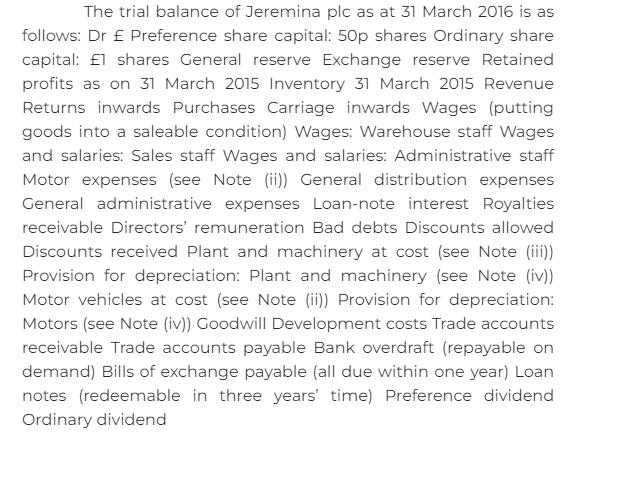

The trial balance of Jeremina plc as at 31 March 2016 is as follows: Dr Preference share capital: 50p shares Ordinary share capital: 1

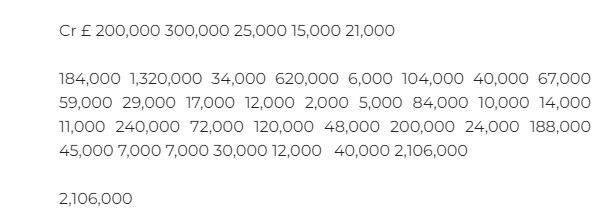

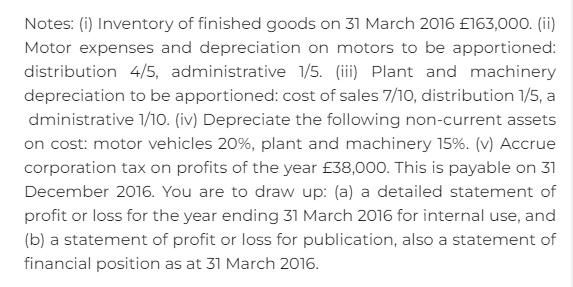

The trial balance of Jeremina plc as at 31 March 2016 is as follows: Dr Preference share capital: 50p shares Ordinary share capital: 1 shares General reserve Exchange reserve Retained profits as on 31 March 2015 Inventory 31 March 2015 Revenue Returns inwards Purchases Carriage inwards Wages (putting goods into a saleable condition) Wages: Warehouse staff Wages and salaries: Sales staff Wages and salaries: Administrative staff Motor expenses (see Note (ii)) General distribution expenses General administrative expenses Loan-note interest Royalties receivable Directors' remuneration Bad debts Discounts allowed Discounts received Plant and machinery at cost (see Note (iii)) Provision for depreciation: Plant and machinery (see Note (iv)) Motor vehicles at cost (see Note (ii)) Provision for depreciation: Motors (see Note (iv)) Goodwill Development costs Trade accounts receivable Trade accounts payable Bank overdraft (repayable on demand) Bills of exchange payable (all due within one year) Loan notes (redeemable in three years' time) Preference dividend Ordinary dividend Cr 200,000 300,000 25,000 15,000 21,000 184,000 1,320,000 34,000 620,000 6,000 104,000 40,000 67,000 59,000 29,000 17,000 12,000 2,000 5,000 84,000 10,000 14,000 11,000 240,000 72,000 120,000 48,000 200,000 24,000 188,000 45,000 7,000 7,000 30,000 12,000 40,000 2,106,000 2,106,000 Notes: (i) Inventory of finished goods on 31 March 2016 163,000. (ii) Motor expenses and depreciation on motors to be apportioned: distribution 4/5, administrative 1/5. (iii) Plant and machinery depreciation to be apportioned: cost of sales 7/10, distribution 1/5, a dministrative 1/10. (iv) Depreciate the following non-current assets on cost: motor vehicles 20%, plant and machinery 15%. (v) Accrue corporation tax on profits of the year 38,000. This is payable on 31 December 2016. You are to draw up: (a) a detailed statement of profit or loss for the year ending 31 March 2016 for internal use, and (b) a statement of profit or loss for publication, also a statement of financial position as at 31 March 2016.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of profit or loss for the year ending 31 March 2016 Revenue 1320000 Cost of sales 123600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started