Answered step by step

Verified Expert Solution

Question

1 Approved Answer

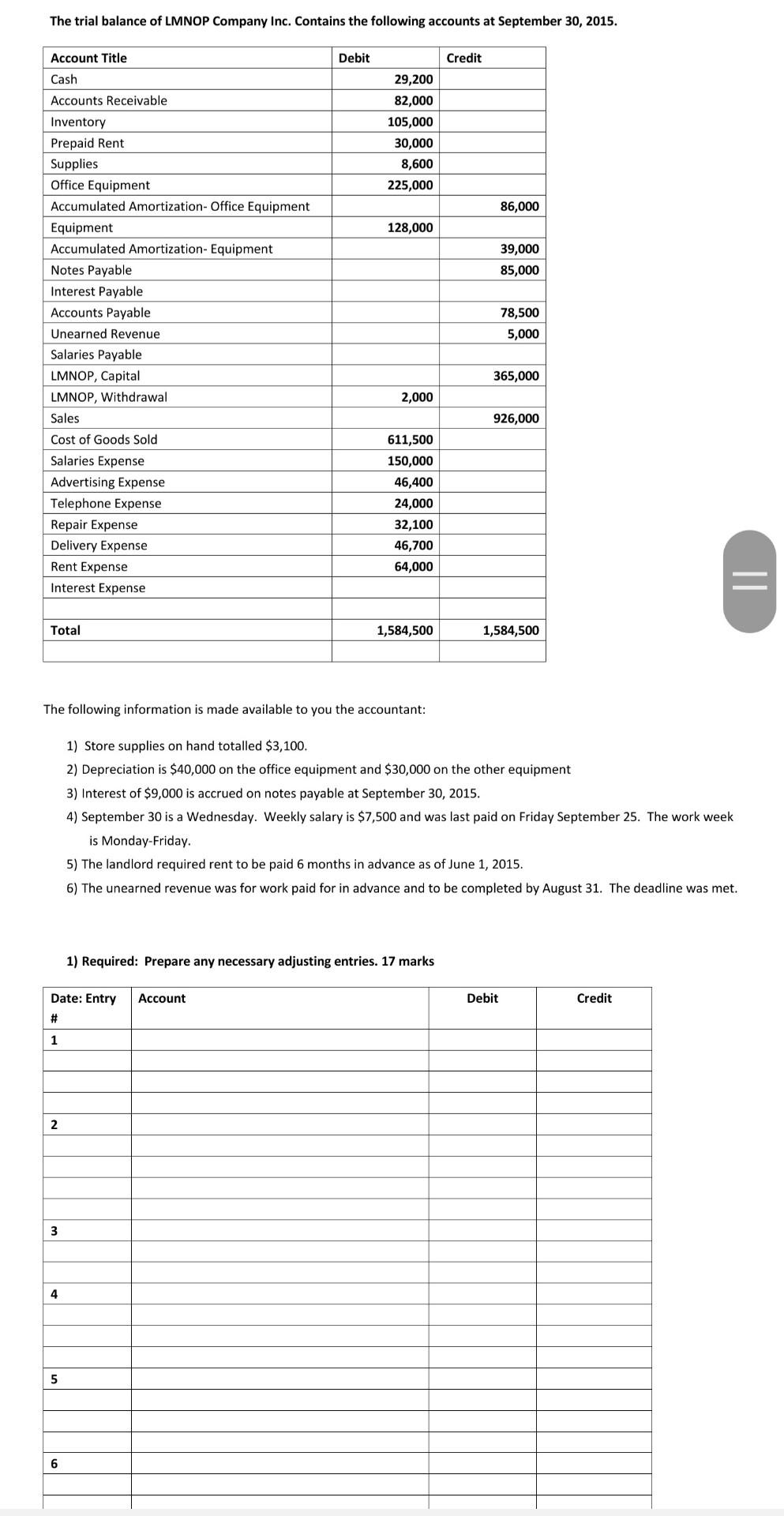

The trial balance of LMNOP Company Inc. Contains the following accounts at September 30, 2015. Account Title Debit Credit Cash Accounts Receivable 29,200 82,000 105,000

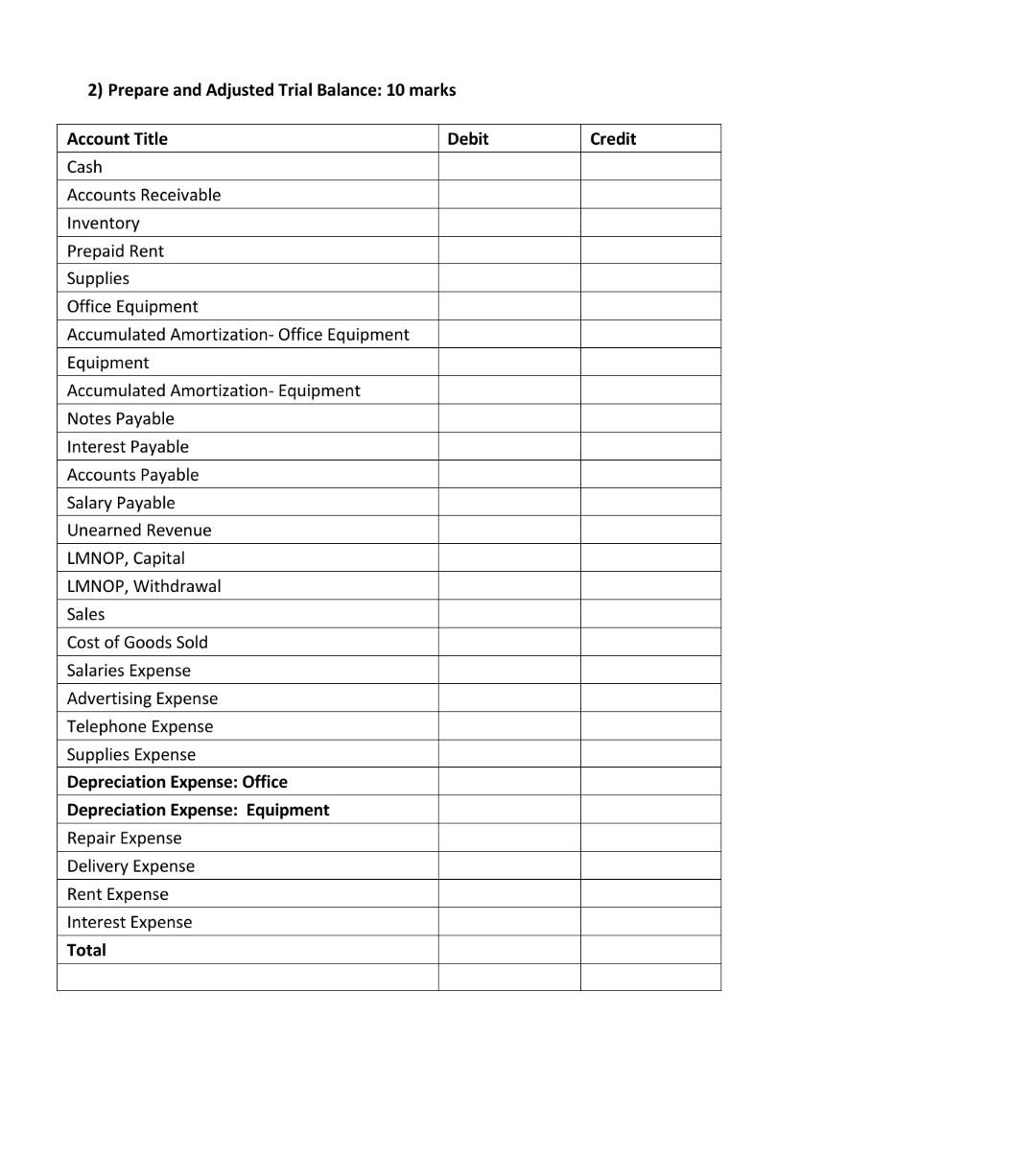

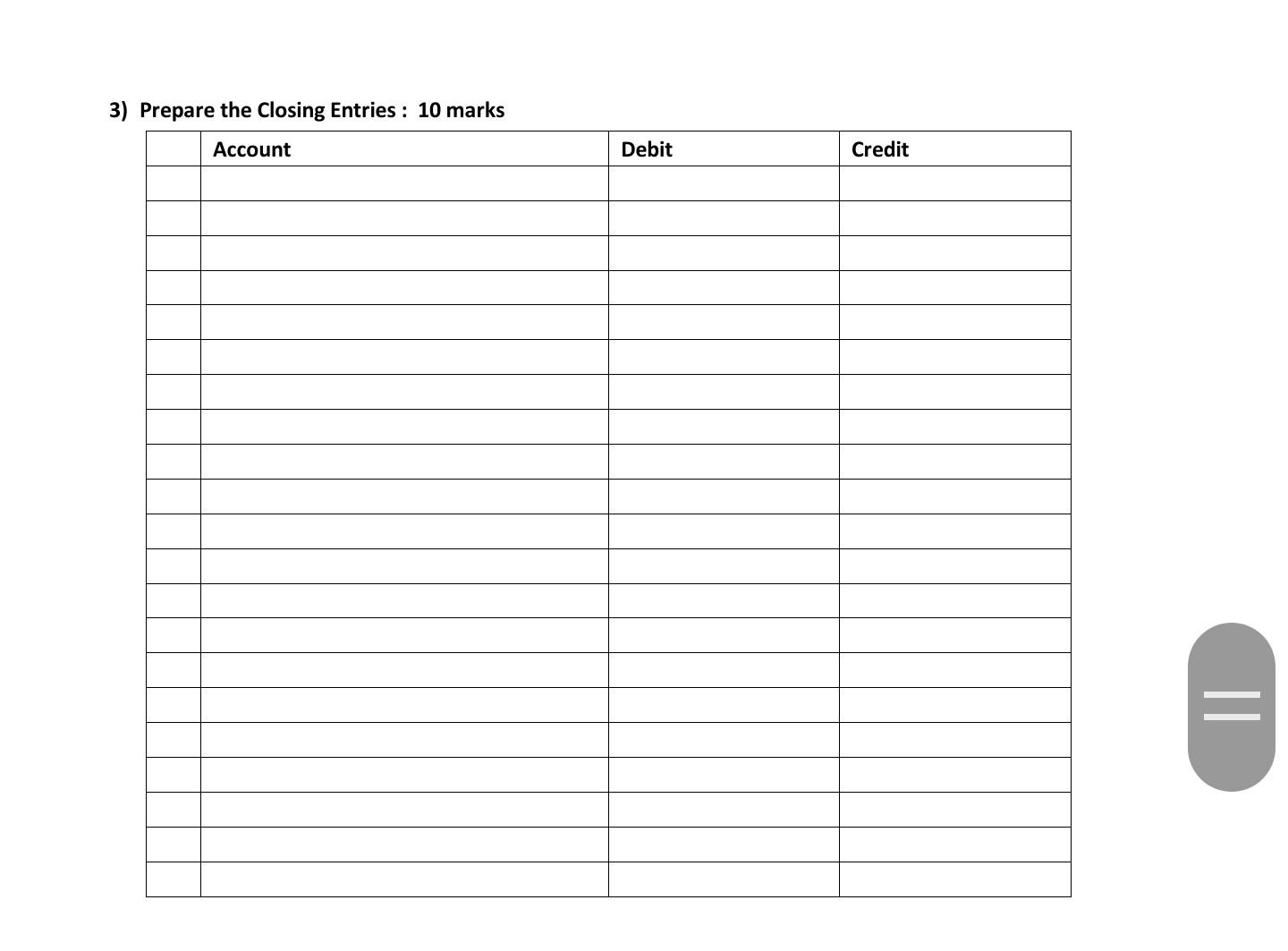

The trial balance of LMNOP Company Inc. Contains the following accounts at September 30, 2015. Account Title Debit Credit Cash Accounts Receivable 29,200 82,000 105,000 30,000 8,600 225,000 86,000 128,000 39,000 85,000 78,500 5,000 Inventory Prepaid Rent Supplies Office Equipment Accumulated Amortization - Office Equipment Equipment Accumulated Amortization- Equipment Notes Payable Interest Payable Accounts Payable Unearned Revenue Salaries Payable LMNOP, Capital LMNOP, Withdrawal Sales Cost of Goods Sold Salaries Expense Advertising Expense Telephone Expense Repair Expense Delivery Expense Rent Expense Interest Expense 365,000 2,000 926,000 611,500 150,000 46,400 24,000 32,100 46,700 64,000 = Total 1,584,500 1,584,500 The following information is made available to you the accountant: 1) Store supplies on hand totalled $3,100. 2) Depreciation is $40,000 on the office equipment and $30,000 on the other equipment 3) Interest of $9,000 is accrued on notes payable at September 30, 2015. 4) September 30 is a Wednesday. Weekly salary is $7,500 and was last paid on Friday September 25. The work week is Monday-Friday. 5) The landlord required rent to be paid 6 months in advance as of June 1, 2015. 6) The unearned revenue was for work paid for in advance and to be completed by August 31. The deadline was met. 1) Required: Prepare any necessary adjusting entries. 17 marks Date: Entry Account Debit Credit # 1 2 3 4 5 6 2) Prepare and Adjusted Trial Balance: 10 marks Debit Credit Account Title Cash Accounts Receivable Inventory Prepaid Rent Supplies Office Equipment Accumulated Amortization - Office Equipment Equipment Accumulated Amortization- Equipment Notes Payable Interest Payable Accounts Payable Salary Payable Unearned Revenue LMNOP, Capital LMNOP, Withdrawal Sales Cost of Goods Sold Salaries Expense Advertising Expense Telephone Expense Supplies Expense Depreciation Expense: Office Depreciation Expense: Equipment Re Expense Delivery Expense Rent Expense Interest Expense Total 3) Prepare the Closing Entries : 10 marks Account Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started