Answered step by step

Verified Expert Solution

Question

1 Approved Answer

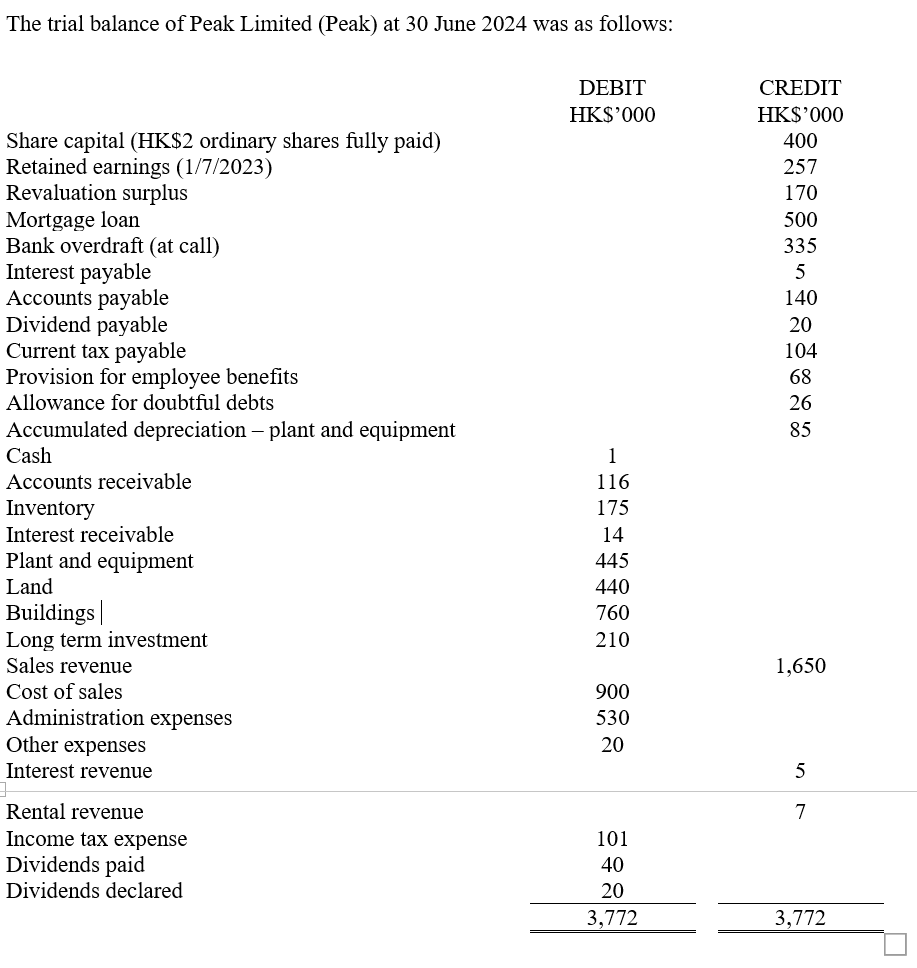

The trial balance of Peak Limited ( Peak ) at 3 0 June 2 0 2 4 was as follows: The trial balance of Peak

The trial balance of Peak Limited Peak at June was as follows: The trial balance of Peak Limited Peak at June was as follows:

DEBIT CREDIT

HK$ HK$

Share capital HK$ ordinary shares fully paid

Retained earnings

Revaluation surplus

Mortgage loan

Bank overdraft at call

Interest payable

Accounts payable

Dividend payable

Current tax payable

Provision for employee benefits

Allowance for doubtful debts

Accumulated depreciation plant and equipment

Cash

Accounts receivable

Inventory

Interest receivable

Plant and equipment

Land

Buildings

Long term investment

Sales revenue

Cost of sales

Administration expenses

Other expenses

Interest revenue

Rental revenue

Income tax expense

Dividends paid

Dividends declared

Additional information:

Administrative expenses for the year included interest expense of HK$

All assets were carried at cost except for land and buildings which were carried at valuation.

On June the directors revalued land and buildings. The revaluation was based on an independent valuation and was based on fair values. The carrying amounts of land and buildings before the revaluation were HK$ and HK$ respectively. The income tax related to the revaluations amounted to HK$

The mortgage loan was repayable in annual instalments of HK$ due on November each year.

The provision for employee benefits consisted of HK$ expected to be paid in the next months and HK$ expected to be paid beyond the next months.

Required:

a Prepare a statement of profit or loss and other comprehensive income for Peak for the year ended June in accordance with IAS

b Prepare a statement of financial position for Peak as at June to comply with IAS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started