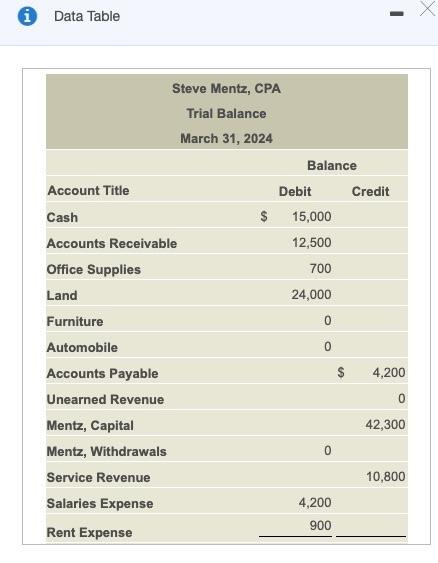

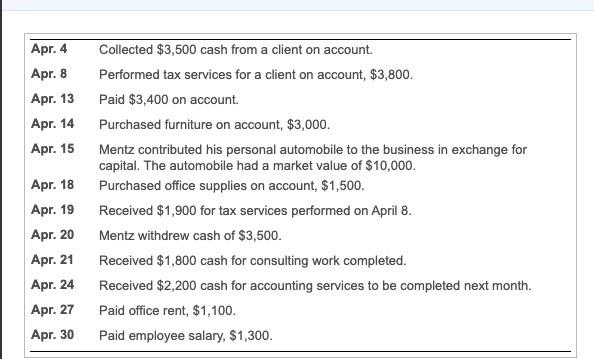

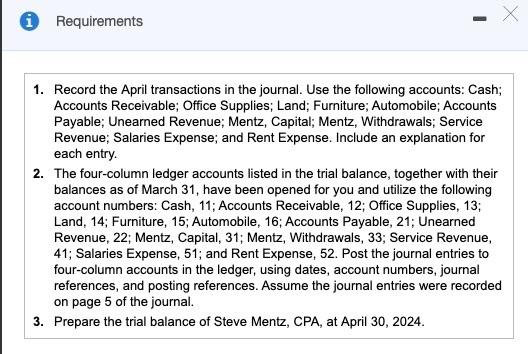

The trial balance of Sieve Mente.CPR Gated March 1, 2024 the con to the Man) Dining Aprl, the business completed the following transactions Click the icon to view the transactions Read the remains Requirement 1. Record the Apransactions in the journal. Use The following account Cost Accounts Receiva. Onice Supplies Land, Future Automobile Accounts Payable. Unearned Rein Capital Menta, Withdrawal Service Revenue Blanes Expere and art Excere. Include an anation for each entry Reconstruits Brede lanation on the of the journaast Apre Collected $3.500 cash from a centon Count Date Account and Explanation Debit Credin A4 Data Table - X Steve Mentz, CPA Trial Balance March 31, 2024 Balance Account Title Debit Credit Cash $ 15,000 Accounts Receivable 12,500 Office Supplies 700 Land 24,000 Furniture 0 Automobile 0 Accounts Payable 4,200 Unearned Revenue 0 Mentz, Capital 42,300 Mentz, Withdrawals 0 Service Revenue 10,800 Salaries Expense 4,200 900 Rent Expense Apr. 4 Apr. 8 Apr. 13 Apr. 14 Apr. 15 Apr. 18 Apr. 19 Apr. 20 Apr. 21 Apr. 24 Apr. 27 Apr. 30 Collected $3,500 cash from a client on account. Performed tax services for a client on account, $3,800. Paid $3,400 on account. Purchased furniture on account $3,000. Mentz contributed his personal automobile to the business in exchange for capital. The automobile had a market value of $10,000. Purchased office supplies on account, $1,500. Received $1,900 for tax services performed on April 8. Mentz withdrew cash of $3,500. Received $1,800 cash for consulting work completed. Received $2,200 cash for accounting services to be completed next month. Paid office rent, $1,100. Paid employee salary, $1,300. X Requirements 1. Record the April transactions in the journal. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Furniture; Automobile; Accounts Payable; Unearned Revenue; Mentz, Capital; Mentz, Withdrawals; Service Revenue; Salaries Expense; and Rent Expense. Include an explanation for each entry. 2. The four-column ledger accounts listed in the trial balance, together with their balances as of March 31, have been opened for you and utilize the following account numbers: Cash, 11; Accounts Receivable, 12; Office Supplies, 13; Land, 14; Furniture, 15; Automobile, 16; Accounts Payable, 21; Unearned Revenue, 22; Mentz, Capital, 31; Mentz, Withdrawals, 33; Service Revenue, 41; Salaries Expense, 51; and Rent Expense, 52. Post the journal entries to four-column accounts in the ledger, using dates, account numbers, journal references, and posting references. Assume the journal entries were recorded on page 5 of the journal. 3. Prepare the trial balance of Steve Mentz, CPA, at April 30, 2024